November 20, 2022: XRP-USD Elliott Wave and Technical Analysis – Video and Charts

Summary: XRP may require a final low before the bear market is over. A target for support is calculated at 0.276. Thereafter, a third wave at primary and cycle degree is expected to begin, which may be a strong upwards trend.

The data used for this analysis comes from CryptoCompare.

Last full written analysis of XRP was on August 10, 2022.

All charts are on a semi-log scale.

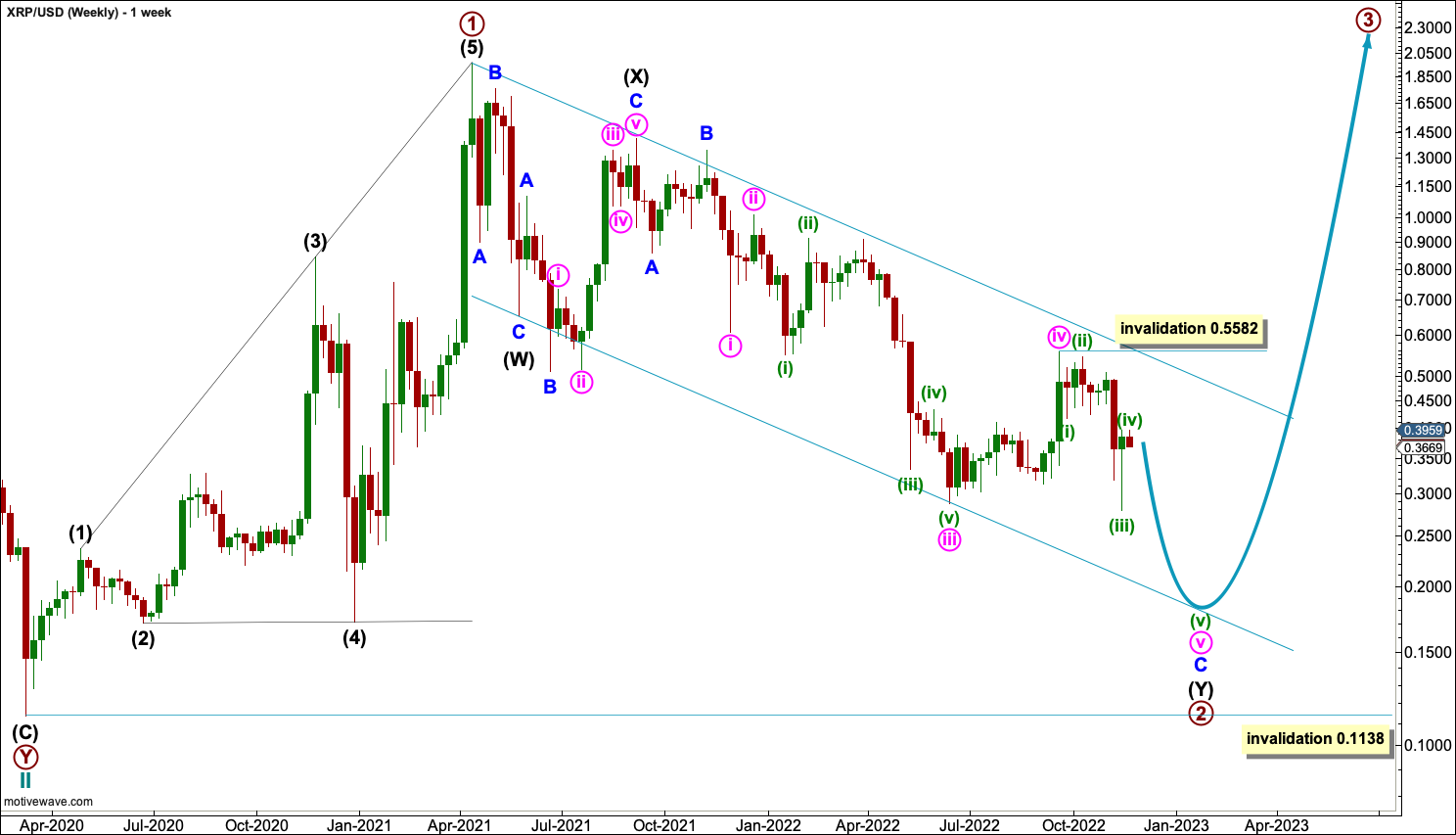

MAIN ELLIOTT WAVE COUNT

WEEKLY

Primary wave 1 may have completed as a leading expanding diagonal.

Primary wave 2 may be nearly complete as a double zigzag.

A conservative channel is drawn about the bear market of primary wave 2 to contain all movement. A breach of this channel would add confidence to this wave count. A new low is expected first.

Within minute wave v, a second wave correction may not move beyond its start above 0.5582.

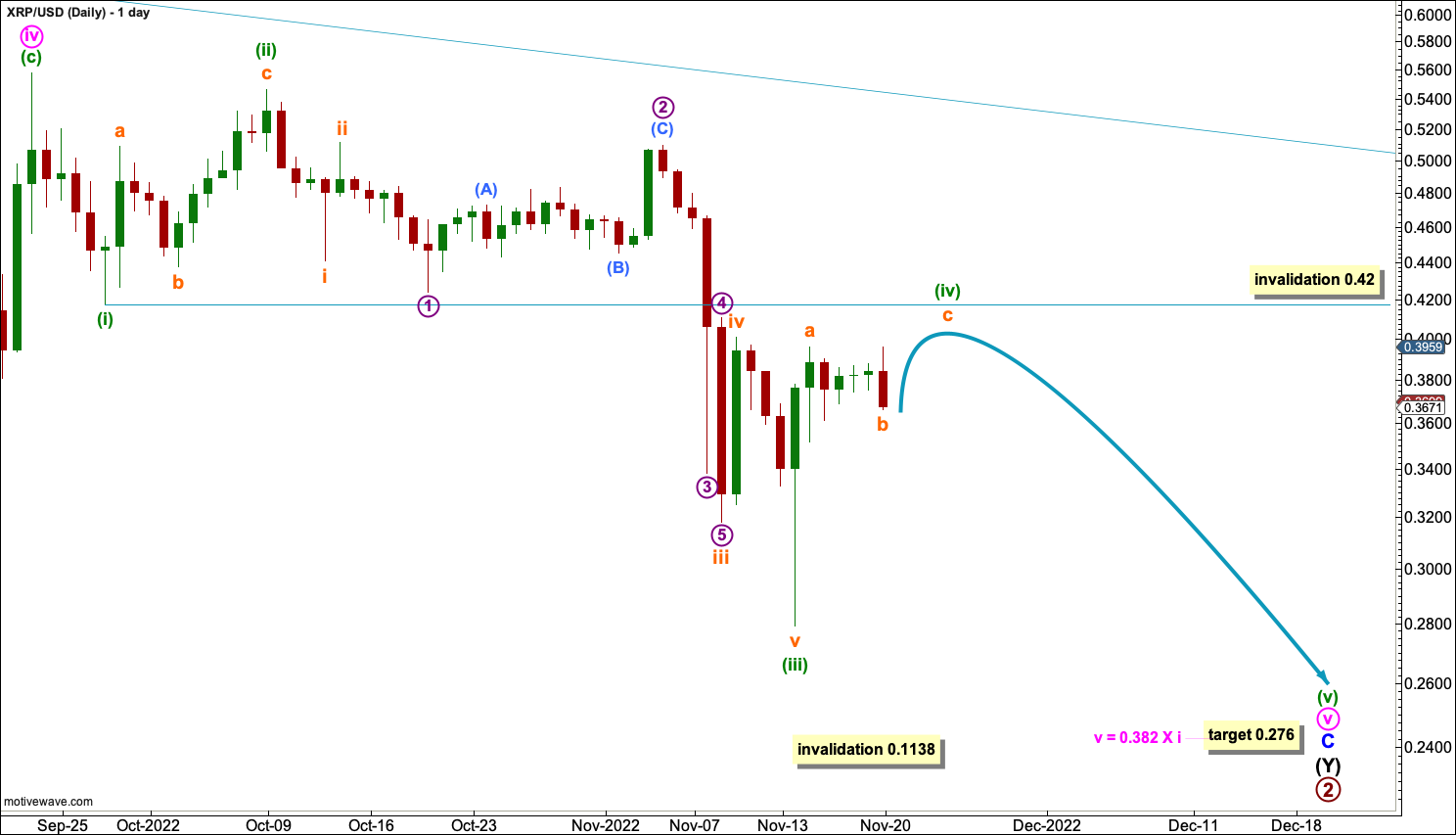

DAILY

The daily chart focusses on the structure of minute wave v.

Minute wave v may only subdivide as a five wave motive structure. It may be an incomplete impulse.

Within minute wave v: Minuette waves (i), (ii) and (iii) may be complete and minuette wave (iv) may continue sideways.

Minuette wave (iv) may not move into minuette wave (i) price territory above 0.42.

A target is calculated for minute wave v to end.

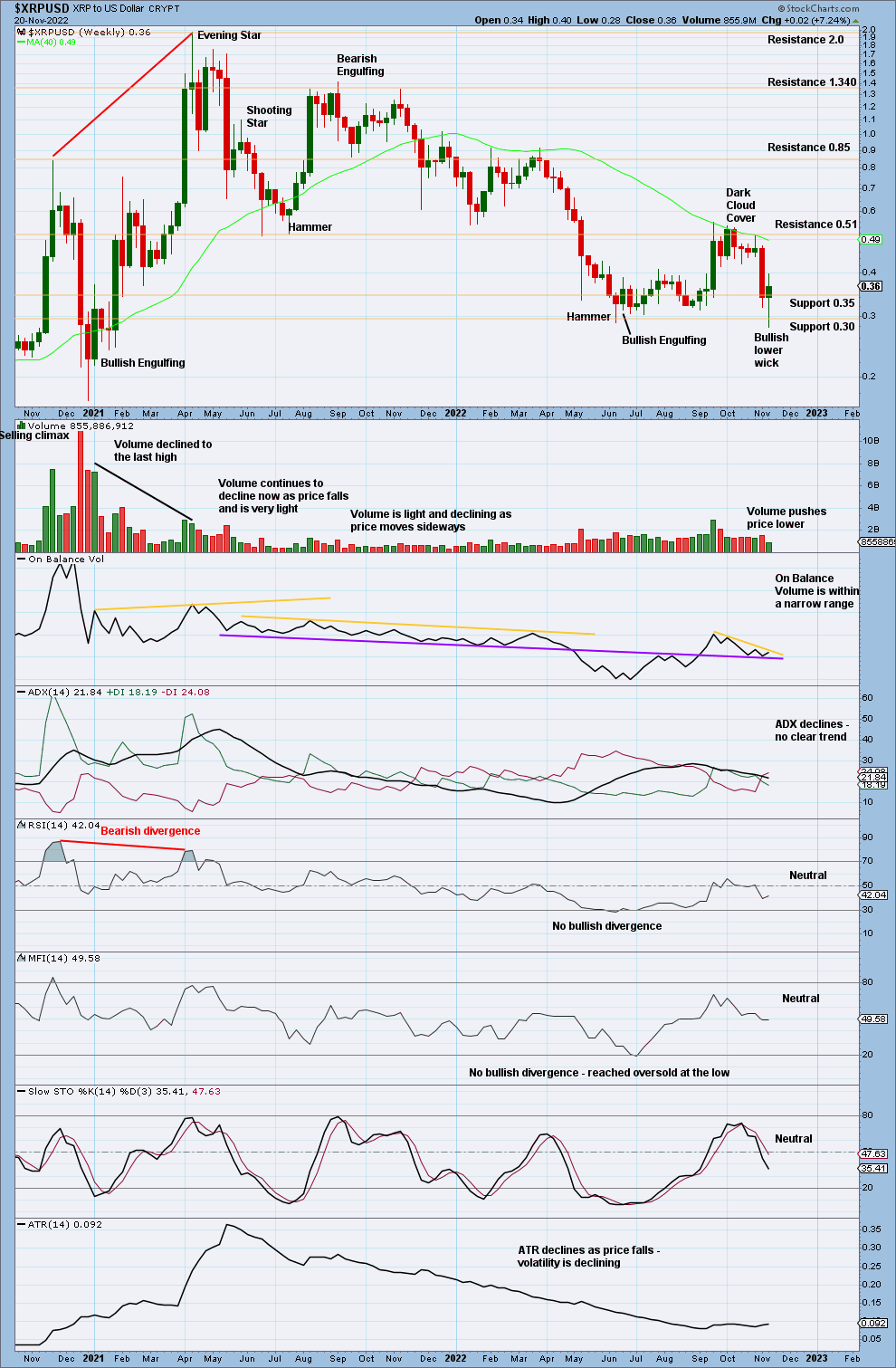

TECHNICAL ANALYSIS

WEEKLY

There is reasonable support about 0.30.

If price makes new lows on a closing basis and exhibits bullish divergence, then that would provide strong support to the view that a sustainable low may be in place.

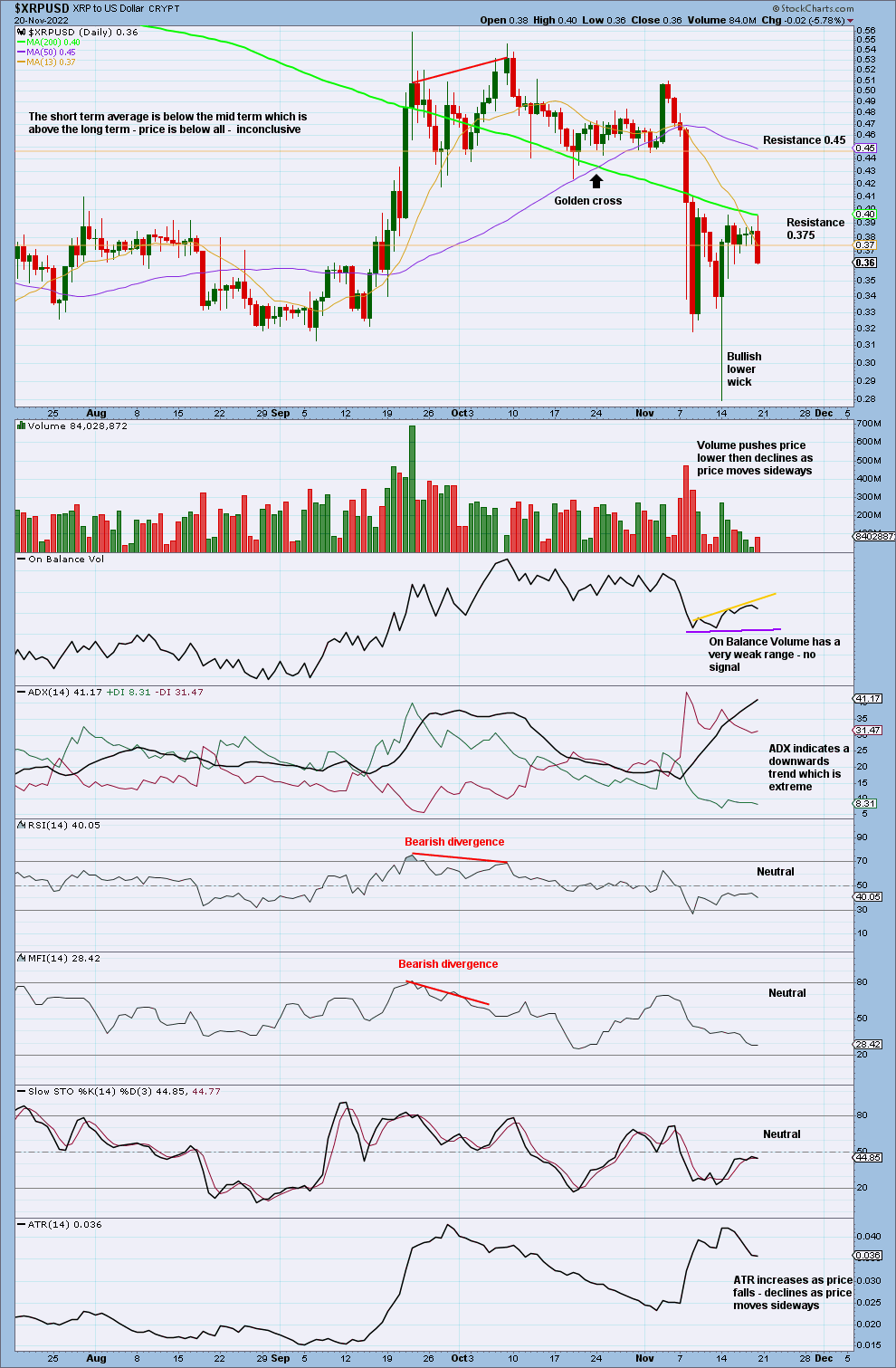

DAILY

Price has made a new low below the prior low of the June 18, 2022, only on an intraday basis and not on a closing basis.

The downwards trend is now extreme. If RSI exhibits bullish divergence and then a bullish candlestick pattern develops that has support from volume, then a sustainable low may be indicated.

There is room below for the trend to continue.

Published @ 07:09 p.m. ET.

—

Careful risk management protects your investments.

Follow my two Golden Rules:

1. Invest only funds you can afford to lose.

2. Have an exit plan for both directions – where or when to take profit, and when to exit a losing investment.

—

New updates to this analysis are in bold.

–