Volume and Breakouts – 2

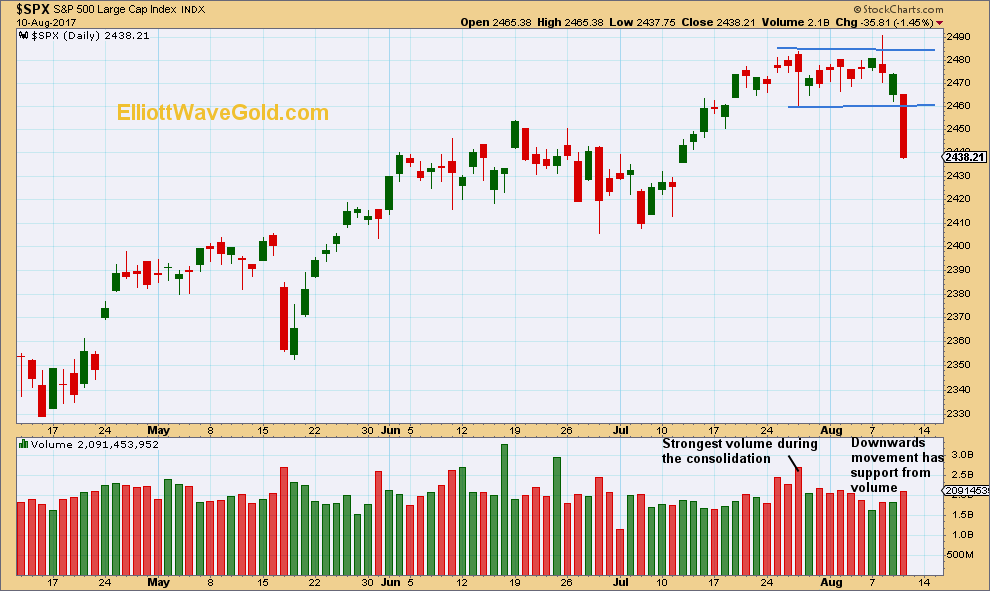

That was proven correct. The strong downwards movement from the S&P comes on a day with an increase in volume. This is a classic downwards breakout.

When a downwards breakout has support from volume, that adds confidence in it. Downwards breakouts do not require support from volume; the market may fall of its own weight. Price can fall due to an absence of buyers as easily as it can from an increase in activity of sellers. But when volume supports downwards movement, it may be more sustainable, at least for the short term.

This downwards breakout was predicted by strongest volume during the consolidation being a downwards day.

This volume analysis technique looks at the presence or absence of support from volume on the breakout after a consolidation period to tells us how reliable the breakout may be.

Published @ 12:17 a.m. EST on 12th August, 2017.