Market Correlations – Statements and Assumptions

Such statements are based upon unacknowledged assumptions that the markets have a correlation. The problem with assumptions is they can be wrong. So is there a simple mathematical technique to determine if two sets of data are correlated, either positively or negatively?

Yes, there is: by looking at the correlation co-efficient range between two sets of data.

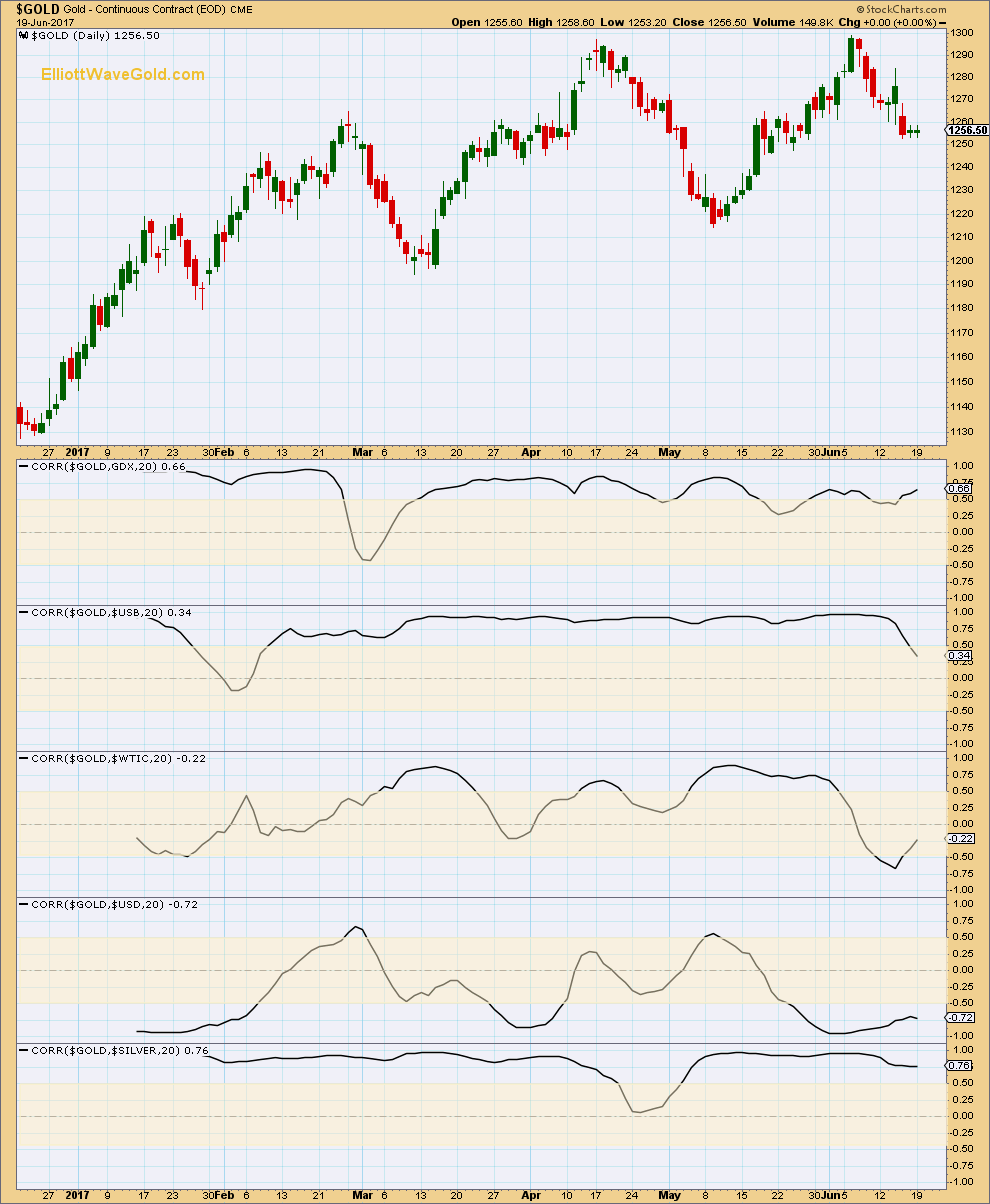

Correlation co-efficient ranges from -1 to +1. A perfect positive correlation will have a correlation co-efficient of +1. A perfect negative correlation will have a correlation co-efficient of -1.

Two sets of data which have a positive correlation will have a correlation co-efficient between +0.5 to +1. Two sets of data which have a negative correlation will have a correlation co-efficient between -0.5 to -1.

Any two sets of data which have a correlation co-efficient between +0.5 and -0.5 are not correlated.

Any two sets of data which have a correlation co-efficient that spends any time between +0.5 and -0.5 does not have a correlation which is reliable. This area of unreliability is shaded in the chart above for several markets which are often assumed to have a correlation to Gold price.

GDX, US Bonds, US Crude Oil, the US dollar index and even Silver do not have a reliable correlation with Gold price. All of these markets have correlation co-efficients which spend time in the shaded areas.

Even if these markets do sometimes exhibit a correlation with Gold, the point is that because this is not always true that when it is so it cannot be assumed to continue. The math shows that it does not.

To base an analysis of Gold on an assumption that another market is moving in a particular direction, and therefore Gold must move in a particular direction, is to base the analysis on assumptions and not data. Such assumptions are unreliable, and why you will not find them in my analyses.

To base an analysis of Gold on actual data and math is more likely to lead to accurate predictions and profitable trading. This does not mean the analysis will always be right, but it does mean the analysis will be based on facts and not assumptions.

This analysis is published @ 04:13 a.m. EST.