November 22, 2022: TLT (iShares 20+ Year Treasury Bond ETF) Elliott Wave and Technical Analysis – Video and Charts

Summary: The downwards trend is extreme, but there is yet no evidence it is complete.

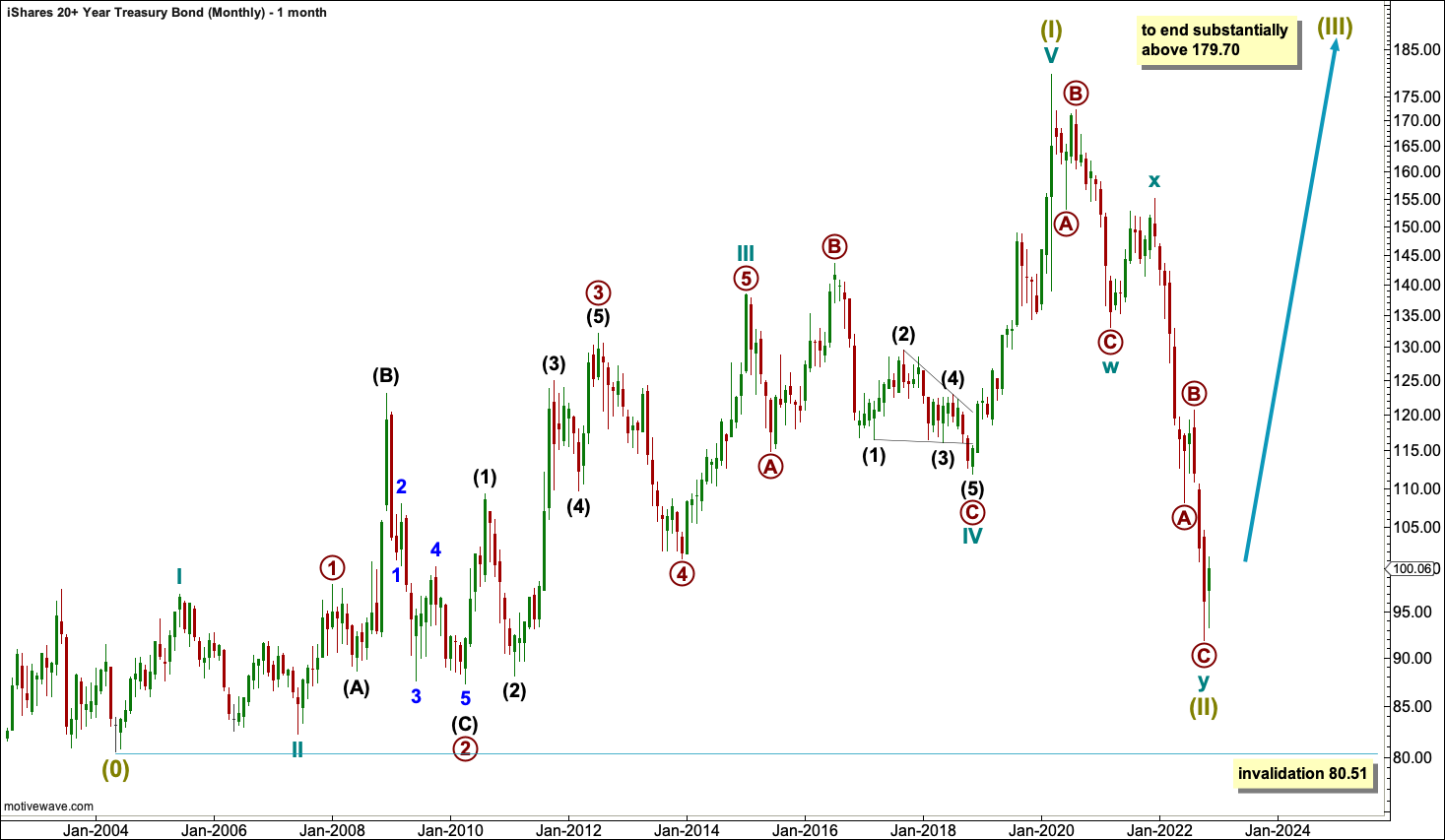

MAIN ELLIOTT WAVE COUNT

MONTHLY

Normally, new markets begin with a five wave structure in the main direction. The main direction for this market began upwards. Super Cycle wave (I) will subdivide as a five wave impulse.

Super Cycle wave (II) may be a nearly complete double zigzag.

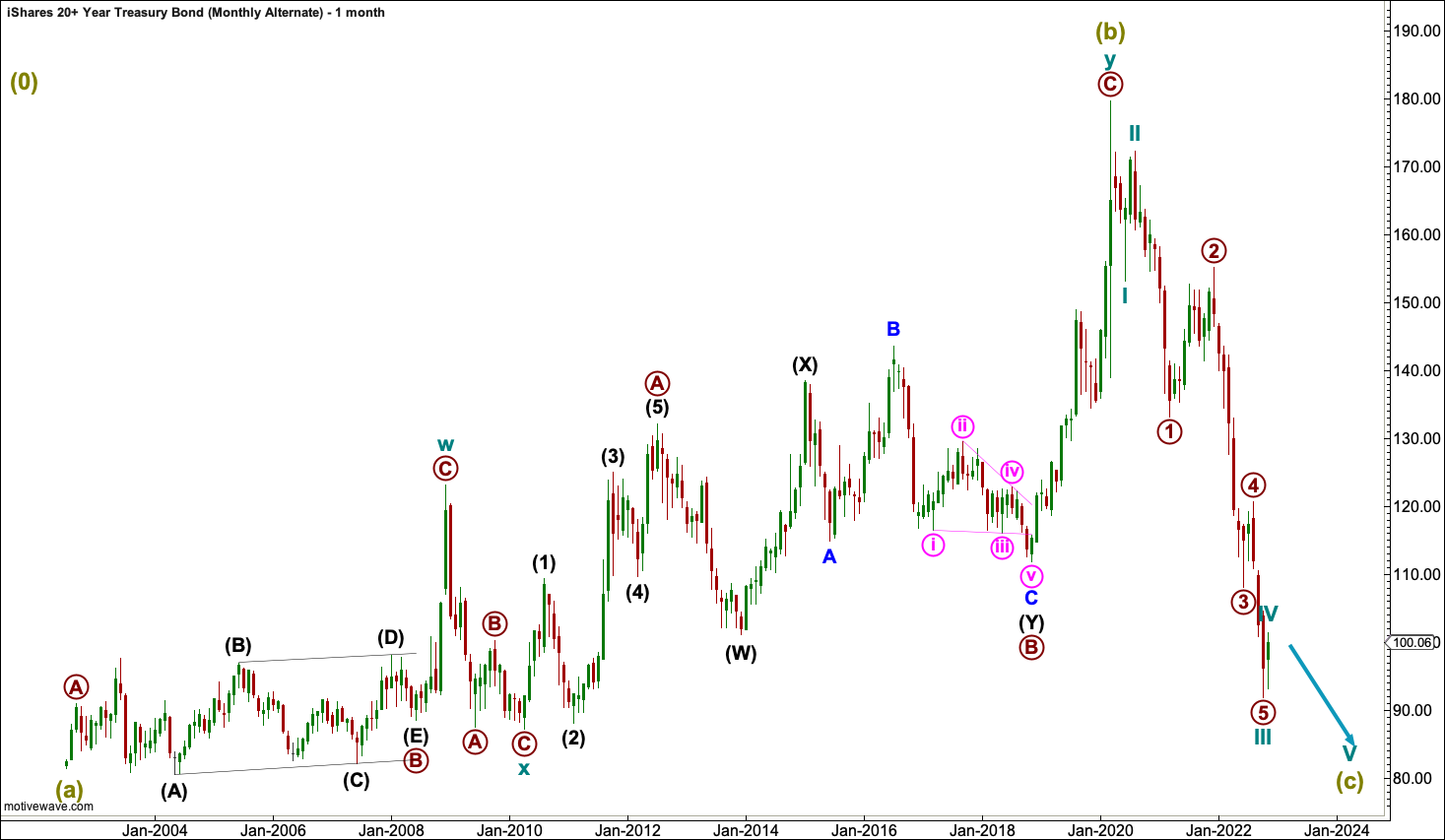

ALTERNATE ELLIOTT WAVE COUNT

The strongest direction is downwards, so a second idea is considered that sees this as the main trend direction. The larger structure at Grand Super Cycle degree would be problematic though as there is no data for Super Cycle wave (a), so at that degree this wave count makes no sense.

If this wave count is correct, then it would be possible that this ETF may fail and cease to exist after Super Cycle wave (c) completes a five wave impulse downwards. This may reach 0.

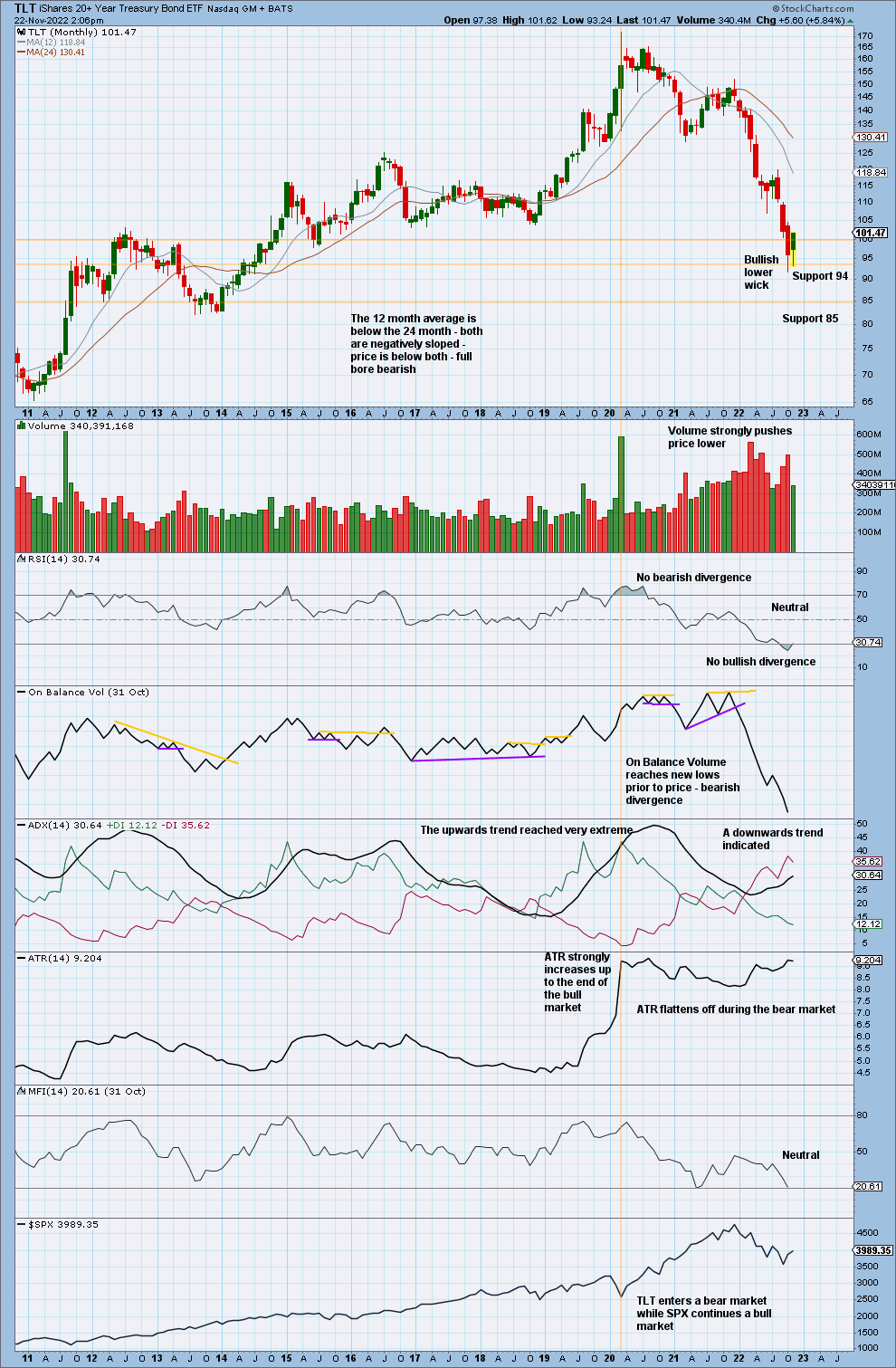

TECHNICAL ANALYSIS

MONTHLY

The downwards trend is deeply oversold. Volume is pushing price lower. There is no indication yet at this time frame that the trend is over.

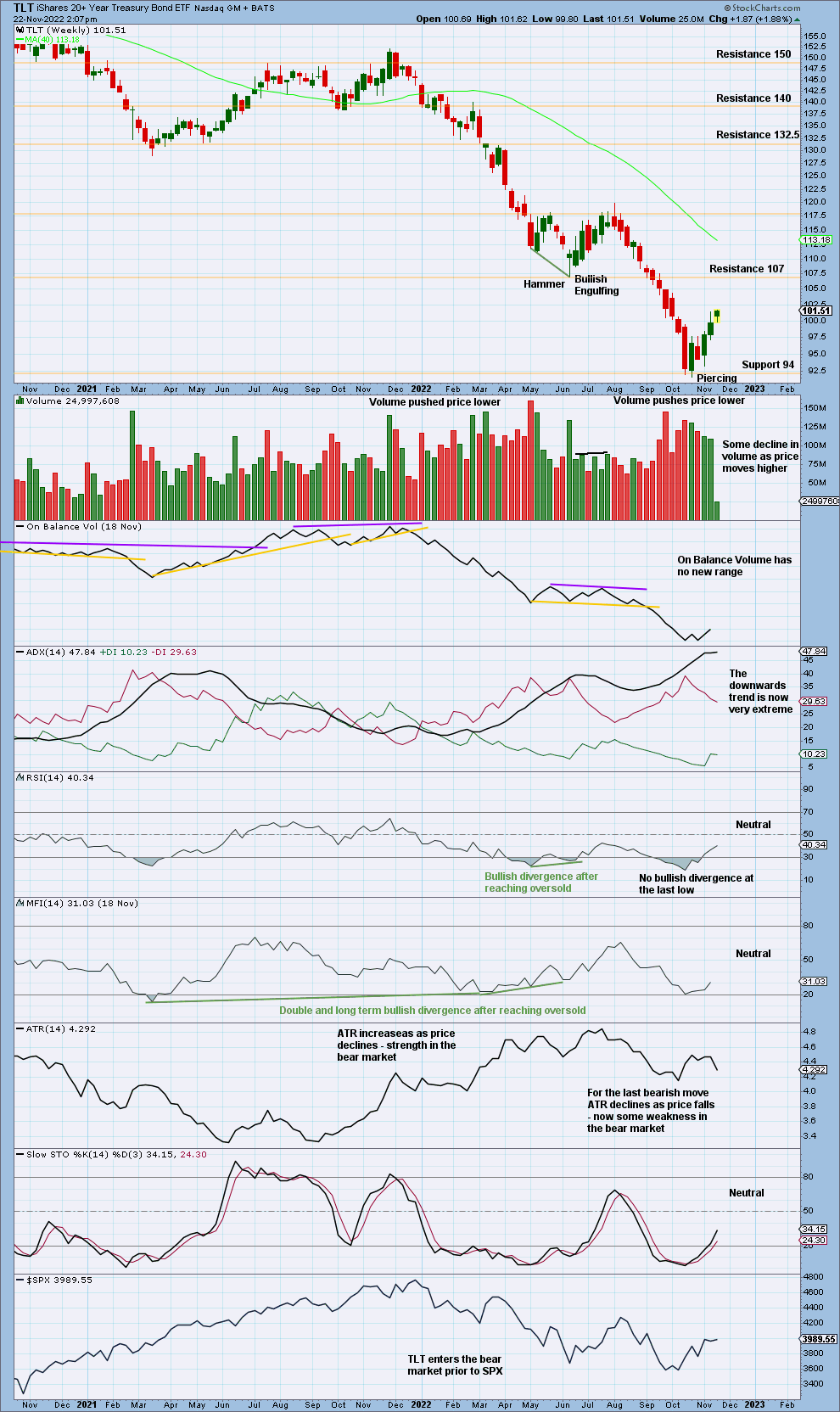

WEEKLY

The downwards trend is extreme and has reached oversold, but there was no bullish divergence at the last low and the Piercing bullish candlestick reversal pattern lacked support from volume.

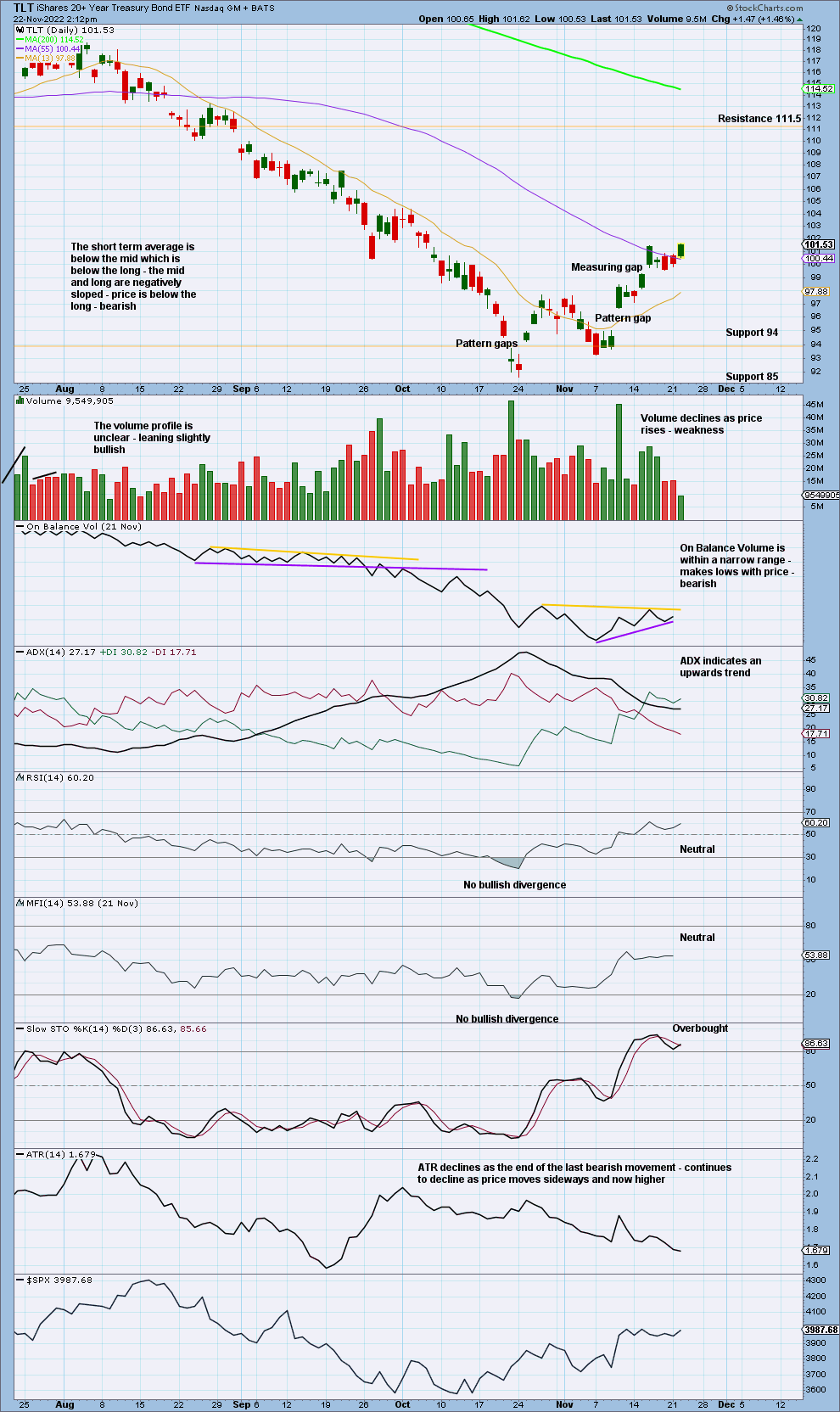

DAILY

A short-term target from the measuring gap is at 102.40.

There was no bullish candlestick reversal pattern at the last low and no bullish divergence between price and either of RSI or MFI. There is not enough evidence to have confidence the larger downwards trend has ended, so upwards movement may be more short term.

Published @ 07:21 p.m. ET.

—

Careful risk management protects your investments.

Follow my two Golden Rules:

1. Invest only funds you can afford to lose.

2. Have an exit plan for both directions – where or when to take profit, and when to exit a losing investment.

—

New updates to this analysis are in bold.

–