4 Different Types of Gaps

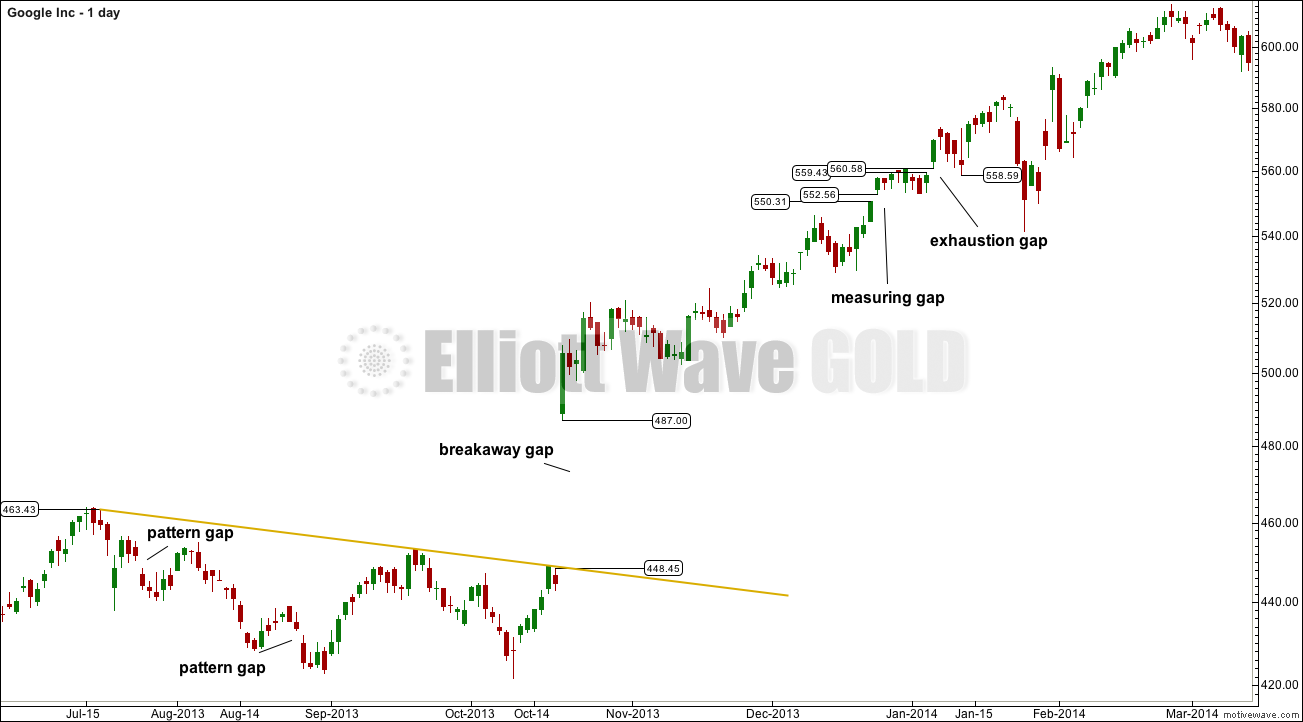

The above chart of Google shows daily data.

Equities more commonly have gaps and session only data of indices often does too. Forex rarely has gaps because forex markets are open 24 hours.

The four different types of gaps are:

1. PATTERN GAPS

These gaps are the ones which are almost always closed. Only the very last gap within a consolidation may not be closed.

These gaps suggest a congestion area is forming. They are not useful in trading.

2. BREAKAWAY GAPS

These are the most profitable gaps. After a period of sideways movement draw trend lines to determine support and resistance for the consolidation. A breakout above or below the zone accompanied by a gap signals the end of consolidation and the return of a trend.

Breakaway gaps are rarely closed within any reasonable time frame. They may be used as areas of support or resistance to set stops.

If the gap is filled reasonably quickly, then it is unlikely to be a breakaway gap.

3. MEASURING GAPS

These are gaps that occur within a clear trend. Assume such a gap is a measuring gap until proven otherwise. Proven otherwise means until the gap is closed.

Measuring gaps are not closed within any reasonable time frame. They may be used as areas of support or resistance, and to place stops. They may also be used to set targets. They often occur about mid way within a price run, so calculate the distance of the pole prior to the gap and add that to the end of the gap to give a target.

4. EXHAUSTION GAPS

These gaps are closed within a relatively short time frame. As soon as the gap is closed, it indicates an end to the price run and the start of either a trend change or a period of consolidation.

Exhaustion gaps are filled within a few candlesticks.

Published @ 04:53 p.m. EST.