US OIL: Elliott Wave and Technical Analysis – Weekly – Video and Charts – March 4, 2022

The alternate Elliott wave count is this week discarded. Only one Elliott wave count remains.

Summary: There is only one Elliott wave count.

A consolidation may unfold for a large degree fourth wave. Support may be found about 103.77.

The low of April 2020 at 10.24 is expected to not be breached.

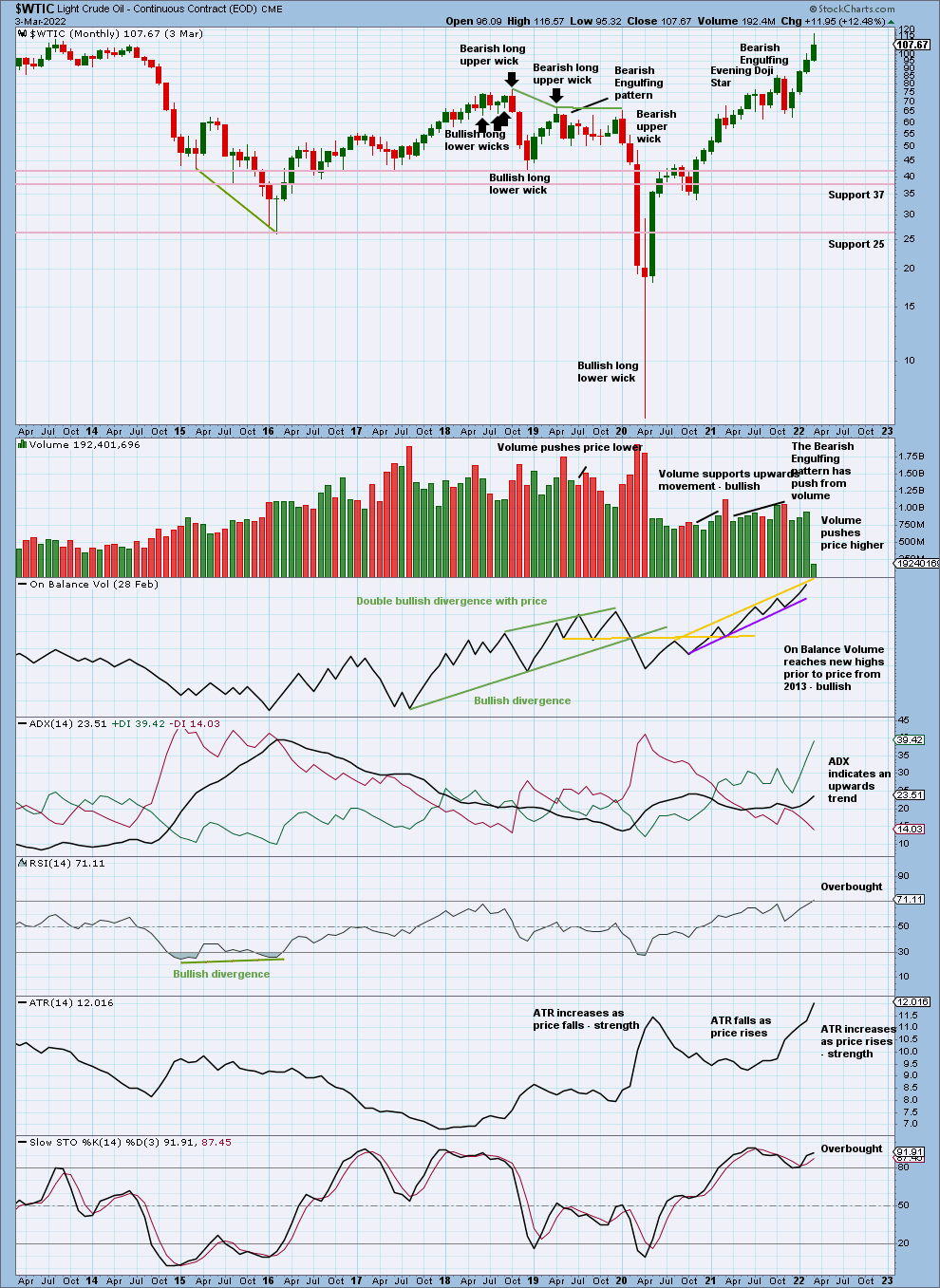

Monthly technical analysis is updated in today’s analysis.

ELLIOTT WAVE COUNT

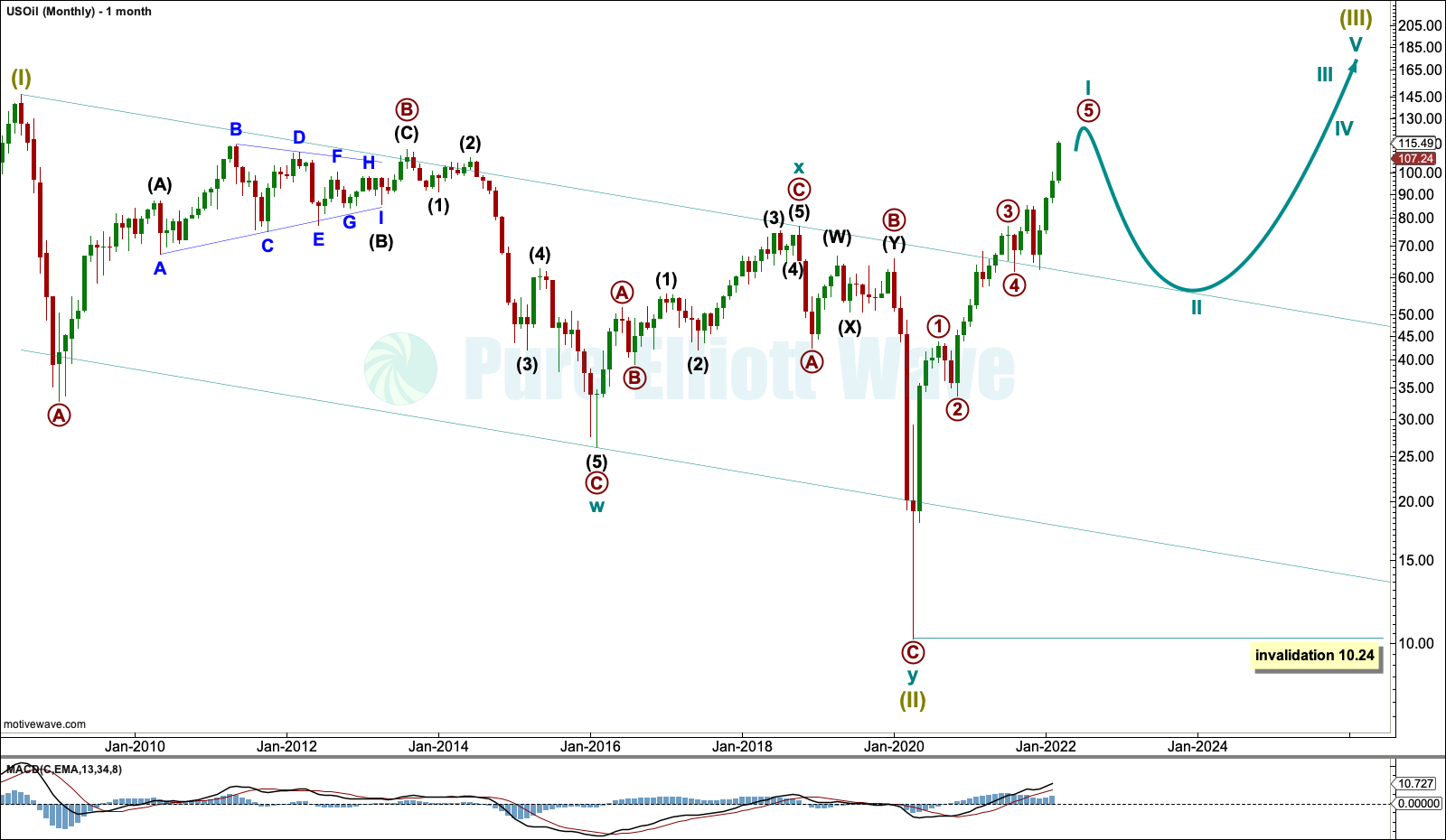

MONTHLY CHART

The basic Elliott wave structure is five steps forward and three steps back. This Elliott wave count expects that US Oil has completed a three steps back pattern, which ended in April 2020. The Elliott wave count expects that the bear market for US Oil is now over.

Following Super Cycle wave (II), which was a correction (three steps back), Super Cycle wave (III), which may have begun, should be five steps up when complete. Super Cycle wave (III) may last a generation and must make a new high above the end of Super Cycle wave (I) at 146.73.

A channel is drawn about Super Cycle wave (II): draw the first trend line from the start of cycle wave w to the end of cycle wave x, then place a parallel copy on the end of cycle wave w.

The upper edge of the channel has now been breached by upwards movement. The upper edge of this channel has provided support.

A new high above the high at 76.90 from October 2018 has been made. This is a significant new high and was expected from this wave count. Further confidence in the long-term expectations for this Elliott wave count may be had.

Super Cycle wave (III) may only subdivide as a five wave impulse.

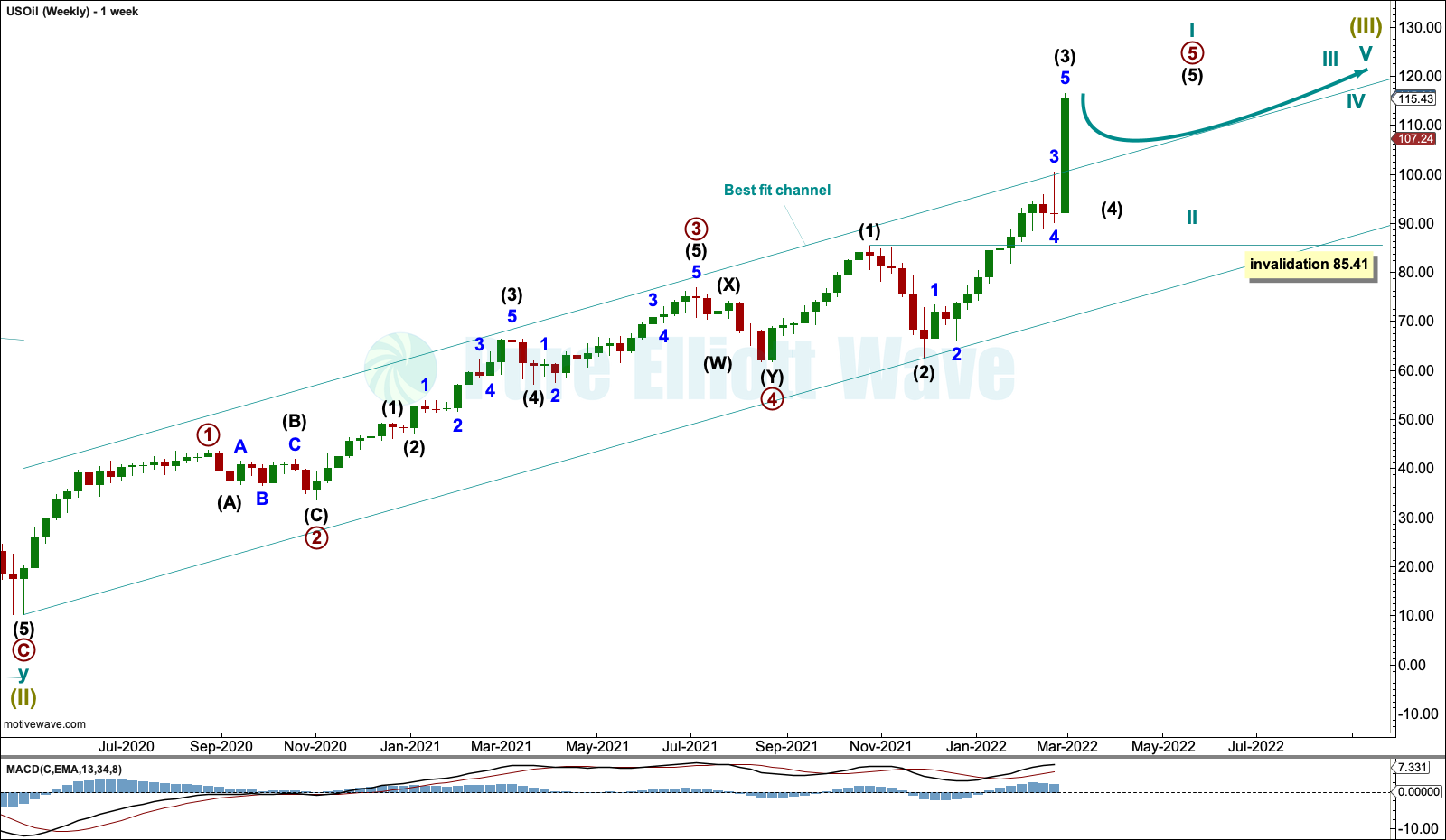

WEEKLY CHART

Super Cycle wave (III) must subdivide as an impulse.

Cycle wave I is incomplete. Primary wave 5 within cycle wave I may be extending.

The channel is drawn on an arithmetic scale. Draw the first trend line from the start of Super Cycle wave (III) to the low of intermediate wave (2) within primary wave 5. Place a parallel copy on the high of intermediate wave (3). The upper edge of this channel has been breached by strong upwards movement; this may be the end of intermediate wave (3).

Intermediate wave (4) may now find support at the upper edge of the channel. Intermediate wave (4) may not move into intermediate wave (1) price territory below 85.41.

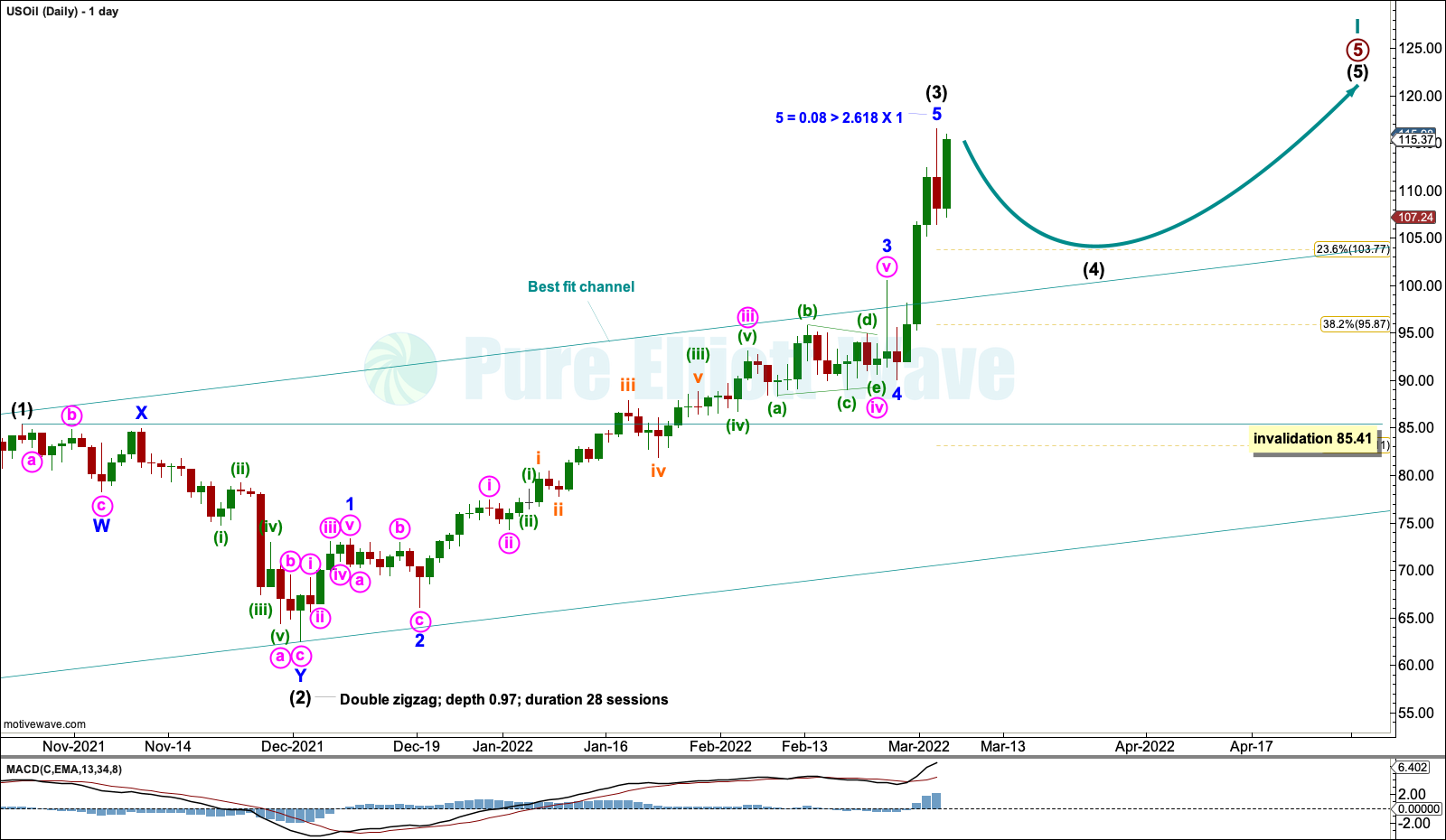

DAILY CHART

Intermediate wave (3) may only subdivide as an impulse.

Minor wave 3 no longer exhibits a Fibonacci ratio to minor wave 1. Minor wave 5, if it is over at this week’s high, is just 0.08 longer than 2.618 the length of minor wave 1. Fifth waves to end third wave impulses one degree higher are commonly very strong in commodities; this behaviour looks normal.

Intermediate wave (4) may be a shallow consolidation that may be more brief than intermediate wave (2).

Intermediate wave (4) may find support about the upper edge of the best fit channel, which is copied over from the weekly chart. Intermediate wave (4) may not move into intermediate wave (1) price territory below 85.41.

TECHNICAL ANALYSIS

MONTHLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The last completed month of February shows support from volume and a small bearish upper wick. It should be noted that the last two bearish candlestick patterns in an Evening Doji Star for June-July-August 2021 and a Bearish Engulfing pattern for November 2021 were followed by little to no downwards movement.

When this market has a strong bullish trend, RSI can remain overbought for a few months while price travels a considerable distance. At the all-time high in July 2008, there was no bearish divergence between price and RSI.

There is a bullish trend that is strong and not yet as extreme as it can get for this market.

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is an upwards trend at all time frames.

RSI is now overbought at the monthly chart and weekly chart level. RSI can reach more deeply overbought before the trend changes though.

ADX is not yet extreme.

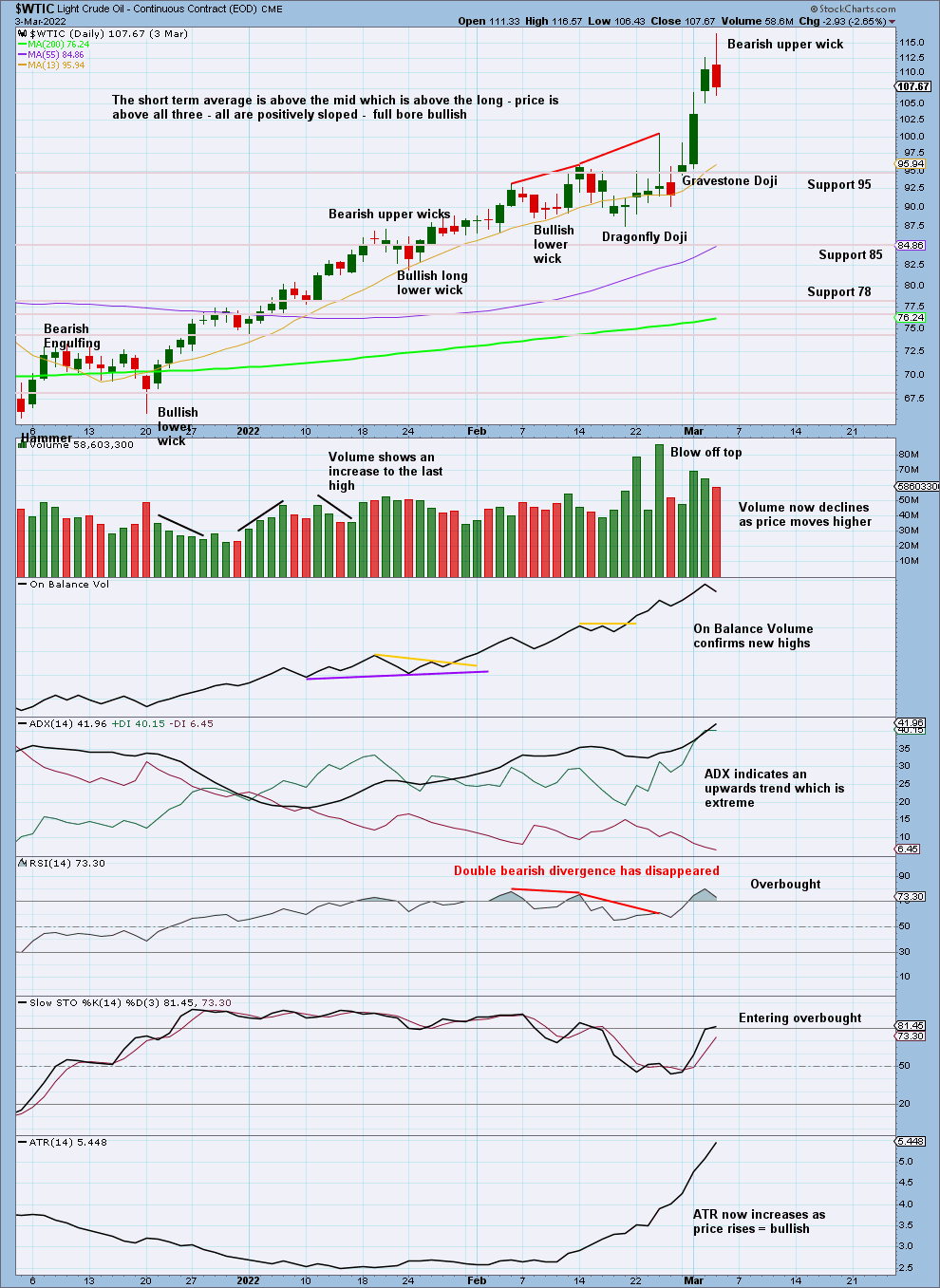

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Bearish divergence between price and RSI disappeared; price has continue higher.

The blow off top was followed only by a brief interruption to the trend.

Overall, volume is now declining as price moves higher. This market looks vulnerable to a consolidation or pullback about here.

Published @ 07:20 p.m. ET.

—

Careful risk management protects your investment account(s).

Follow my two Golden Rules:

1. Invest only funds you are prepared to lose entirely.

2. Always have an exit strategy for both directions; when or where to take profit on a winning investment, and when or where to close a losing investment.

—

New updates to this analysis are in bold.

—