September 11, 2023: NASDAQ Elliott Wave and Technical Analysis – Video and Charts

Summary: Recent upwards movement adds confidence to the expectation the bullish trend will resume. A short-term target is calculated at 14,462. A mid-term target is calculated at 14,941.

Note that the S&P 500 and NASDAQ do not always find highs and lows together. The last all-time high for the S&P 500 was on January 4, 2022, whereas the last all-time high for NASDAQ was November 22, 2021.

Last updated monthly charts are here.

MAIN ELLIOTT WAVE COUNT

WEEKLY CHART

Price continues to increase with some decline in momentum.

Minor wave 4 is labeled a complete zigzag. The low is expected to be sustained.

An Elliott channel is drawn using Elliott’s first technique. Draw a line from the end of minor wave 1 to the end of minor wave 3, with a parallel copy placed on the end of minor wave 2. Minor wave 5 may find resistance at the upper edge of this channel.

A second wave corrective movement within minor wave 5 cannot move below 13,161.76.

Intermediate wave (3) has a target calculated at 14,941, which is 4.236 times the length of intermediate wave (1).

DAILY CHART

Price increases for the beginning of minor wave 5. Minute waves i and ii are expected to be complete. Minute wave iii is pushing price higher and has a target calculated at 14,463, the 1.618 Fibonacci ratio of minute wave i.

Minor wave 5 is expected to move beyond the end of minor wave 3 in order to avoid a truncation.

Minute wave iii is currently in the beginning of minuette wave (iii). Overlapping third waves at minuette, minute, and intermediate degrees are expected to push price higher with increased momentum.

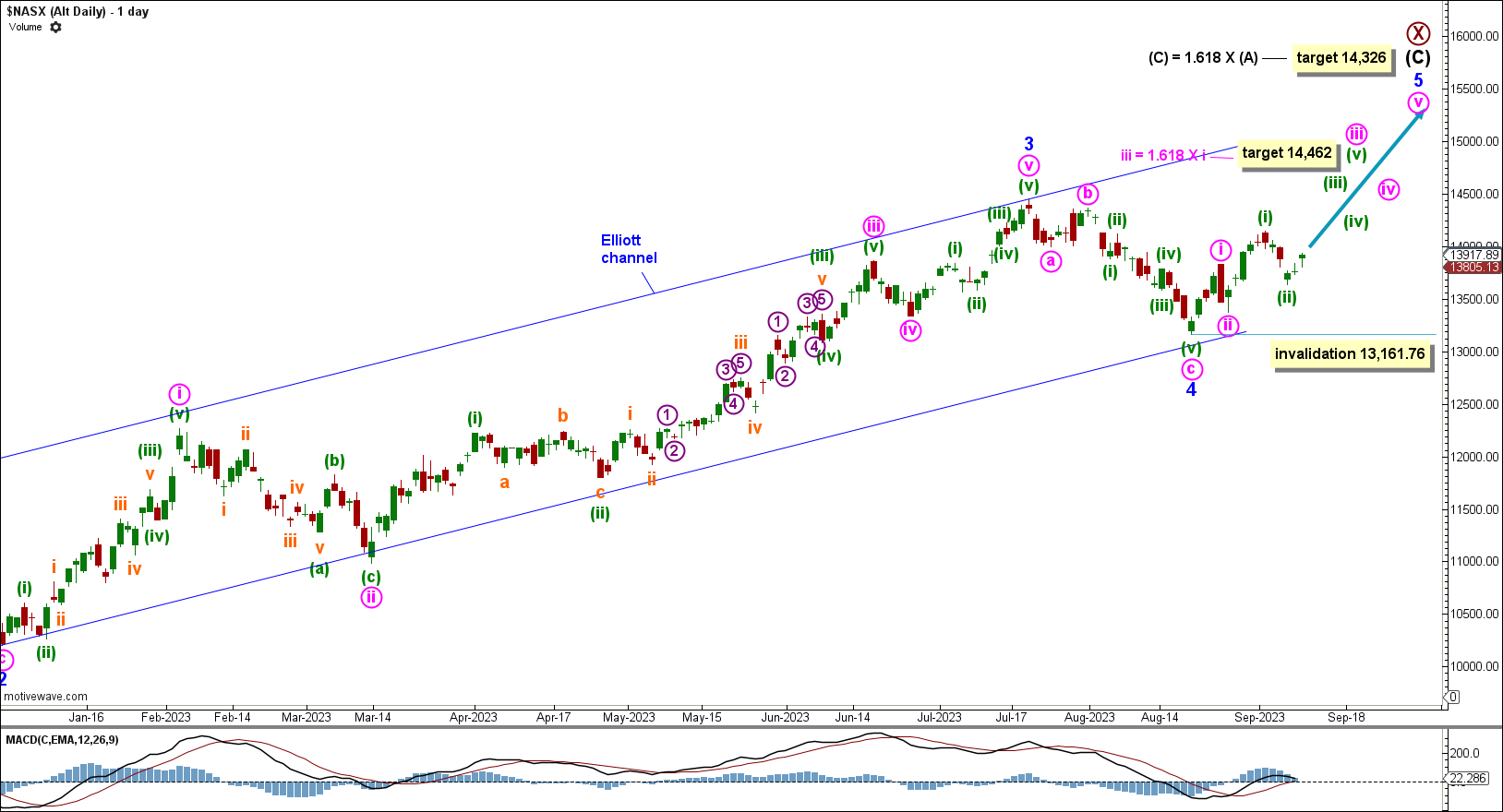

ALTERNATE ELLIOTT WAVE COUNT

ALTERNATE WEEKLY CHART

This alternate sees cycle wave IV incomplete and expects the current bullish movement to be a rally within a larger bearish trend. For the long term, price is expected to continue down for the end of primary wave Y and cycle wave IV.

Within intermediate wave (C), minor wave 4 is labeled complete and subdivides as a zigzag.

A channel is drawn using Elliott’s first technique. Draw a line from the end of minor wave 1 to the end of minor wave 3, with a parallel copy placed on the end of minor wave 2. Minor wave 5, intermediate wave (C), and primary wave X may find resistance at the upper edge of this channel.

A second wave corrective movement within minor wave 5 cannot move below 13,161.76.

Intermediate wave (C) has a target calculated to reach 1.618 times the length of intermediate wave (A) at 14,326.

A low below 12,269.55 will add confidence to this wave count because it is the invalidation of the main wave count.

ALTERNATE DAILY CHART

Price overall continues to move upwards with some corrective movements.

Minor wave 5 within minute wave iii pushes price higher.

Minor wave 5 is expected to move beyond the end of minor wave 3 in order to avoid a truncation.

Within minor wave 5, minute wave iii has a target calculated at 14,462, the 1.618 Fibonacci ratio of minute wave i.

TECHNICAL ANALYSIS

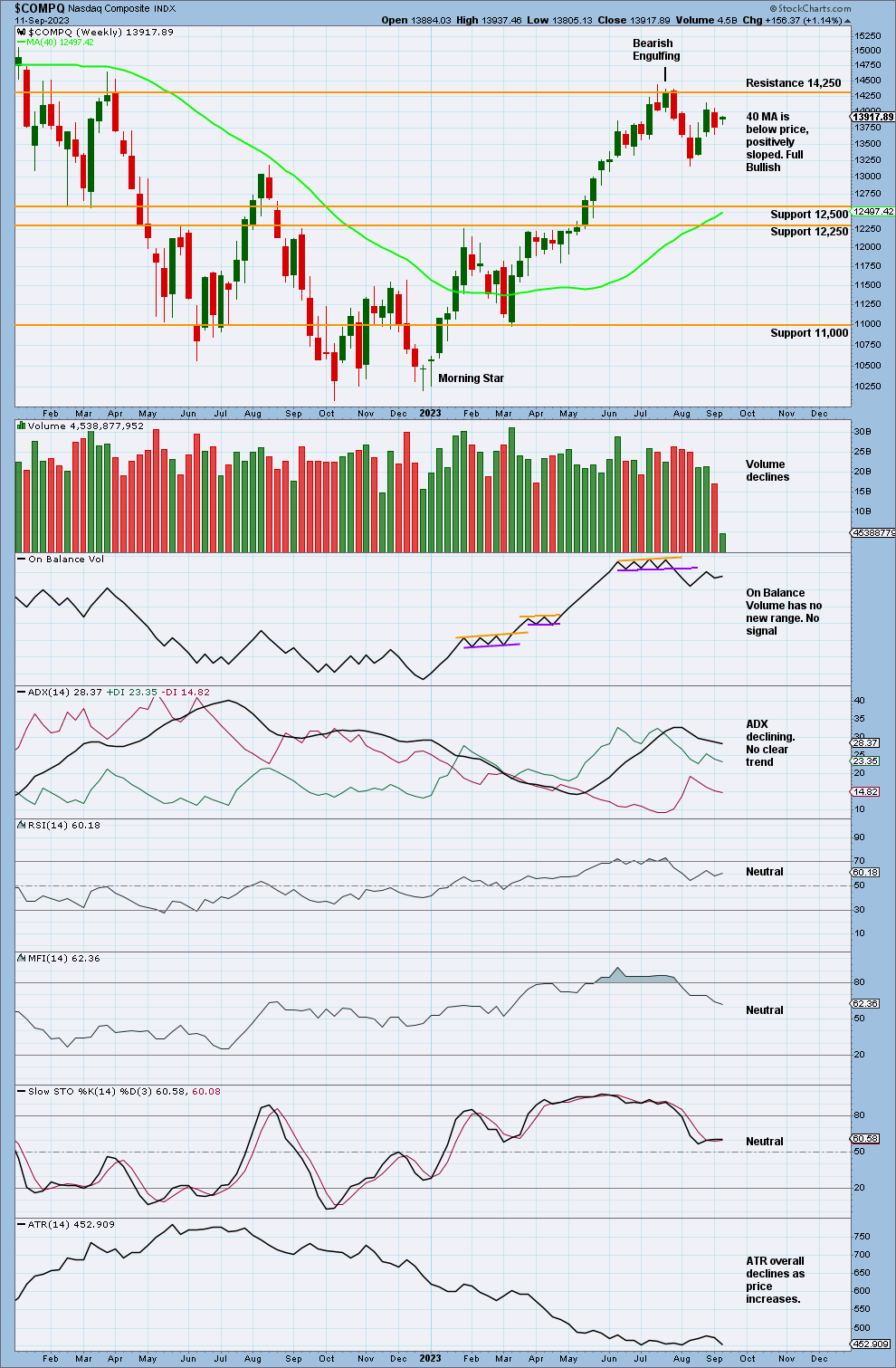

WEEKLY CHART

Price consolidates with declining volume.

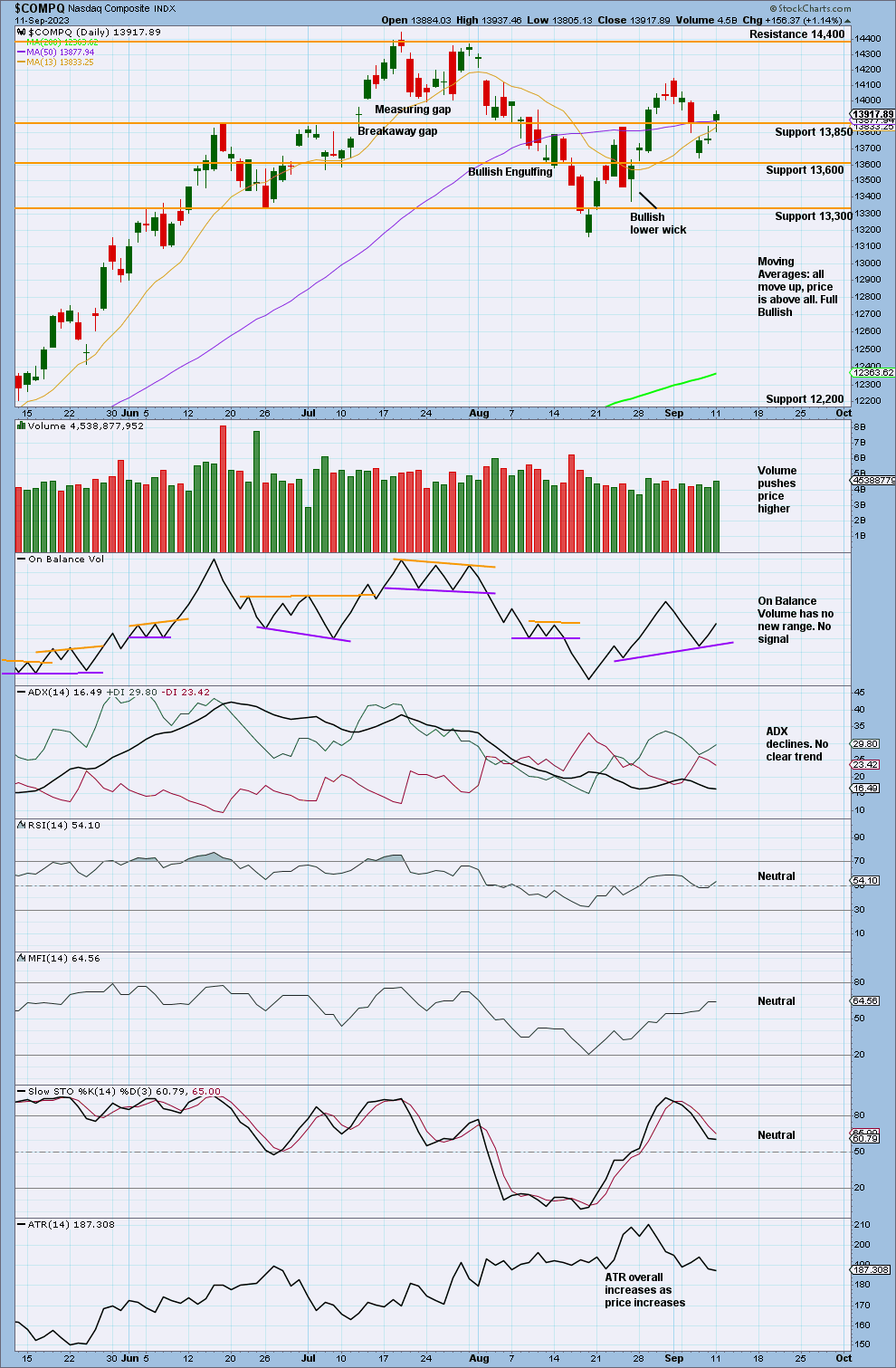

DAILY CHART

Price moves above support at 13,850 with a push from volume.

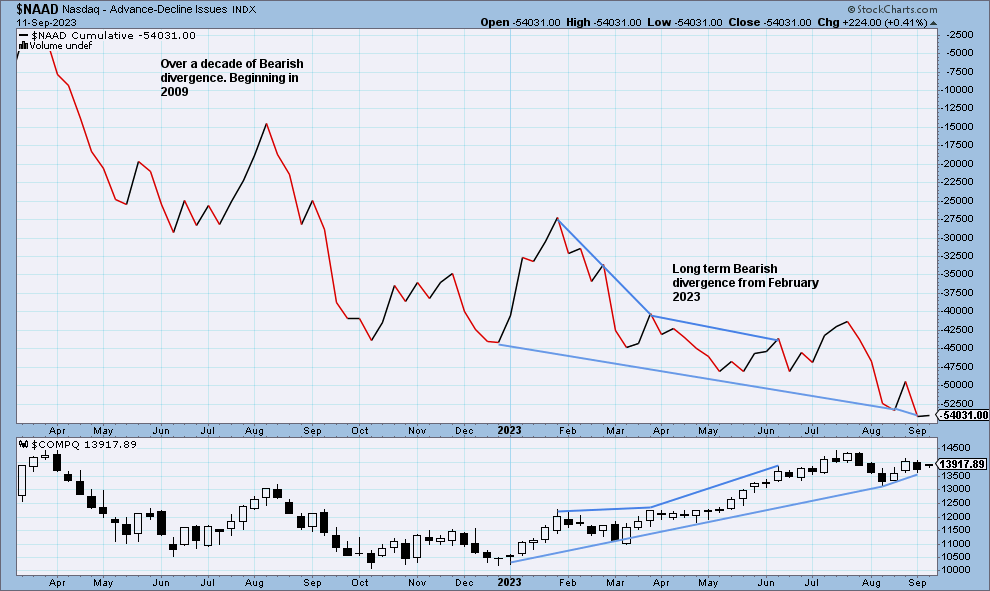

NAAD WEEKLY CHART

Nasdaq price is making higher highs, but the Nasdaq AD line has made lower highs. This divergence is bearish, and it shows that the rise in price does not have support from rising market breadth.

Nasdaq AD line is making new lows while price makes higher lows. This bearish divergence continues back to 2009.

Published @ 23:55 p.m. ET.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.

—