December 21, 2022: ETH-USD (Ethereum) Elliott Wave and Technical Analysis – Video and Charts

Summary: For the short term, a new low below November 22, 2022, is expected. A target for support is at 986. The low of June 2022 is expected to be sustained.

A new high above 1,671.48 would indicate the next bullish run may be underway.

A possible target for intermediate wave (3) is calculated at 13,704, and for primary wave 3 at 54,226.

The data used for this analysis comes from Yahoo Finance ETH-USD.

All charts are on a semi-log scale.

MAIN ELLIOTT WAVE COUNT

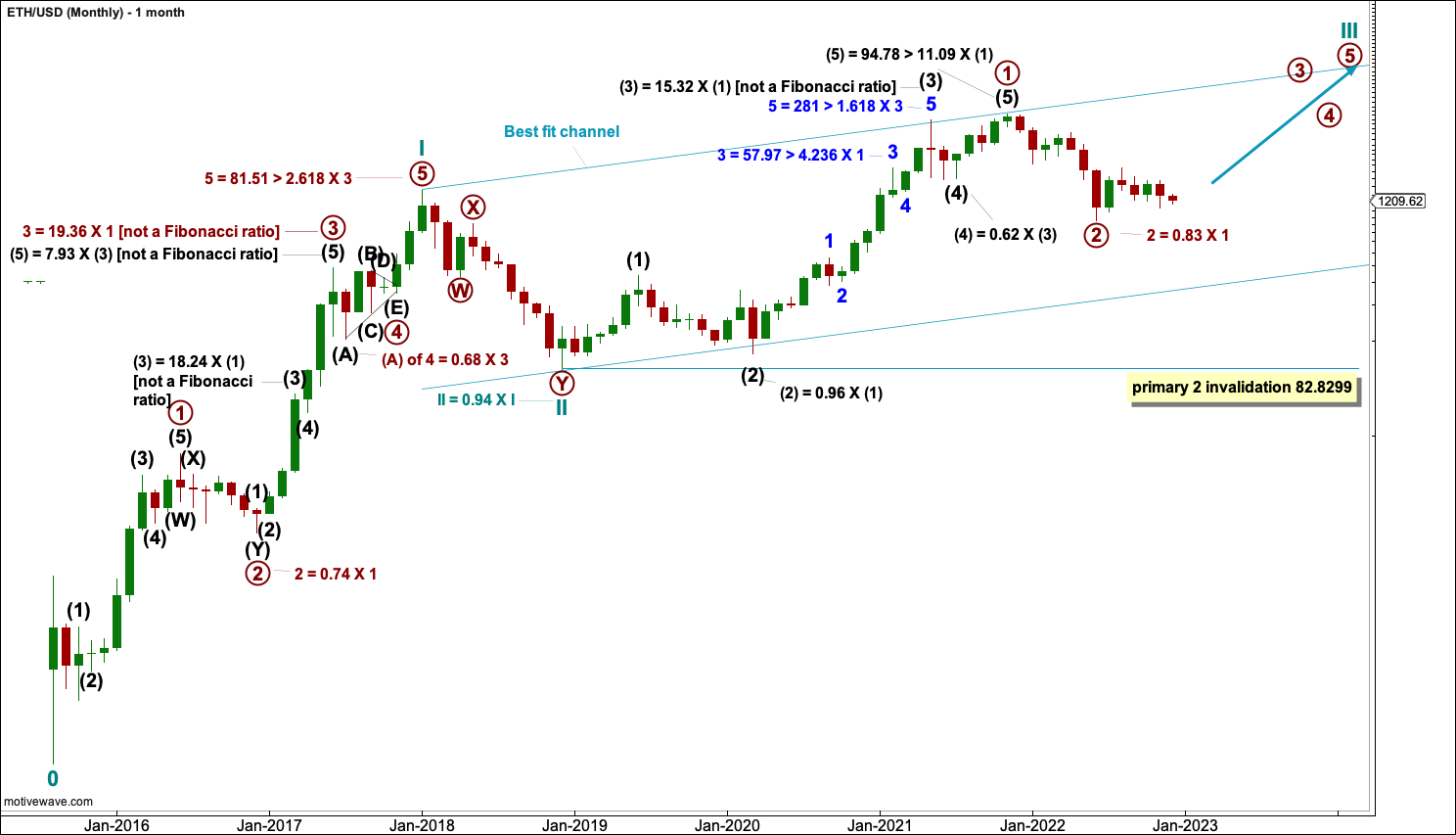

MONTHLY

The monthly chart looks at the entire price history of Ethereum. The Elliott wave count begins at the low of October 2015.

From October 2015 to December 2017 this upwards wave subdivides perfectly as an Elliott wave impulse, labelled cycle wave I. The impulse lasted just over two years, which is within the expected duration for a cycle degree wave, so confidence that this degree of labelling is correct may be had.

Within cycle wave I, note that wave lengths noted on the chart are not Fibonacci ratios but guides to expected behaviour for Ethereum. Prior Ethereum price history exhibits very long third waves and fifth waves which are longer than third waves (with the exception of intermediate wave (5) within primary wave 1 within cycle wave III).

The depth of primary wave 2 and the deepest part of primary wave 4 within cycle wave I are also noted. Ethereum has had deep corrections, but not as deep as other cryptocurrencies, within cycle wave I.

Within cycle wave III, primary wave 2 may not move beyond the start of primary wave 1 below 82.8299. If primary wave 2 within cycle wave III is over at the last low, then it would be 0.83 of primary wave 1. This is a normal to be expected depth.

Cycle wave III may only subdivide as an impulse. It must move far enough above the end of cycle wave I to allow room for cycle wave IV to unfold and remain above cycle wave I price territory.

WEEKLY

Ethereum sometimes exhibits Fibonacci ratios between its actionary waves. Within primary wave 1, the ratios are noted on the chart.

The structure of primary wave 1 may be complete. Primary wave 2 may be a complete double zigzag.

Within primary wave 3: Intermediate wave (1) may now be complete and intermediate wave (2) may not move beyond the start of intermediate wave (1) below 896.109.

*How to read the notations: For example, for minor wave 3 within intermediate wave (3) the notation “3 = 57.97 > 4.236 X 1” is read as minor wave 3 was 57.97 longer than 4.236 the length of minor wave 1.

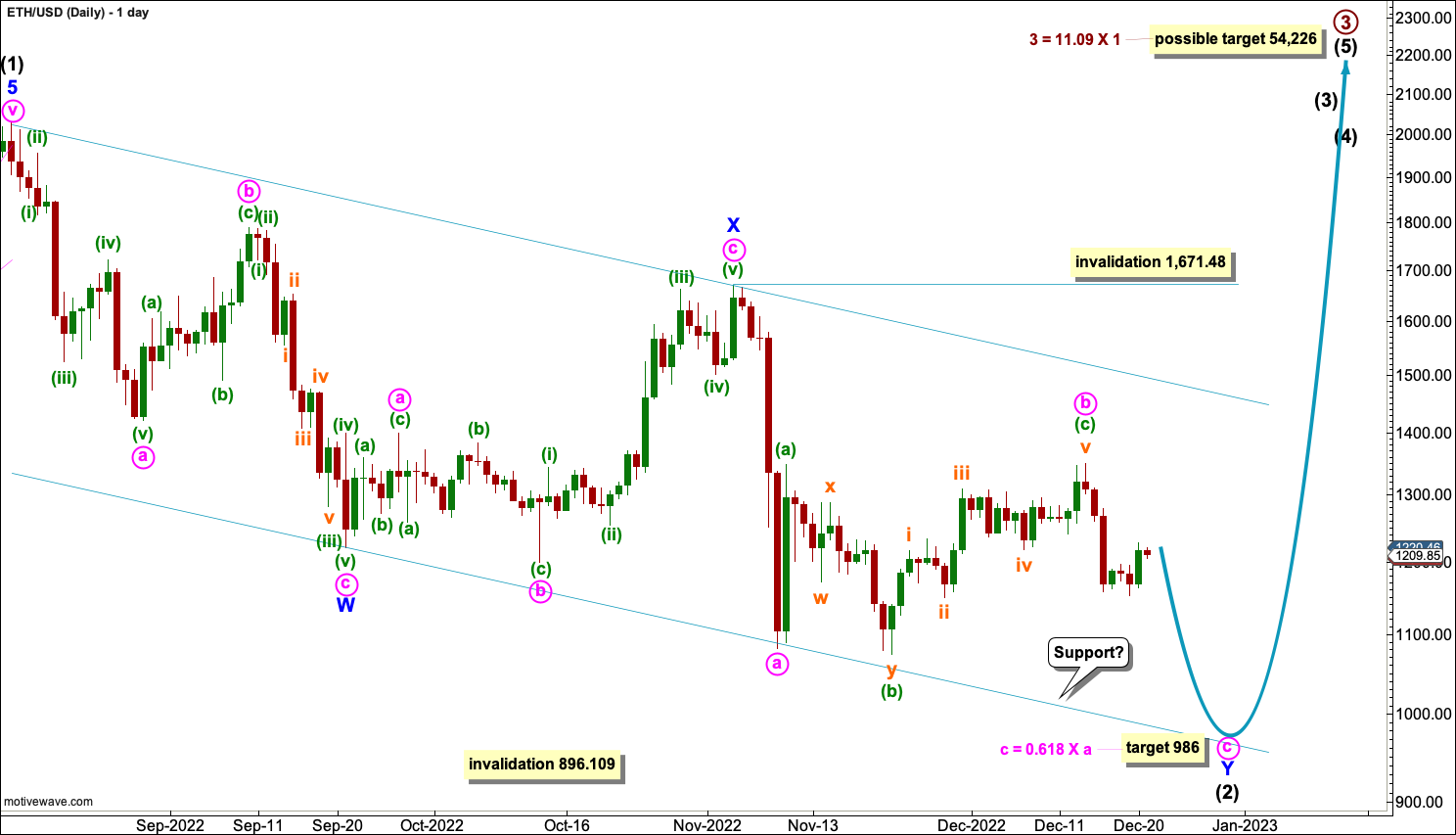

DAILY

Intermediate wave (2) may be an incomplete double zigzag.

A new channel is drawn about the bear market of intermediate wave (2). Draw the first trend line from the start of minor wave W to the end of minor wave X, then place a parallel copy on the end of minor wave W. When this channel is breached by upwards movement, then it may be taken as reasonable indication that intermediate wave (2) may be over and intermediate wave (3) may be underway.

A target is calculated at minute degree for intermediate wave (2) to end. Intermediate wave (2) may not move beyond the start of intermediate wave (1) below 896.109.

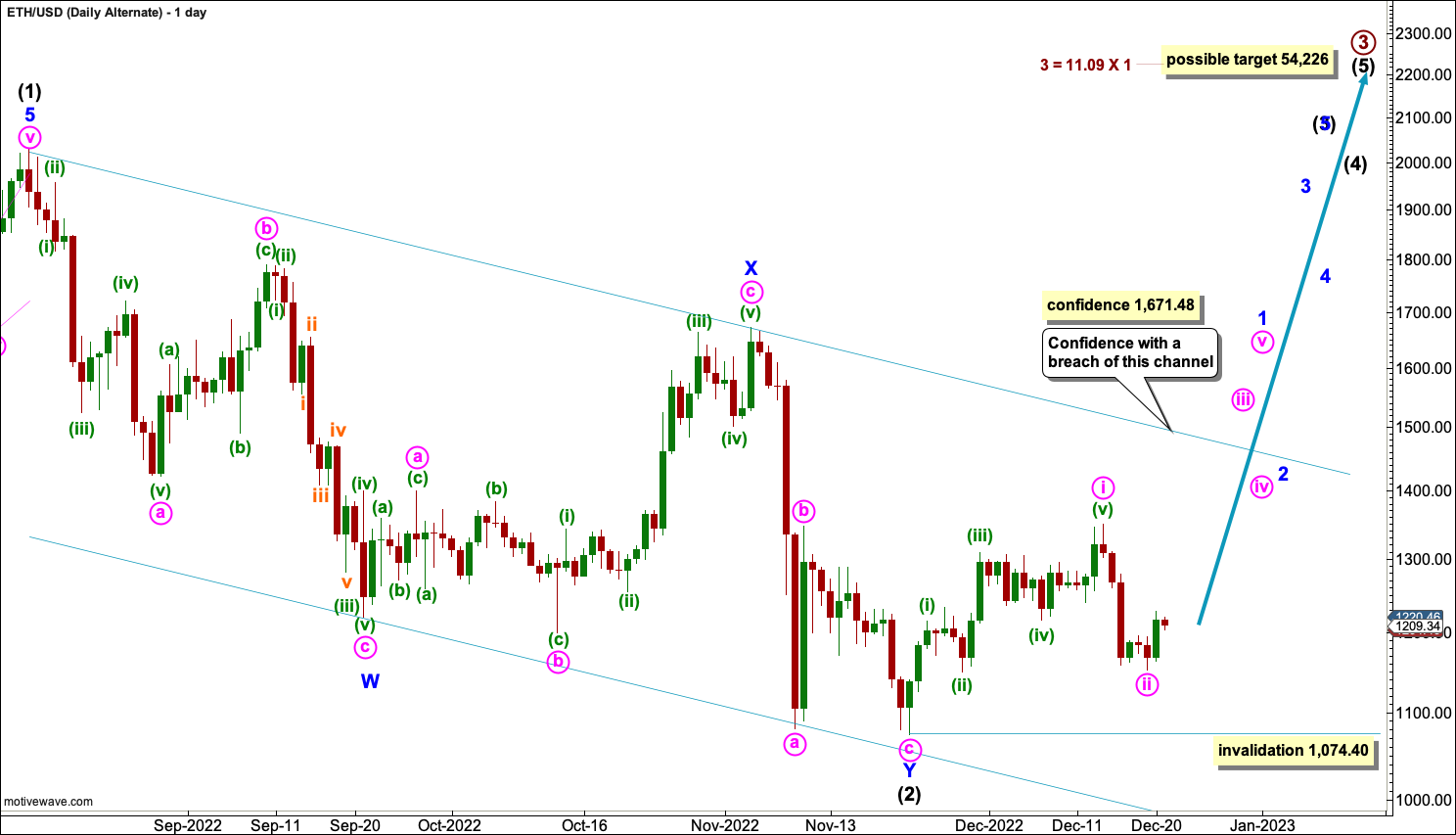

DAILY ALTERNATE

It is possible that intermediate wave (2) may be over, but this wave count lacks support from classic technical analysis. A breach of the channel would add confidence to this wave count. Thereafter, a new high above 1,671.48 would add further confidence.

WEEKLY ALTERNATE

Primary waves 1, 2, 3 and 4 within the impulse of cycle wave III may be complete.

Primary wave 2 was a deep 0.95 zigzag, lasting 37 weeks. Primary wave 4 may be a complete expanded flat, lasting 58 weeks.

It is common to see fourth waves within commodities and cryptocurrencies that are more brief than their counterpart second waves. Here, primary wave 4 is longer lasting than primary wave 2; this reduces the probability of this wave count to an alternate.

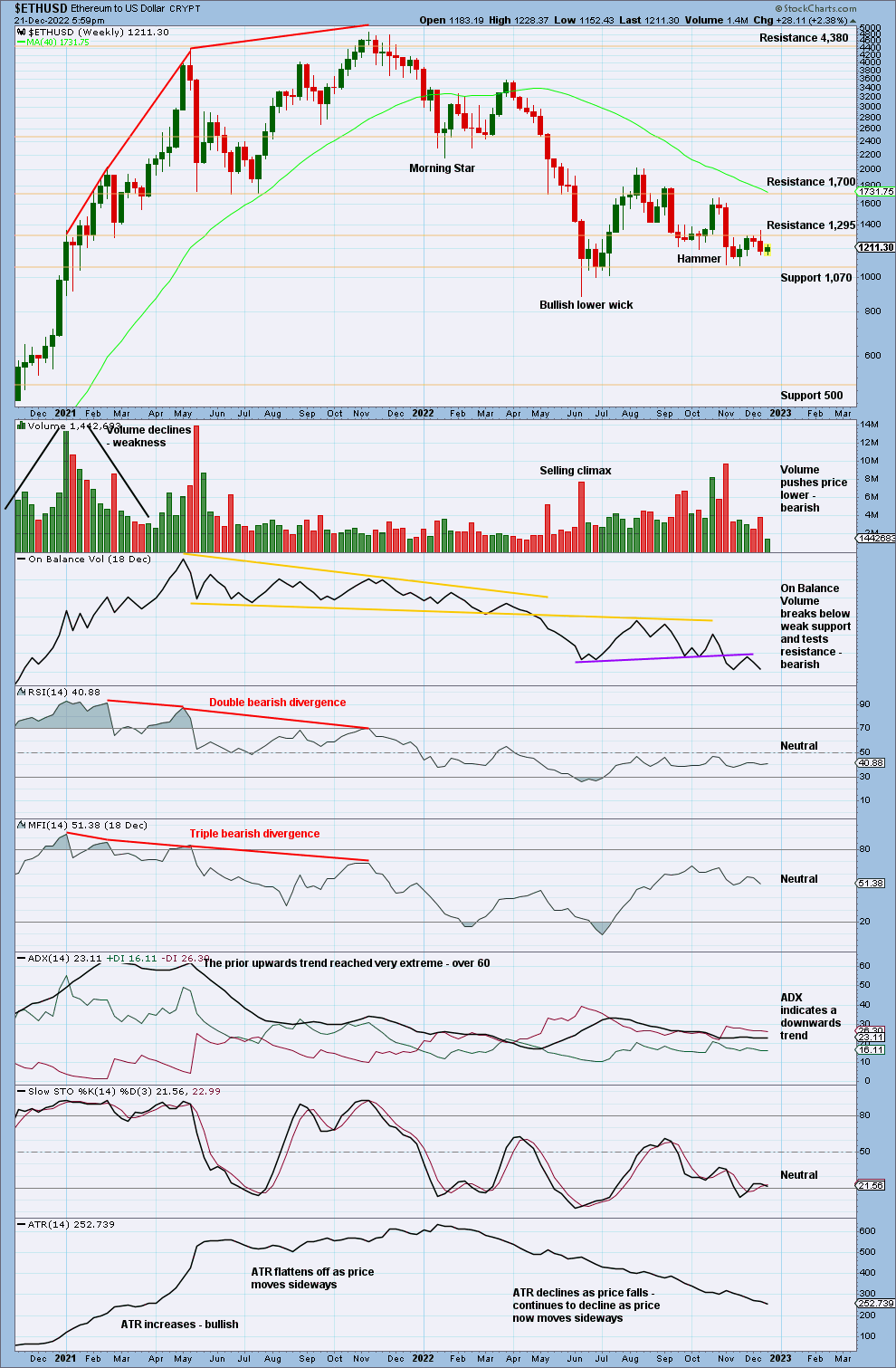

TECHNICAL ANALYSIS

WEEKLY

RSI reached oversold on the weekly chart at the low in June 2022. This has only happened once before, in December 2018, which was a sustainable low.

For the short term, there is no evidence that a sustainable low has formed for the week beginning November 21, 2022.

DAILY

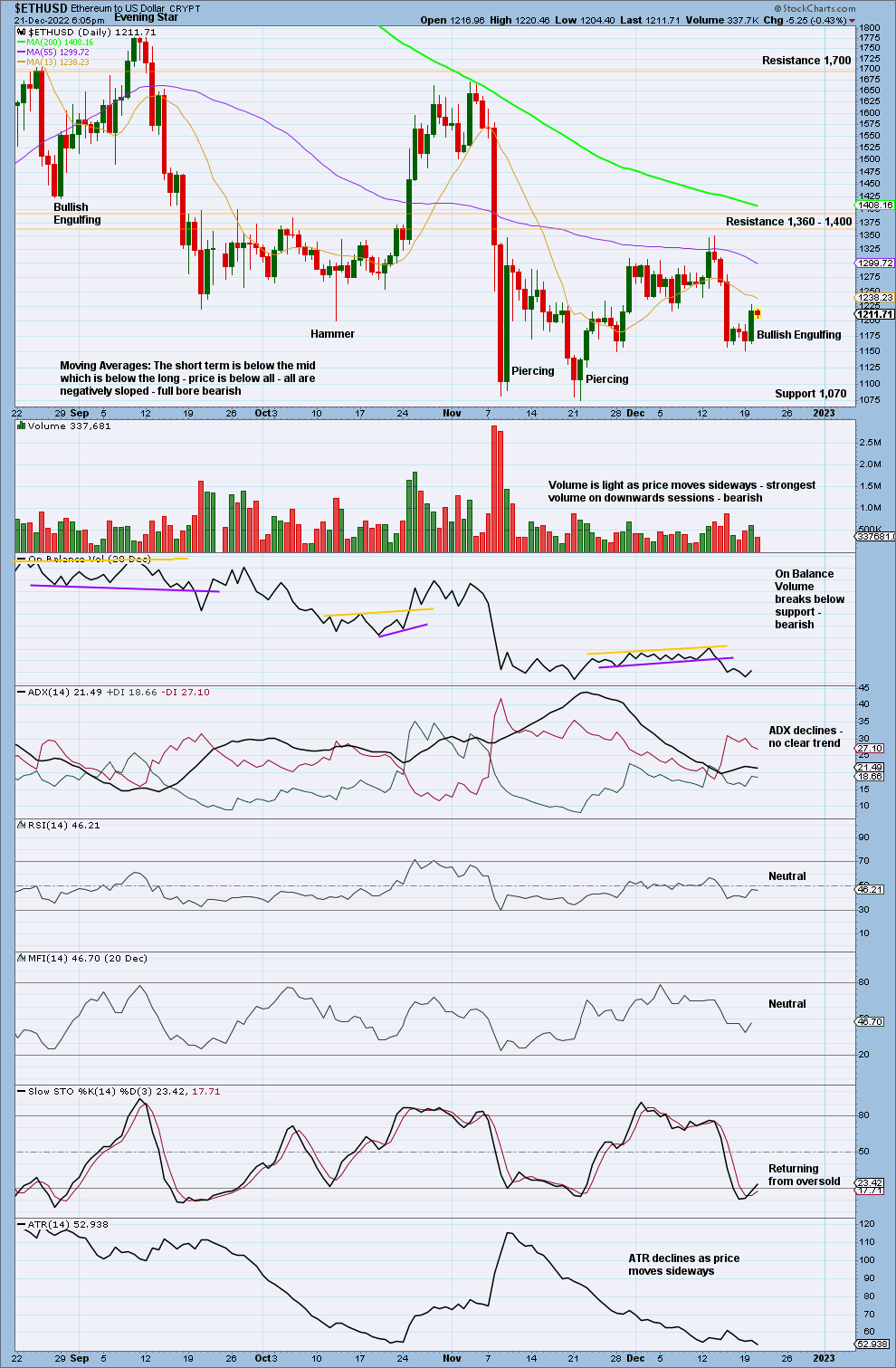

Yesterday’s Bullish Engulfing pattern does have support from volume.

The last two Piercing patterns lack support from volume. Price should show strength off the low for confidence that a sustained low has formed.

This chart is overall bearish.

Published @ 07:48 p.m. ET.

—

Careful risk management protects your investments.

Follow my two Golden Rules:

1. Invest only funds you can afford to lose.

2. Have an exit plan for both directions – where or when to take profit, and when to exit a losing investment.

—

New updates to this analysis are in bold.

–