BTCUSD: Elliott Wave and Technical Analysis | Charts – August 11, 2021

Last Bitcoin analysis, on 5th August, expected upwards movement towards a target about 57,669 as most likely. Over the last week this is what has happened.

Summary: At this stage, all three short-term daily Elliott wave counts expect more upwards movement. The target at 57,669 is approximate only. This upwards movement is expected to be a continuation of a much larger consolidation, which looks most likely to continue sideways as a triangle for weeks to a few more months.

The data used for this analysis comes from Yahoo Finance BTC-USD.

Monthly and weekly charts are on a semi-log scale. The close up daily chart is on an arithmetic scale.

For notes on identifying highs and lows for Bitcoin, see this article here.

MAIN ELLIOTT WAVE COUNT

MONTHLY

It is possible to see a completed five wave impulse upwards for Bitcoin to the high in December 2017. This has been followed by a deep three wave structure downwards to the low in December 2018.

I am unable to find many reasonable Fibonacci ratios within this wave count. It appears that Bitcoin may not exhibit Fibonacci ratios very often between its actionary waves, so this makes target calculation impossible. Classic technical analysis was used to identify a high in place on December 23, 2017.

What is very clear from this chart is that Bitcoin forms classic bubbles. It has done so now several times and is now doing so again. So far each bubble has popped and Bitcoin has collapsed, to then thereafter form a new bubble. Each bubble is larger than the one prior; so if another Bitcoin bubble is forming, it may be expected to take price substantially higher.

Bitcoin tends to behave like an extreme commodity: price moves upwards for about 2 – 4 weeks in a near vertical movement at the end of its rises. Following this vertical movement the resulting downwards movement is very deep (in percentage terms) and often very quick.

The next rise begins slowly with basing action over weeks or months, and then as the rise nears its end another vertical movement completes it. Also, there are volume spikes just before or at the end, which is another feature typical of commodity like behaviour.

This has happened now several times. The most notable instances are the rise up to the week ending 24th November 2013, the week ending 5th June 2011, the high on 17th December 2017 at 19,870.62 and the high on 26th June 2019 at 13,796. The following sharp drops were 94%, 93%, 84% and 91%,respectively.

WEEKLY

The weekly chart focusses on cycle wave III. Cycle wave III may only subdivide as an impulse. Within the impulse: Primary waves 1, 2 and 3 may now be complete, and primary wave 4 may now be underway.

Primary wave 4 may subdivide as any one of more than 23 possible corrective structures. It is impossible to be confident of the structure of a fourth wave until it is over; alternate wave counts and flexibility are essential during corrections. When primary wave 4 may be complete, then an upwards breakout would be expected for primary wave 5. Primary wave 5 would very likely be longer than primary wave 3 by many multiples; it is common for this market for its fifth waves to be very long.

Primary wave 4 may not move into primary wave 1 price territory below 13,826.76.

Draw an Elliott channel about cycle wave III (weekly charts are drawn on a semi-log scale). Draw the first trend line from the ends of primary waves 1 to 3, then place a parallel copy on the end of primary wave 2. If it is long lasting or deep enough, then primary wave 4 may find support about the lower edge of the channel. The same channel is drawn on daily charts, but daily charts are drawn on an arithmetic scale and the trend channel sits differently.

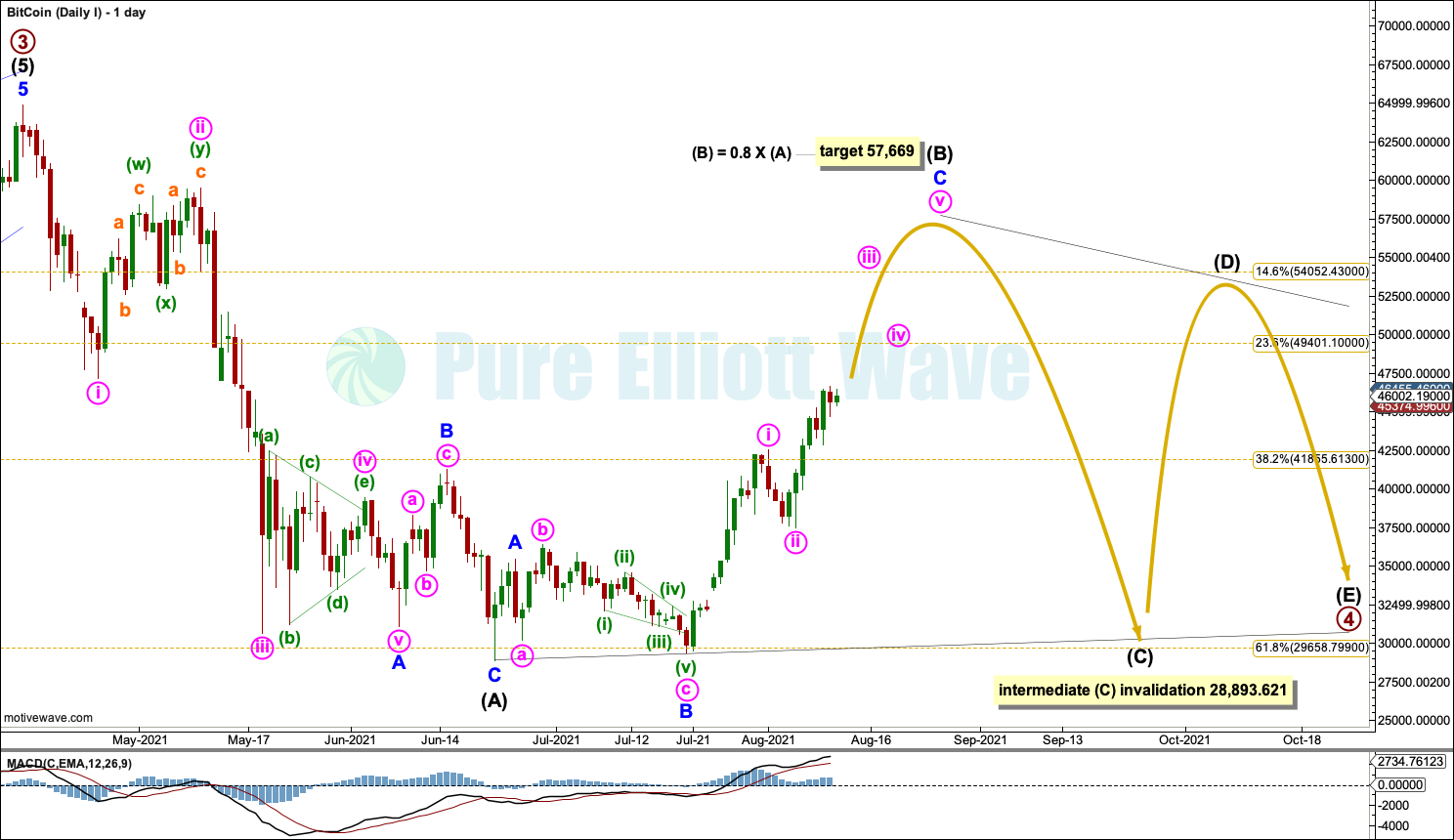

DAILY – FIRST

Primary wave 4 looks most likely to subdivide as a triangle if support about 29,000 holds. Technical analysis suggests it may.

The most common type of triangle is a regular contracting triangle, and the most common length for intermediate wave (B) would be about 0.8 the length of intermediate wave (A). This target is provided as an approximate guide only.

If primary wave 4 unfolds as a running triangle, then intermediate wave (B) may make a new price extreme beyond the start of intermediate wave (A) above 64,863.09. A new all time high does not mean that primary wave 4 would definitely be over.

Intermediate wave (C) within a contracting or barrier triangle may not move beyond the end of intermediate wave (A) below 28,893.621.

Intermediate wave (D) within a contracting or barrier triangle may not move reasonably beyond the end of intermediate wave (B).

Intermediate wave (E) within a contracting or barrier triangle may not move beyond the end of intermediate wave(C).

A triangle may take many months to complete.

At this stage, this first wave count has the best look and highest probability.

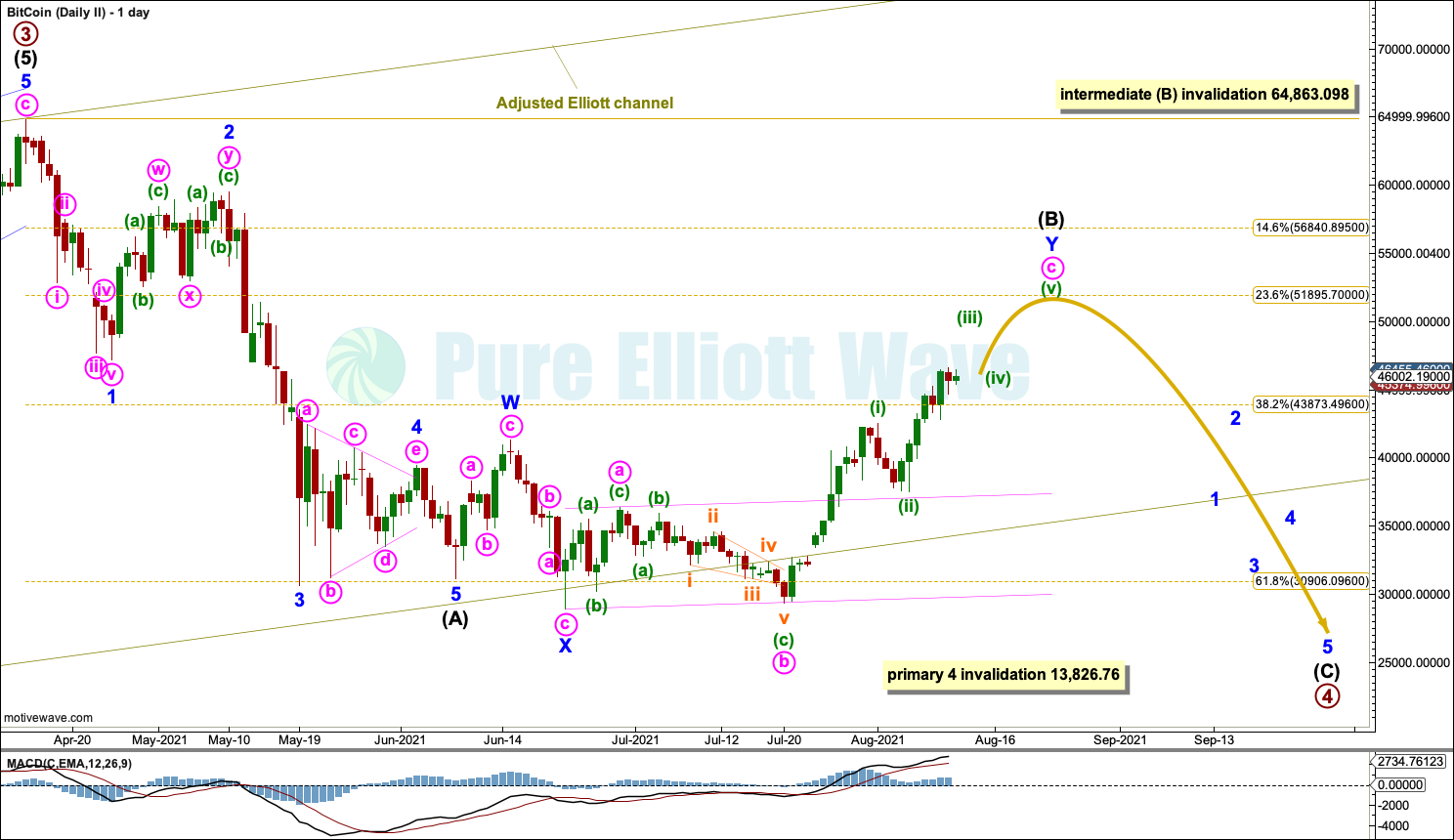

DAILY – SECOND

A new low below 28,893.621 would invalidate the first daily Elliott wave count and leave the second and third wave counts valid.

Primary wave 4 may subdivide as a single zigzag. Since primary wave 2 subdivided as a single zigzag, then this would provide no alternation in structure; however, alternation is a guideline and not a rule, and not always seen. A zigzag is the most common corrective structure by a wide margin, so this wave count must be considered as a possibility.

Intermediate wave (B) within the zigzag is labelled as a possible double combination. The first structure in the double labelled minor wave W subdivides as a zigzag. The double is joined by a three in the opposite direction, a zigzag labelled minor wave X. The second structure in the double labelled minor wave Y subdivides as a regular flat. However, combinations should be sideways movements; minor wave Y has now moved substantially beyond the end of minor wave W, which no longer looks like a normal combination, so the probability of this wave count is reduced. Regular flat corrections normally have C waves that are reasonably close in length to their A waves, but here minute wave c within minor wave Y is much longer than minute wave a, further reducing the probability of this wave count, so it may be discarded next week.

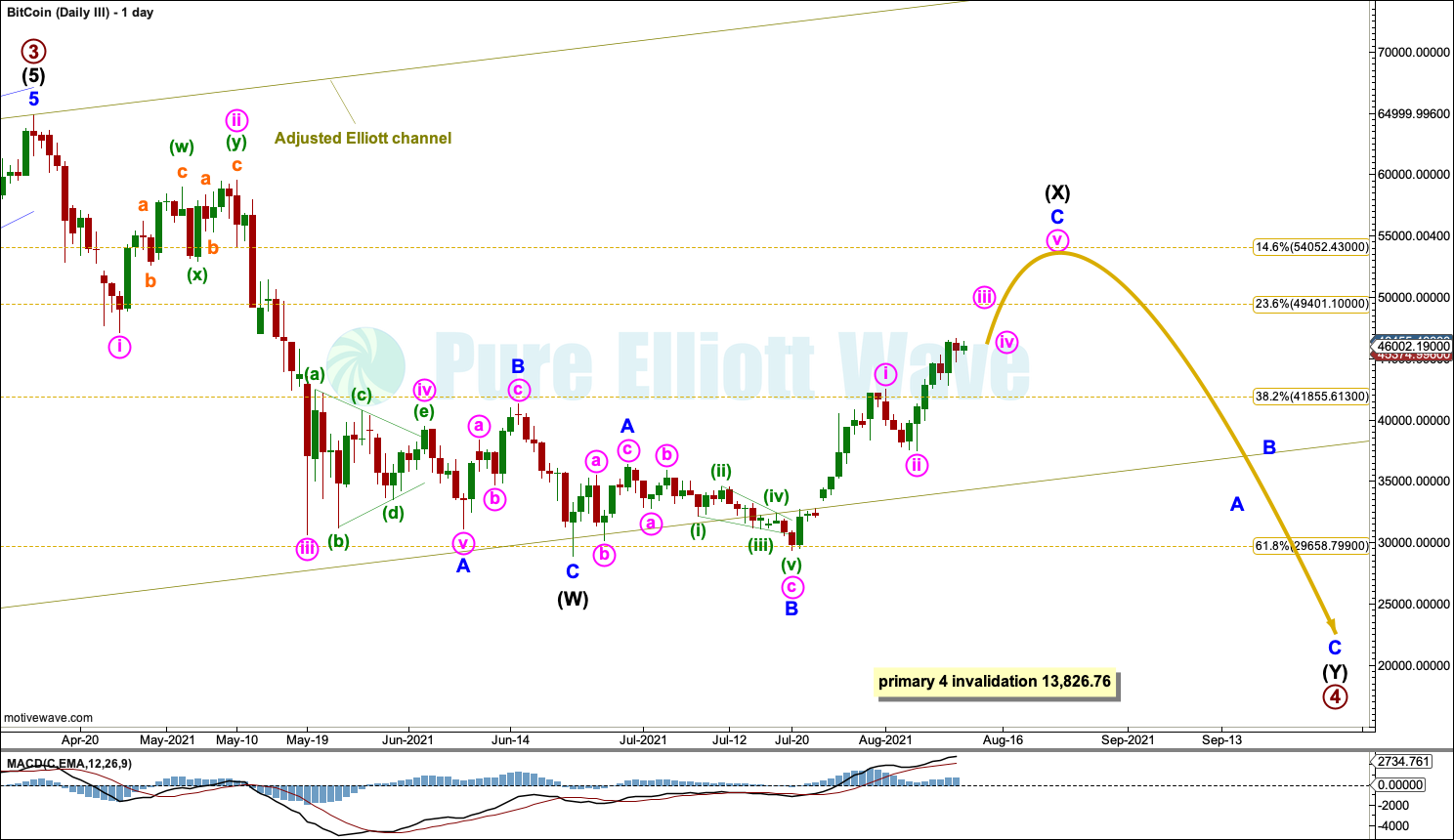

DAILY – THIRD

It is also possible that primary wave 4 may subdivide as a double zigzag.

The first zigzag within the double zigzag labelled intermediate wave (W) may be complete. The double may now be joined by an incomplete three in the opposite direction, a regular flat labelled intermediate wave (X).

Regular flats normally have C waves that are reasonably close to equal in length with their A waves, but minor wave C within intermediate wave (X) is now much longer than minor wave A. This does not look like a normal regular flat and the probability of this wave count is reduced, so it may be discarded next week.

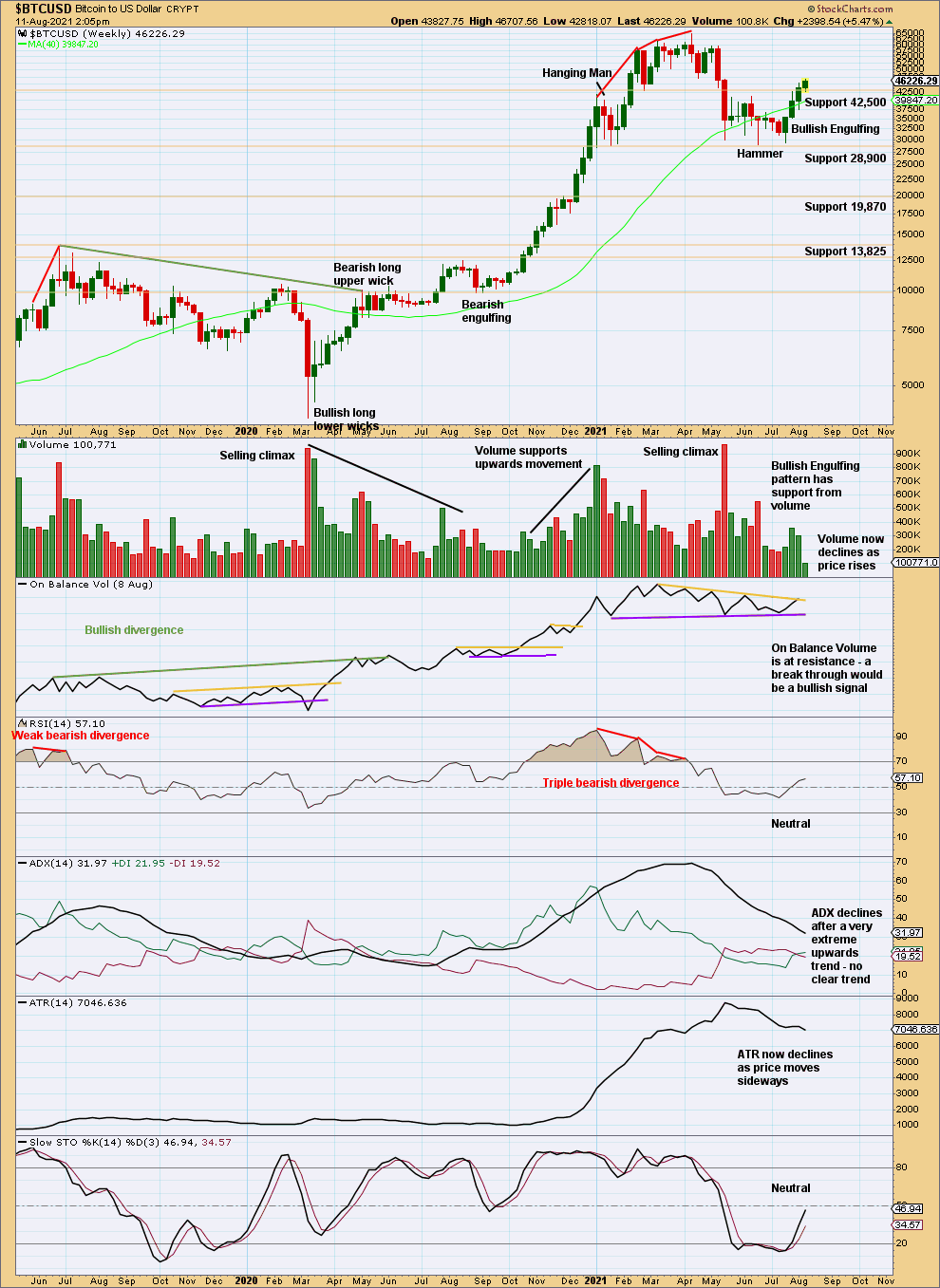

TECHNICAL ANALYSIS

WEEKLY

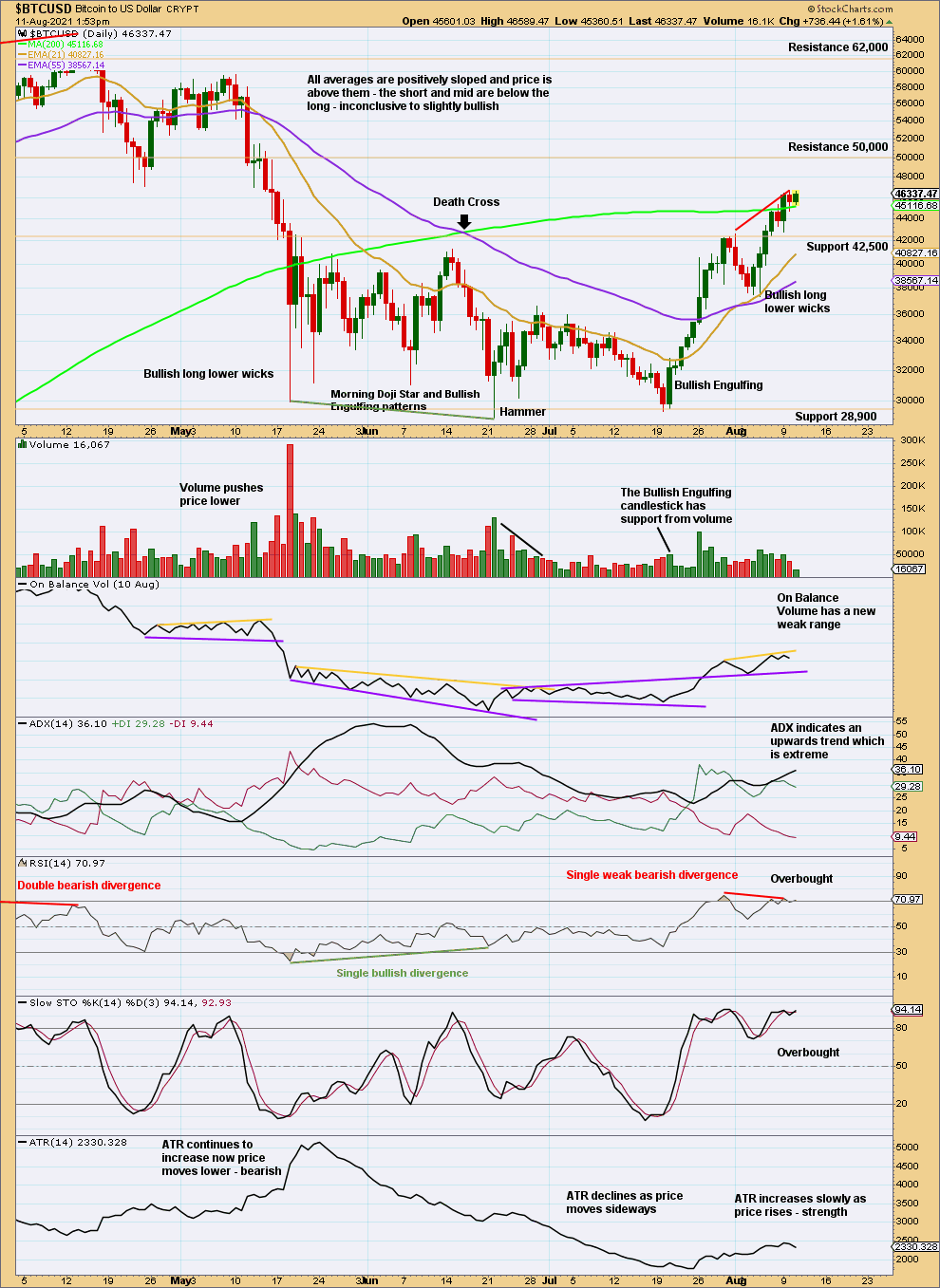

The prior upwards trend reached very extreme. Now support is holding strong about 28,900. Watch On Balance carefully for a signal soon.

There may be a signal from On Balance Volume at the conclusion of this current week.

DAILY

Bullish candlestick patterns appear at the last three lows, and long lower wicks appear at the first four. Support is strong about 28,900. Bullish divergence at the low of June 22, 2021, between price and RSI after RSI neared oversold, strongly suggests a low may be in for Bitcoin.

Although ADX is extreme and RSI has reached overbought, Bitcoin can sustain conditions much more extreme than this and for a reasonable period of time. There is plenty of room for price to continue higher here before conditions may become extreme enough to suggest the upwards trend may be over.

Bullish divergence between price and RSI is noted, but it is too weak for confidence that this upwards trend should end here.

Published @ 11:35 p.m. EST.

—

Careful risk management protects your investments.

Follow my two Golden Rules:

1. Invest only funds you can afford to lose.

2. Have an exit plan for both directions – where or when to take profit, and when to exit a losing investment.

—

New updates to this analysis are in bold.