April 9, 2022: ETHUSD Elliott Wave and Technical Analysis – Video and Charts

Price remains below 3,959.228, but it has been moving higher. The main wave count expects the bull run to continue. An alternate allows the prior bear pullback to be deeper first; this has a lower probability.

The data used for this analysis comes from Yahoo Finance ETH-USD.

Monthly and Weekly charts are on a semi-log scale. The close up daily chart is on an arithmetic scale.

MAIN ELLIOTT WAVE COUNT

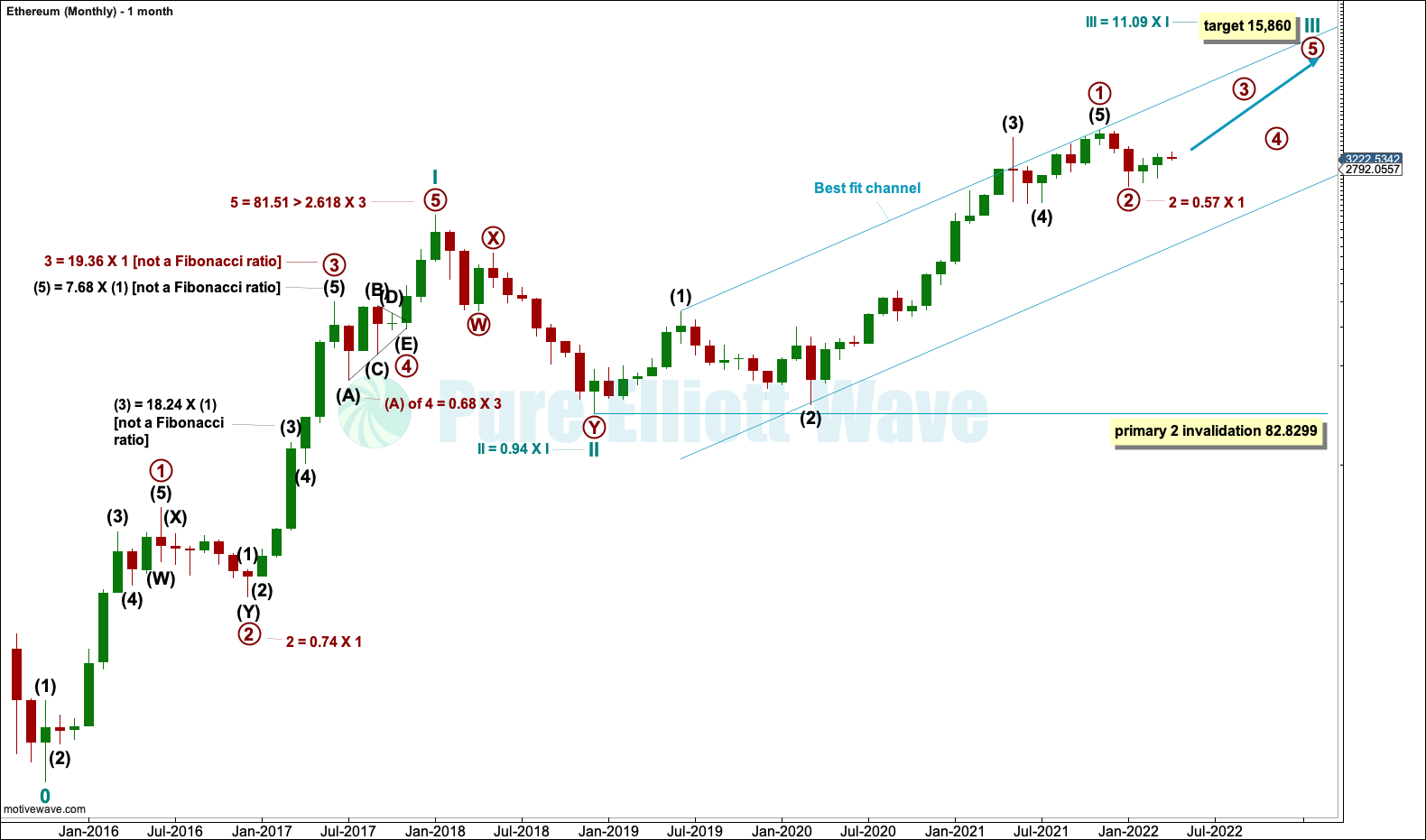

MONTHLY

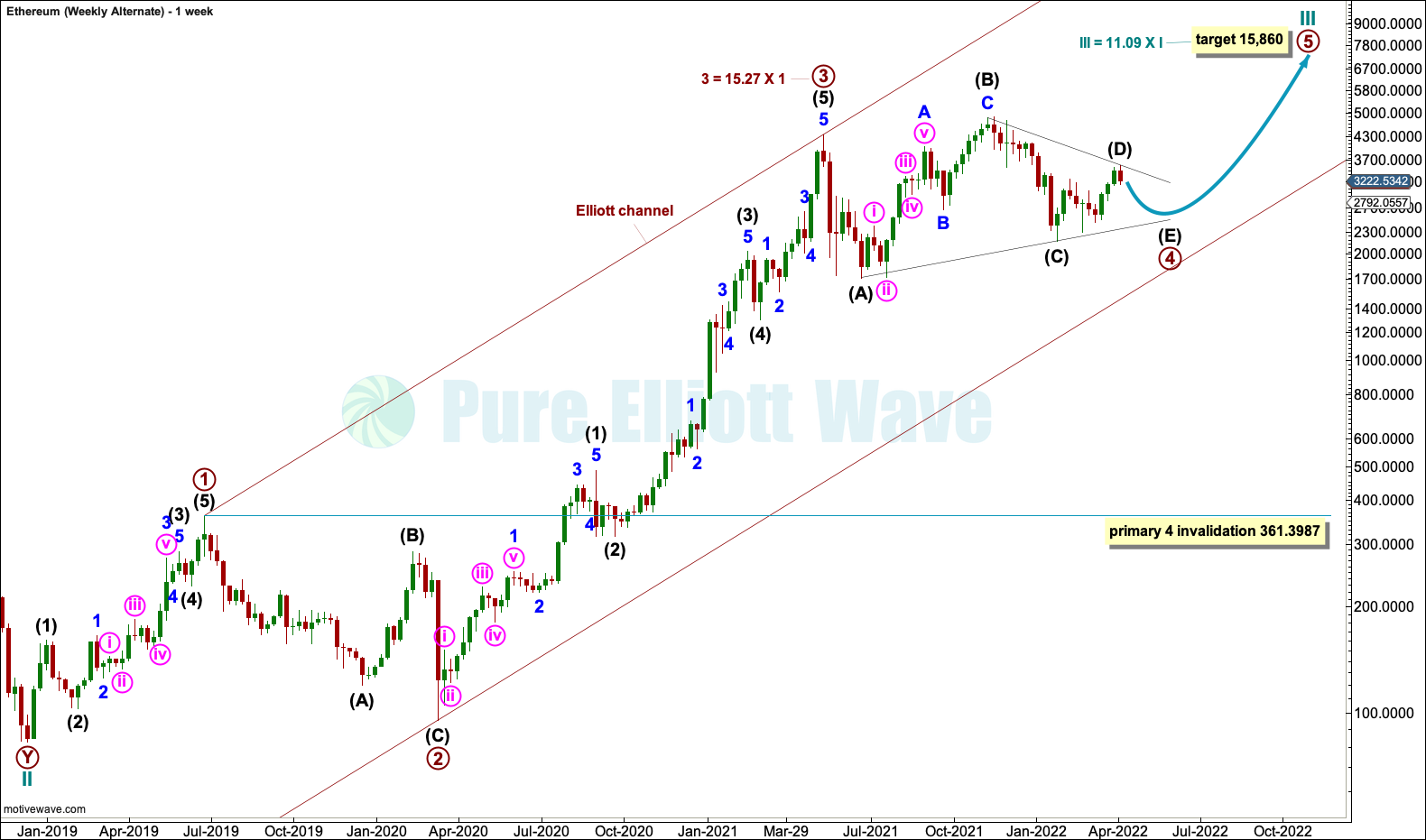

The monthly chart looks at the entire price history of Ethereum. The Elliott wave count begins at the low of October 2015.

From October 2015 to December 2017 this upwards wave subdivides perfectly as an Elliott wave impulse, labelled cycle wave I. The impulse lasted just over two years, which is within the expected duration for a cycle degree wave, so confidence that this degree of labelling is correct may be had.

Within cycle wave I, note that wave lengths noted on the chart are not Fibonacci ratios but guides to expected behaviour for Ethereum. Prior Ethereum price history exhibits very long third waves and fifth waves which are longer than third waves.

The depth of primary wave 2 and the deepest part of primary wave 4 within cycle wave I are also noted. Ethereum has had deep corrections, but not as deep as other cryptocurrencies, within cycle wave I.

Within cycle wave III, primary wave 2 may not move beyond the start of primary wave 1 below 82.8299. If primary wave 2 within cycle wave III is over at the last low, then it would be only 0.57 of primary wave 1. This would usually be considered too shallow for a cryptocurrency, but for Ethereum it is more possible.

Cycle wave III may only subdivide as an impulse. It must move far enough above the end of cycle wave I to allow room for cycle wave IV to unfold and remain above cycle wave I price territory.

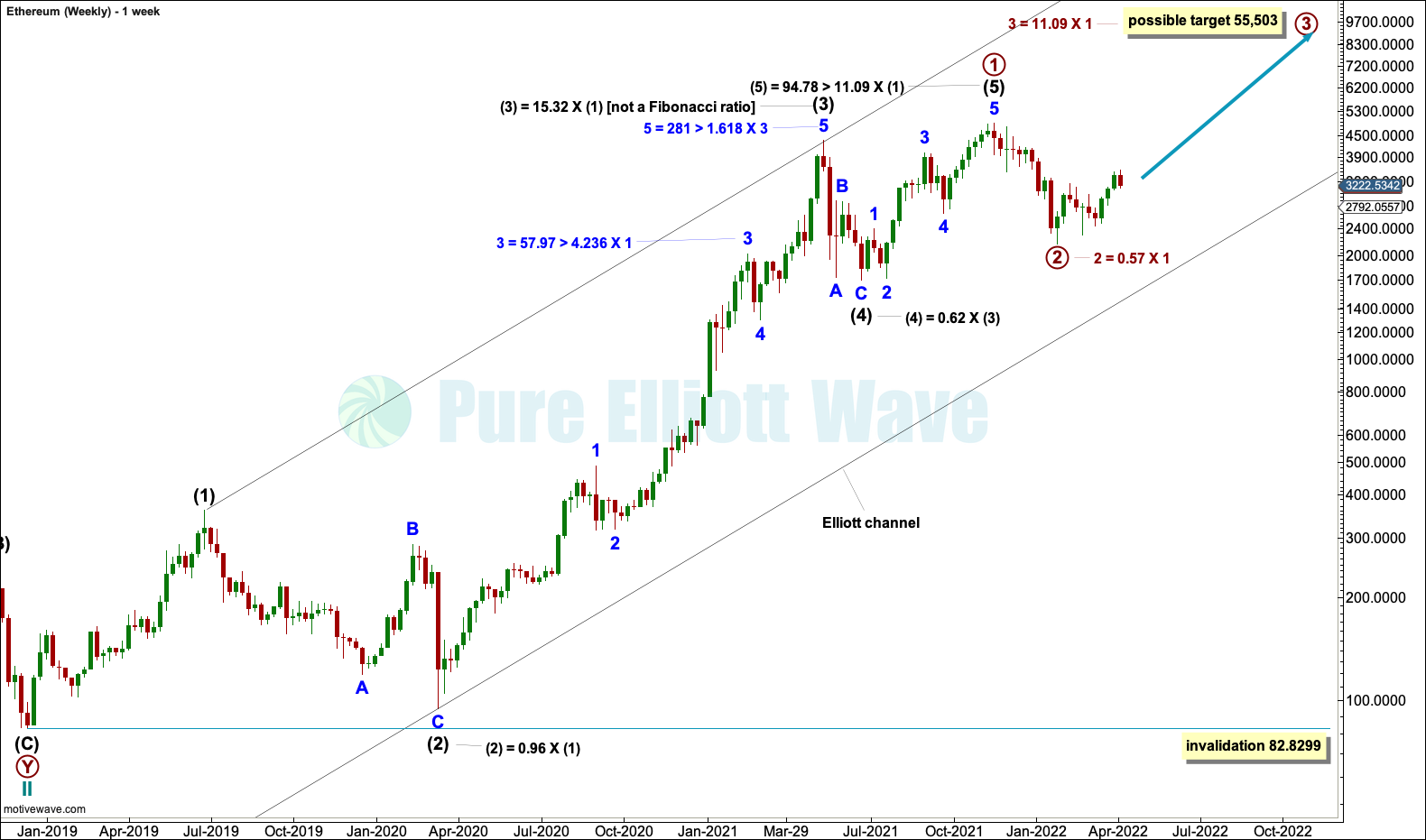

WEEKLY

Ethereum does exhibit Fibonacci ratios between its actionary waves; they tend to be extreme Fibonacci ratios. Within primary wave 1, the ratios are noted on the chart.

The structure of primary wave 1 may be complete. The structure of primary wave 2 is analysed in more detail on the daily chart below.

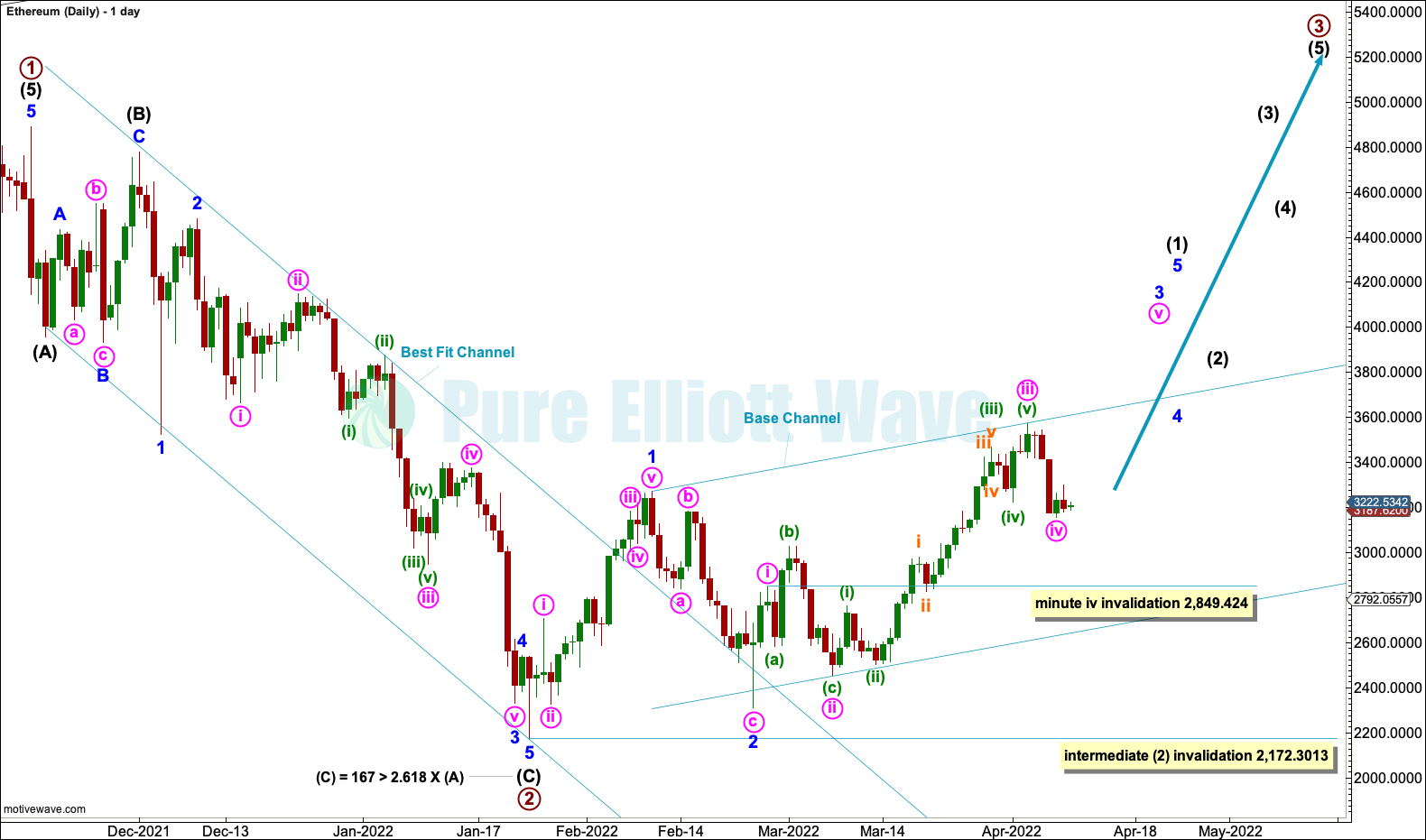

DAILY

The last and long bearish movement subdivides well as a zigzag, which may be complete. It is possible that primary wave 2 may be a complete zigzag and primary wave 3 may have begun. Within primary wave 2, intermediate wave (C) is 167 greater than 2.618 the length of intermediate wave (A) (the variation is just less than 10% the length of intermediate wave (C), so it is considered acceptable).

Intermediate wave (1) within primary wave 3 would most likely be incomplete.

Within intermediate wave (1): Minor waves 1 and 2 may be complete and minor wave 3 may be almost complete.

Within minor wave 3, minute wave iv may not move into minute wave i price territory below 2,849.424.

When intermediate wave (1) is complete, then a multi-week pullback for intermediate wave (2) may be expected. Intermediate wave (2) may not move beyond the start of intermediate wave (1) below 2,172.3013.

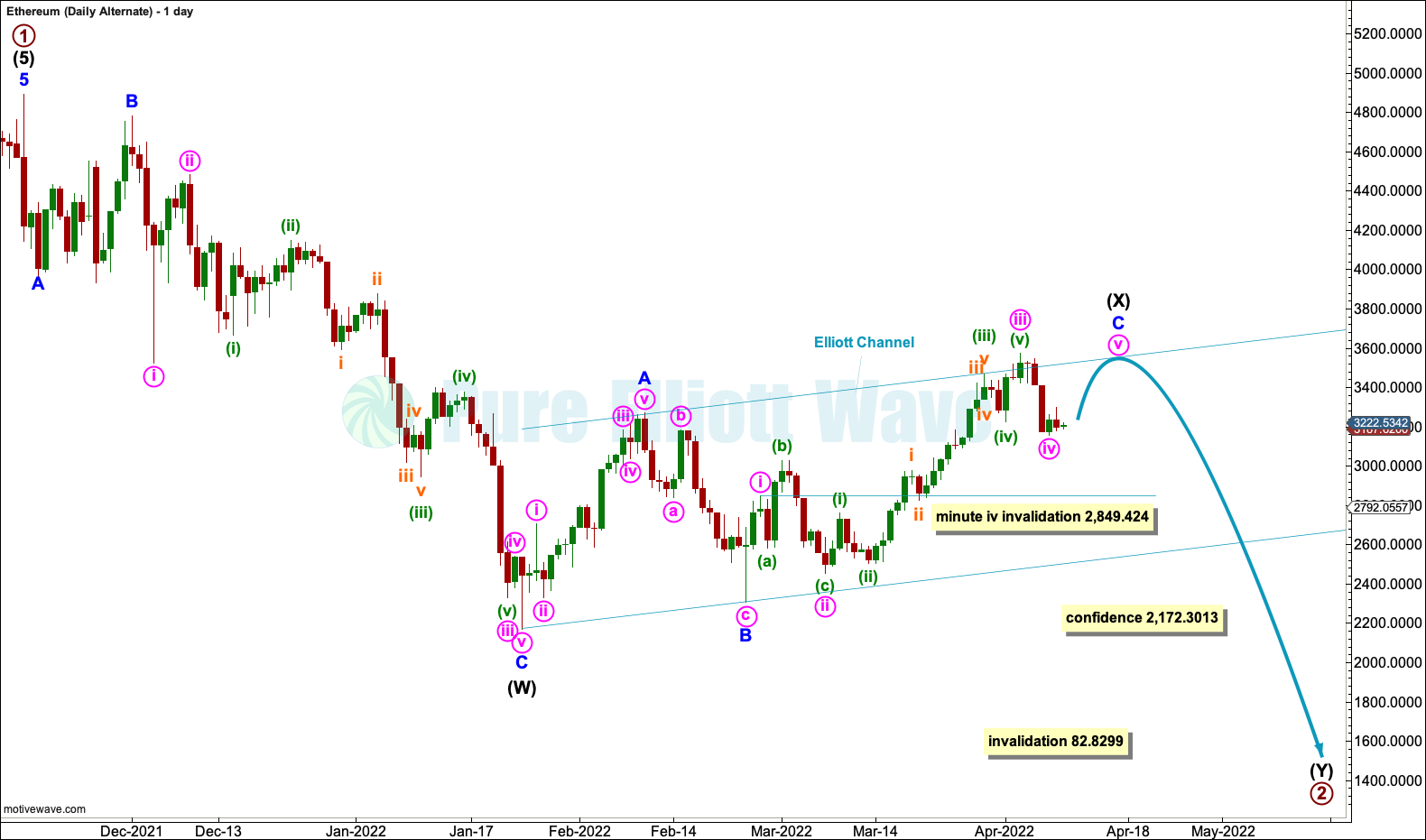

DAILY ALTERNATE

It is also possible that primary wave 2 may be incomplete and may continue lower as a double zigzag. The first zigzag in the double may be complete. A joining structure labelled intermediate wave (X) may be almost complete.

In Elliott wave terms the probability of this wave count is reduced by the duration of intermediate wave (X). X waves within multiple zigzags are most commonly relatively brief and shallow. This one is neither.

WEEKLY ALTERNATE

Within the impulse of cycle wave III: Primary waves 1, 2 and 3 may be complete and primary wave 4 may continue sideways as a large triangle for a few more months.

Primary wave 2 was a deep 0.95 zigzag, lasting 37 weeks. If primary wave 4 subdivides as a shallow triangle, then it would exhibit alternation. So far primary wave 4 has lasted 47 weeks; it may be longer lasting than primary wave 2 as triangles are usually longer lasting than zigzags. At this time, primary wave 4 may be close to completion.

Primary wave 4 may be a running contracting triangle. Intermediate wave (B) within primary wave 4 is a 1.19 length to intermediate wave (A). This is within a normal range for running triangles.

At this stage, the triangle looks possible still, but small overshoots of the triangle trend lines reduce the probability of this wave count. Elliott wave triangle trend lines are normally strictly adhered to; they should never be breached and are very rarely overshot. Here, both triangle trend lines have small overshoots.

TECHNICAL ANALYSIS

WEEKLY

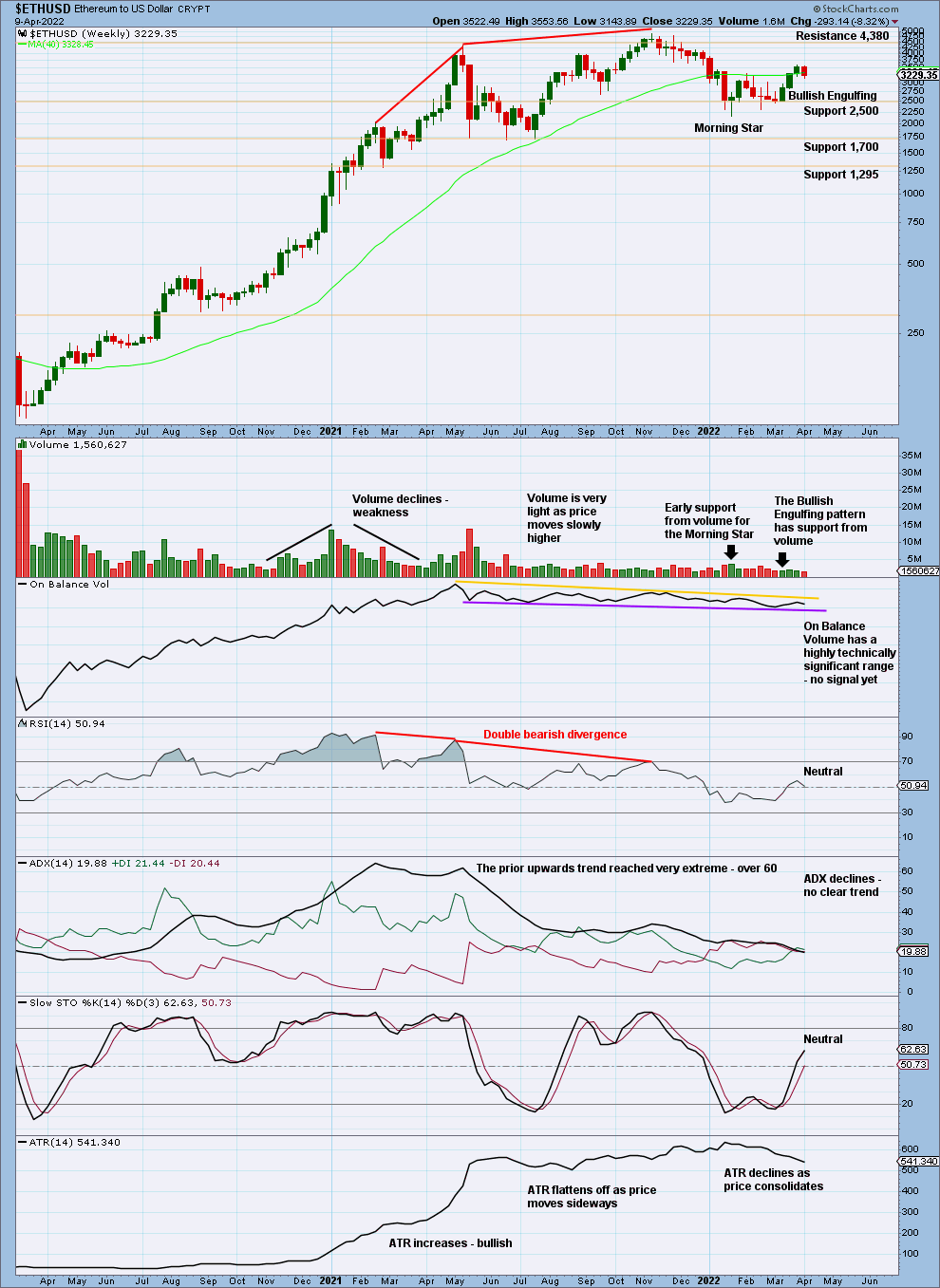

Like almost every other cryptocurrency I have analysed, Ethereum can sustain a strong bullish trend for a reasonable time while price travels a considerable distance. RSI can reach deeply overbought and ADX can reach above 50 exhibiting a very extreme trend.

RSI exhibited strong double bearish divergence at the last major high for Ethereum. The question now is: Is the following pullback enough to relieve this bearishness and is it over?

To answer this question we need to see if there is strength off lows. At the last two lows for Ethereum, there are bullish candlestick patterns with a little support from volume, so it is possible that the next bull run has begun.

DAILY

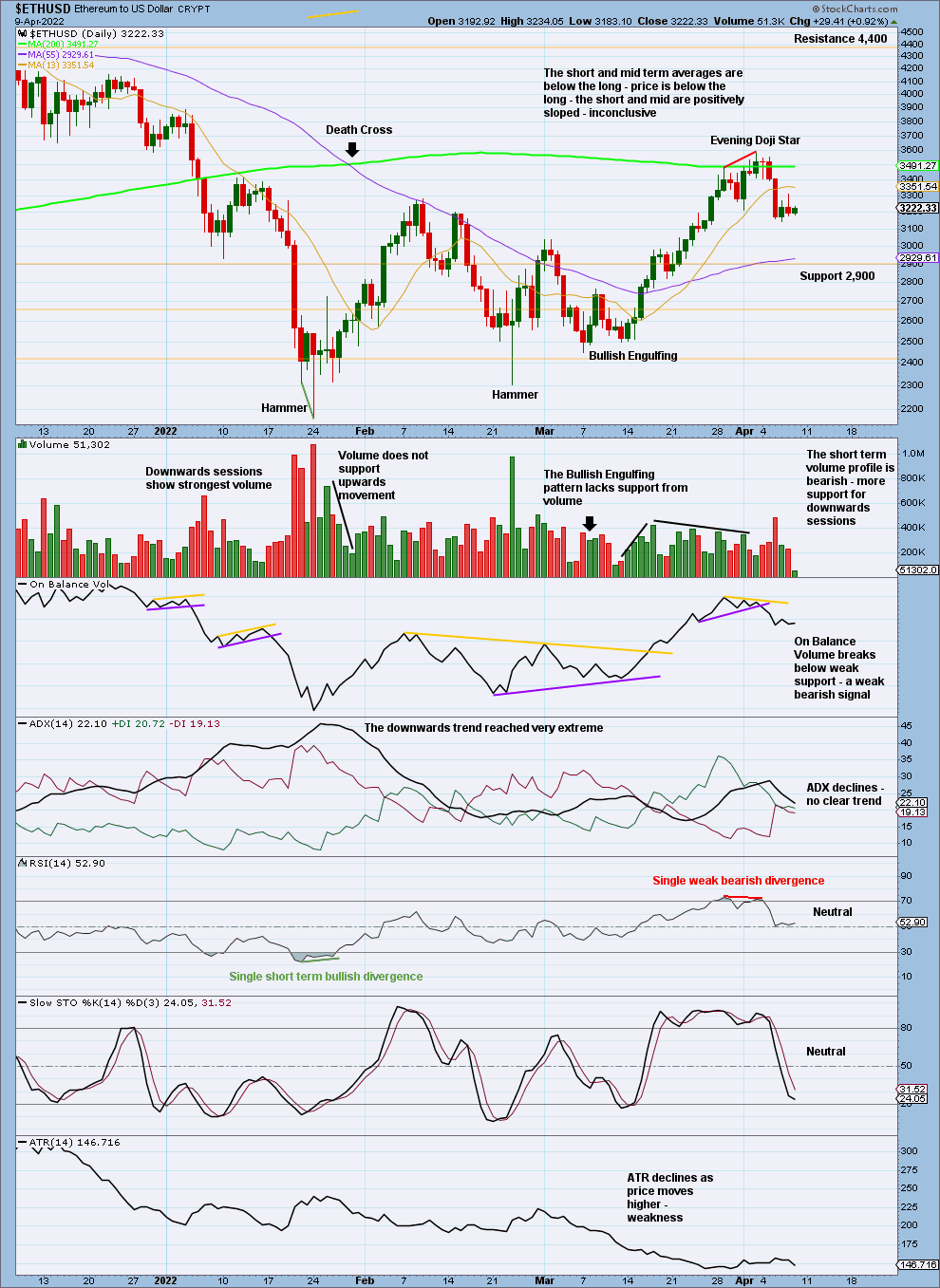

There are bullish candlestick patterns at the last three lows. Both Hammer candlestick patterns come with strong volume. But as they were both downwards sessions, it cannot be interpreted as strength off lows; it looks more likely that they were selling climaxes. This is still bullish.

The Bearish Engulfing pattern lacks support from volume, which puts doubt on the main Elliott wave count. The daily alternate Elliott wave count must be seriously considered.

For the short term, bearish divergence between price and RSI, a bearish candlestick reversal pattern in an Evening Doji Star, and a short-term bearish volume profile all suggest more downwards movement here.

Published @ 03:13 p.m. ET.

—

Careful risk management protects your investments.

Follow my two Golden Rules:

1. Invest only funds you can afford to lose.

2. Have an exit plan for both directions – where or when to take profit, and when to exit a losing investment.

—

New updates to this analysis are in bold.

–