Setting Targets Using Elliott Wave

SUMMARY:

It is appropriate to use targets calculated using Fibonacci ratios greater than 1.618 (following ratios in the sequence) when:

1. A first wave is very short, and a target calculation using only 1.618 would see the third wave not move far enough for a ratio using a higher degree to be reached.

2. Price reaches the first target using 1.618 and keeps moving through it. Then the next Fibonacci ratio in the sequence should be used.

3. The particular market analysed often exhibits extreme Fibonacci ratios such as 6.854 and 11.09. Bitcoin is an example of such a market. This behaviour can be determined by Fibonacci analysis of completed waves.

EXAMPLE:

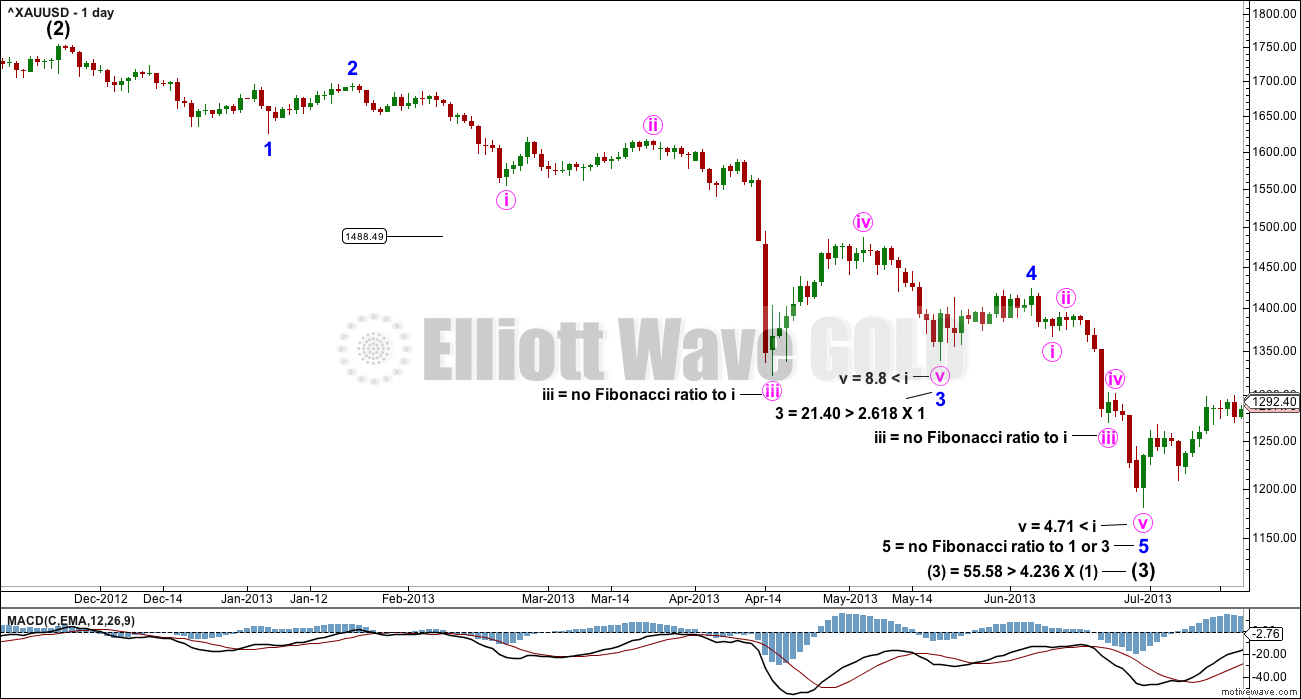

The chart above shows a fairly typical example of a third wave for Gold.

Here, minor wave 1 was relatively short. The first target using 1.618 for minor wave 3 would have been reached about 1,488. The structure was not complete there, unless the end of minute wave i was labelled as minor wave 3. But it did not exhibit a very strong increase in downwards momentum, so although that could have been the end of it (and was suggested to me at the time) that would not have looked right.

Intermediate wave (3) exhibits an extreme Fibonacci ratio to intermediate wave (1). Intermediate wave (1) was very short. As intermediate wave (3) unfolded, it could have been labelled complete at the low labelled minute wave iii. The strongest argument against such labelling would have been that selling climaxes are usually the end of a third wave within a third wave, and not often the end of a third wave of a larger degree.

Both of the fifth waves to end minor wave 3 and intermediate wave (3) exhibit ratios of equality in length with their counterpart first waves.

Published @ 02:11 p.m. EST.