April 7, 2023: EURUSD Elliott Wave and Technical Analysis – Video and Charts

Summary: The bigger picture for Euro expects overall upwards movement for the long term, most likely to not make a new high above 1.60380.

For the short term, a pullback may continue lower to a target zone from 1.04611-1.0179. Thereafter, a strong third wave up may begin.

Recent slow price action shows we are still in a B or X wave. Once price reaches above 1.09826 this may be labeled a flat correction as minor B. Shorter-term bearish momentum is expected after minor wave B is complete.

Quarterly and monthly charts were last updated here.

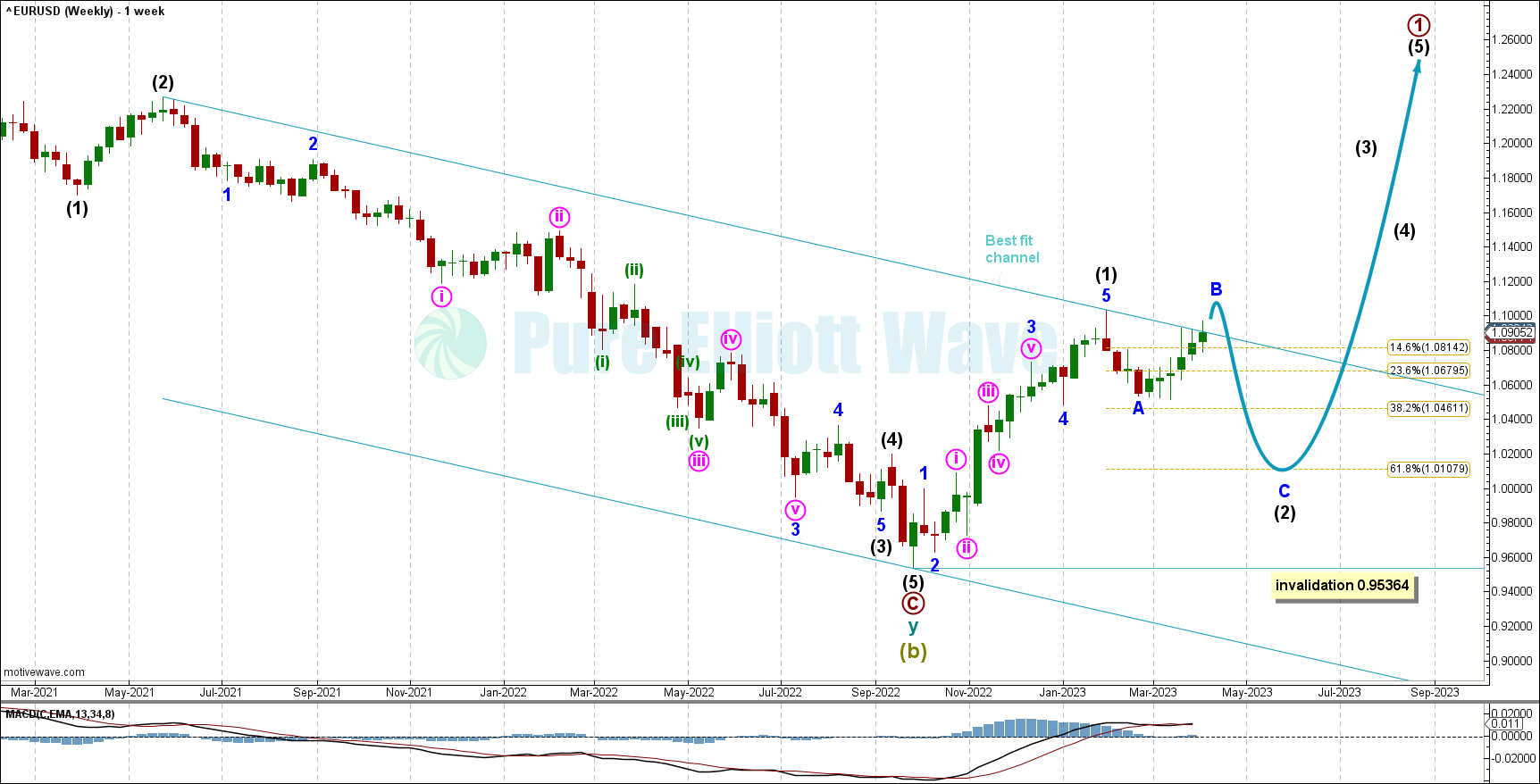

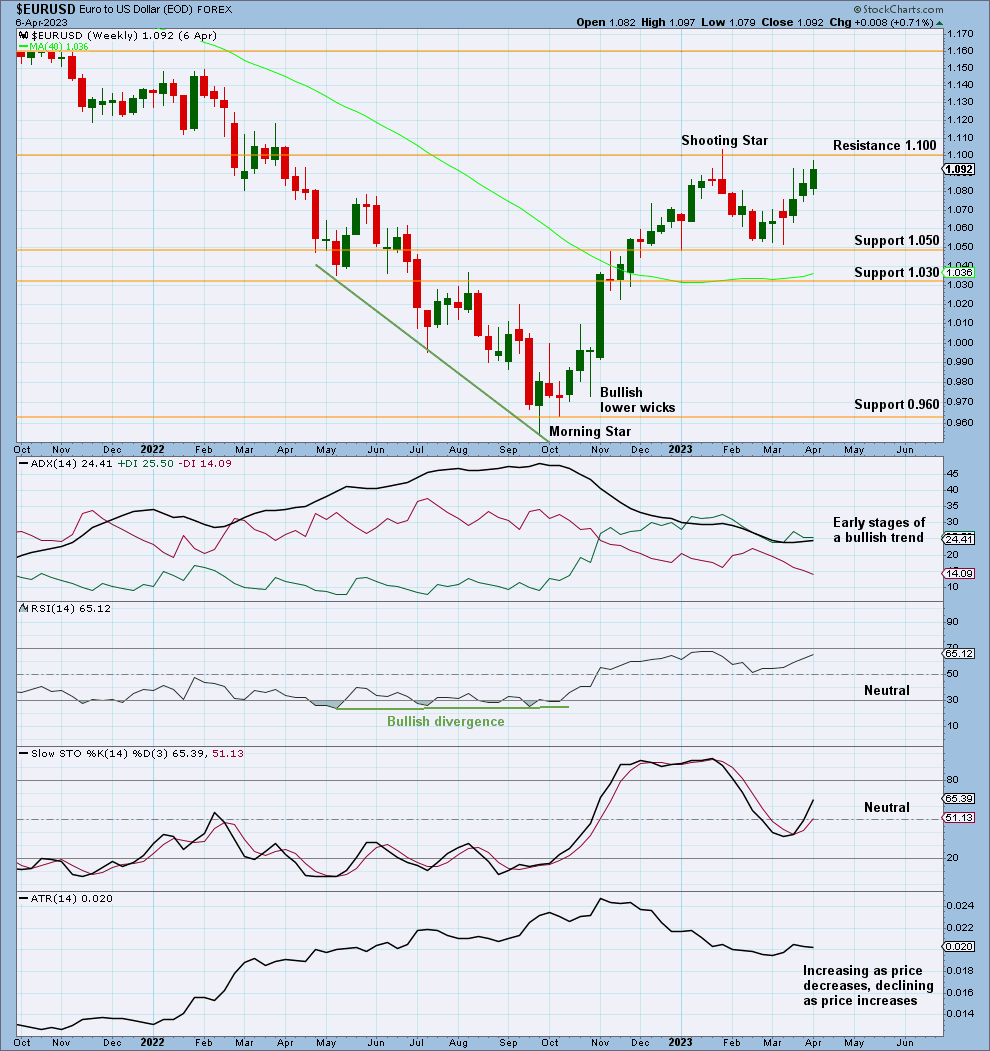

WEEKLY CHART

The weekly chart focusses on the end of Super Cycle wave (b) and the start of Super Cycle wave (c).

Within Super Cycle wave (c), cycle wave a must subdivide as a five wave motive structure. Primary wave 1 within cycle wave a would be most likely incomplete.

Within primary wave 1: Intermediate wave (1) may be over at the last high and now intermediate wave (2) may continue lower to find support about the 0.618 or 0.382 Fibonacci ratios of intermediate wave (1) with a range of 1.04611-1.01079. When wave B is complete, then one of these targets will be much more clear, and another clear target can be calculated based off the ratios of minor wave A and C. According to the daily and hourly wave counts, minor wave B is not complete yet.

Intermediate wave (1) lasted 18 weeks, 3 weeks short of a Fibonacci 21. Intermediate wave (2) may be expected to last about a Fibonacci 13 or 21 weeks in total, give or take about 2 either side of these numbers.

A best fit channel has been drawn to encompass all of the previous bear market and recent peak. Price slightly breached this channel on declining volume; this may act as resistance in the future.

Minor wave C is most likely to unfold as an impulse if minor B reaches above 1.09826. If this does not happen, then minor wave C must be a sharp zig-zag or zig-zag combination as minor Y.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) below 0.95364.

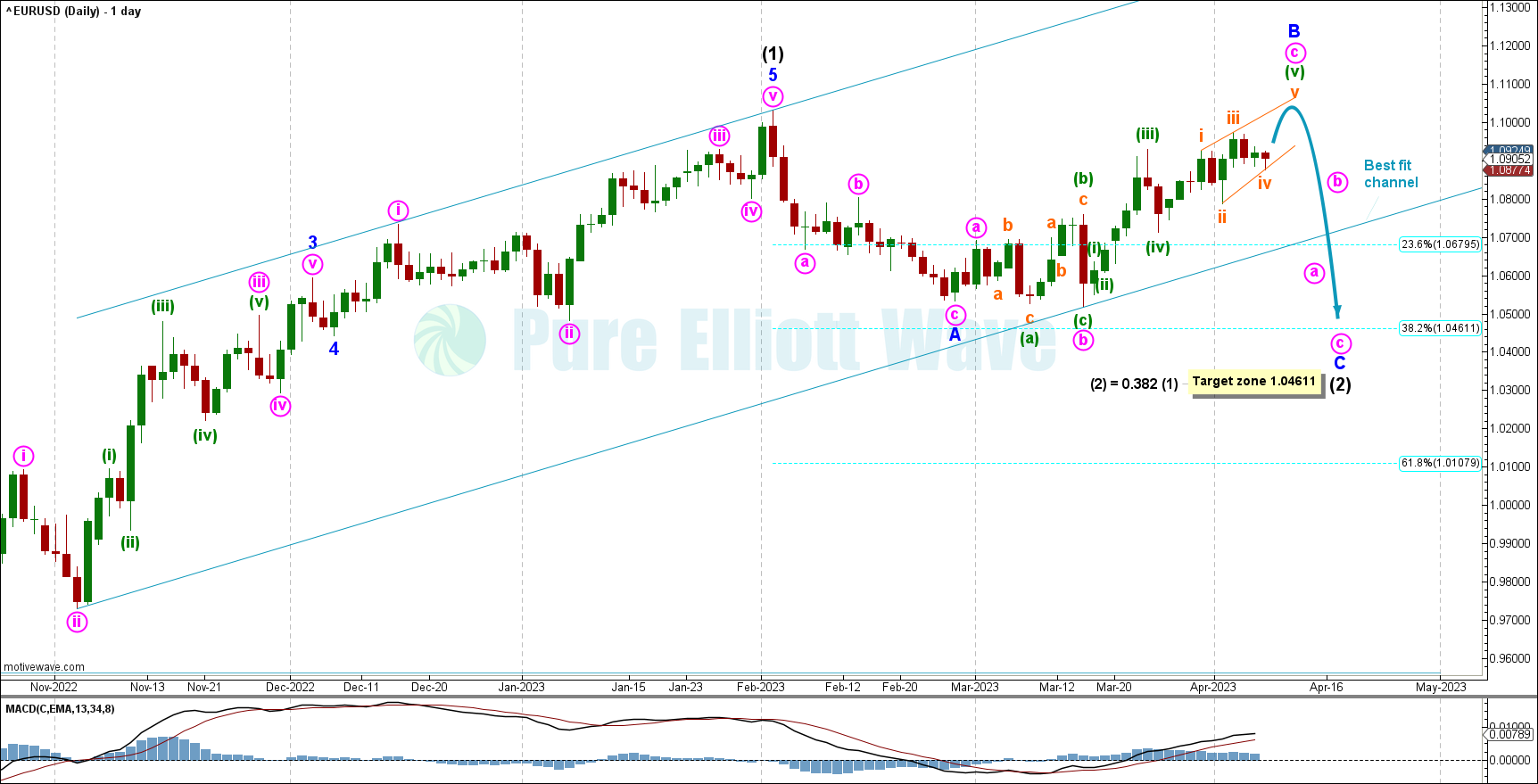

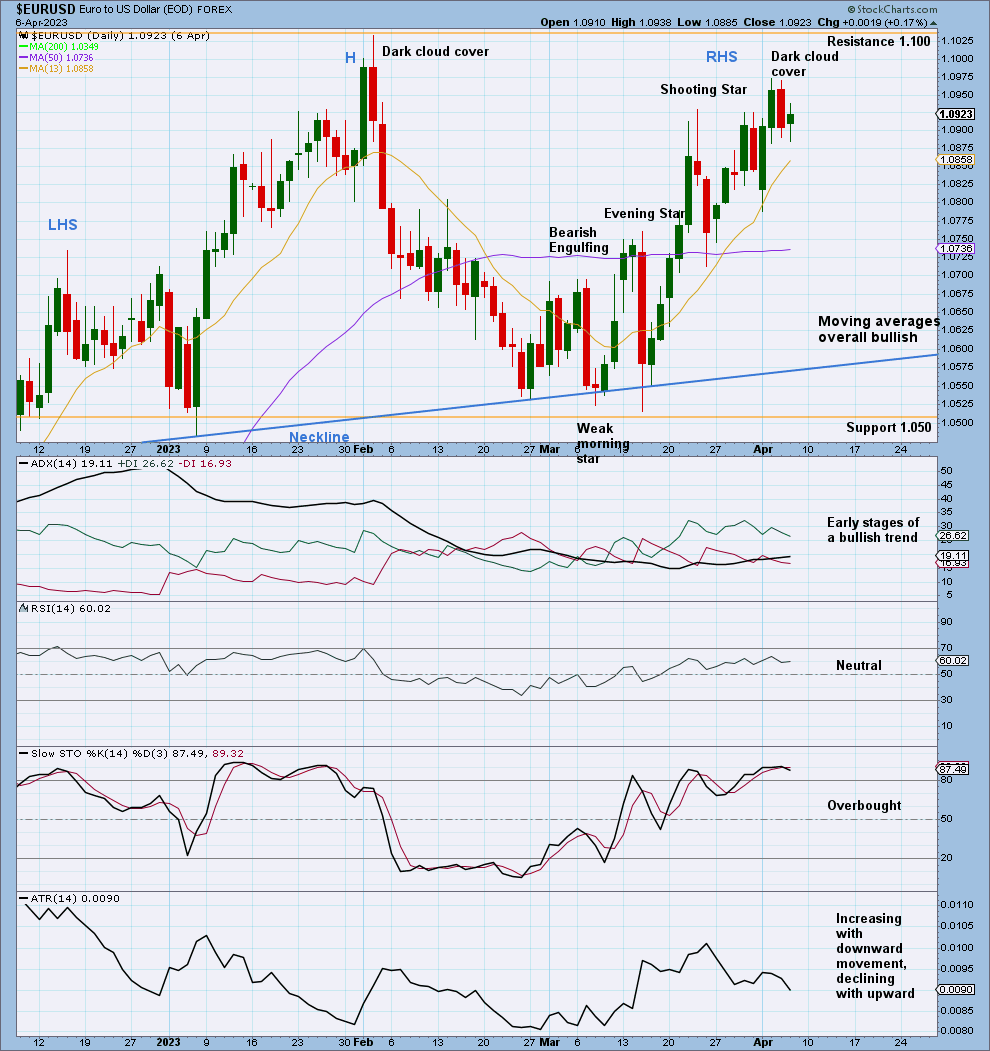

DAILY CHART

The daily chart focusses on intermediate waves (1) and (2).

With recent upwards movement from minor wave B, reaching 88% retracement of the three wave structure labeled as minor A, a flat may be occurring, which is a common corrective structure. The amount of upwards retracement of minor B will tell us what type of flat this will be. If minor B reaches over 105% the length of minor A, then the structure will be an expanded flat with a deeper wave C expected (see daily alternate chart).

This main chart views minor B nearing completion as an expanded flat, with minute C nearing completion as an impulse. The most recent price action from March 24, 2023, to present may be an ending diagonal. Ending diagonals in a C wave signal an exhausted trend with a sharp change to happen soon.

No bullish invalidation is given. Minor wave B may continue upwards and may be labeled a bullish trend if it reaches over 2x the length of minor A, a very unlikely ratio between the two.

A target is calculated based on price reaching at least 1.09826 (see hourly) to complete the 90% requirement of a flat correction. Regular flats with B waves that reach 90%-105% the length of A waves regularly retrace 0.382 of the previous motive wave. This yields a target of 1.04611.

ALTERNATE DAILY CHART

This alternate daily chart shows the possibility minute C of minor B with much more upwards movement expected. Minuette (1) is complete and minuette (3) is extending upwards, a very bullish scenario. This expects minor B to reach 105-138% of minor A at 1.10326-1.1224. These ratios are common for expanded flat B waves.

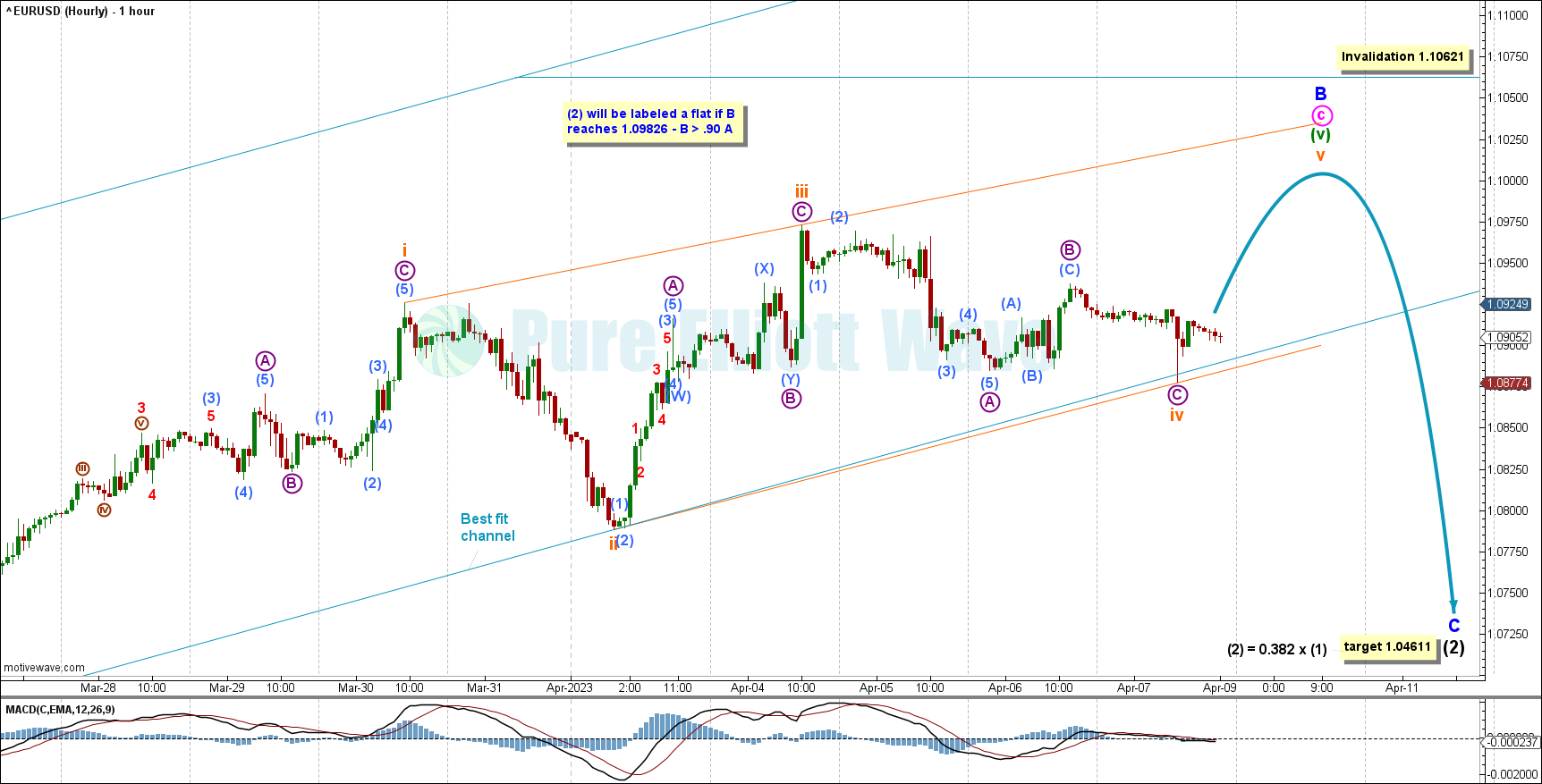

HOURLY CHART

The hourly chart focusses on the end of minor wave B.

The end of minor wave B shows multiple overlapping waves that can be counted as either a diagonal or an extended third wave (shown below). For the ending diagonal count, if subminuette wave v exceeds the length of subminuette iii, then the diagonal would be invalidated at 1.10621. This diagonal displays adequate trend lines and also follows along the best fit channel for the past upwards movement in the past weeks. A breach of this channel on a closing basis may signal the completion of minor wave B.

For the short term, upwards movement is expected to continue (but not above 1.10621) then a sharp decline.

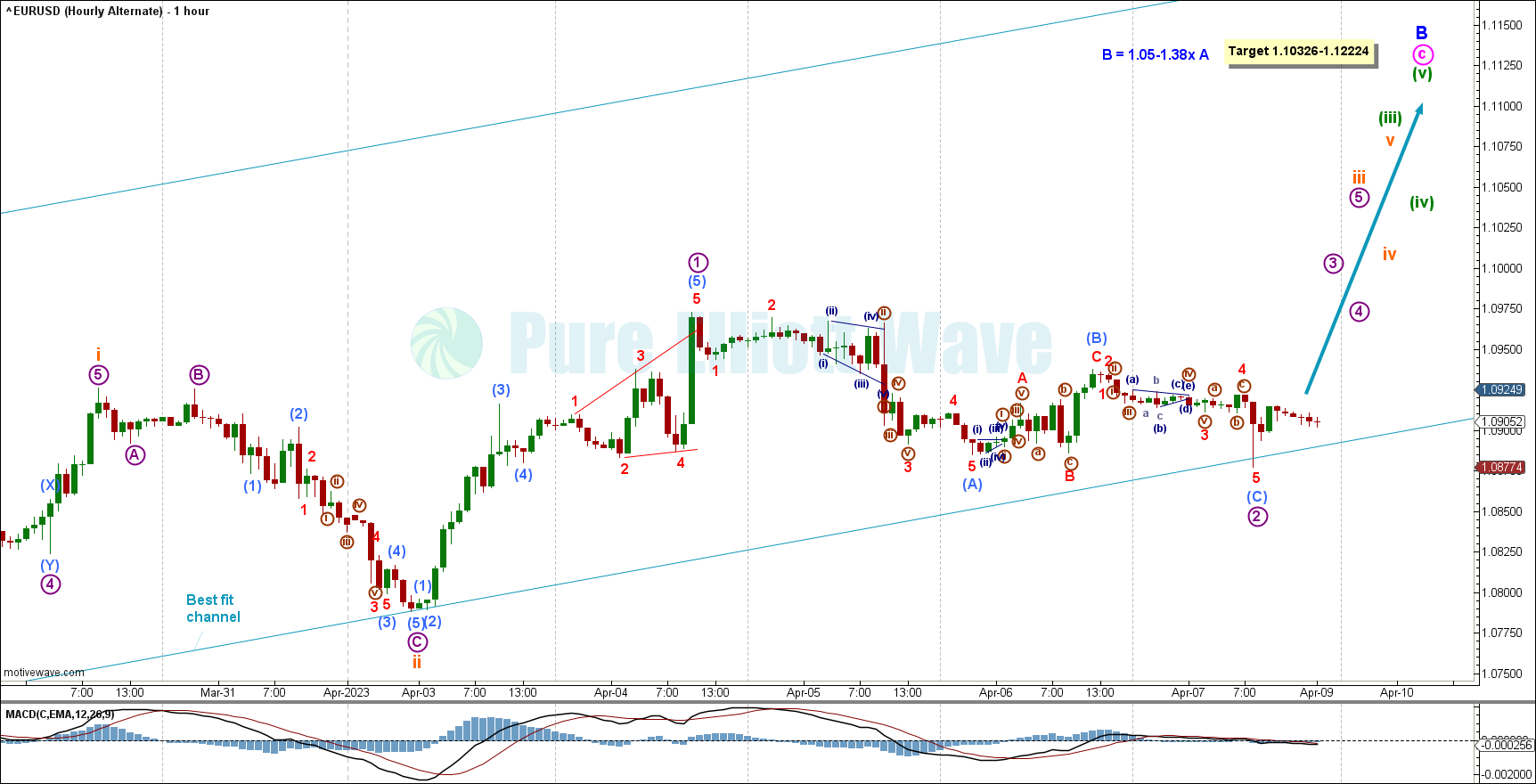

ALTERNATE HOURLY CHART

If price breaks over 1.10621, then this hourly wave count sees minuette wave 3 continuing upwards for minor wave B. A common ratio for wave B in this scenario is 1.05-1.38 times the length of wave A. This gives us a target range of 1.10326-1.12224.

For this alternate, if price moves above 1.10621, then sharp upwards movement may occur to end minor wave B.

TECHNICAL ANALYSIS

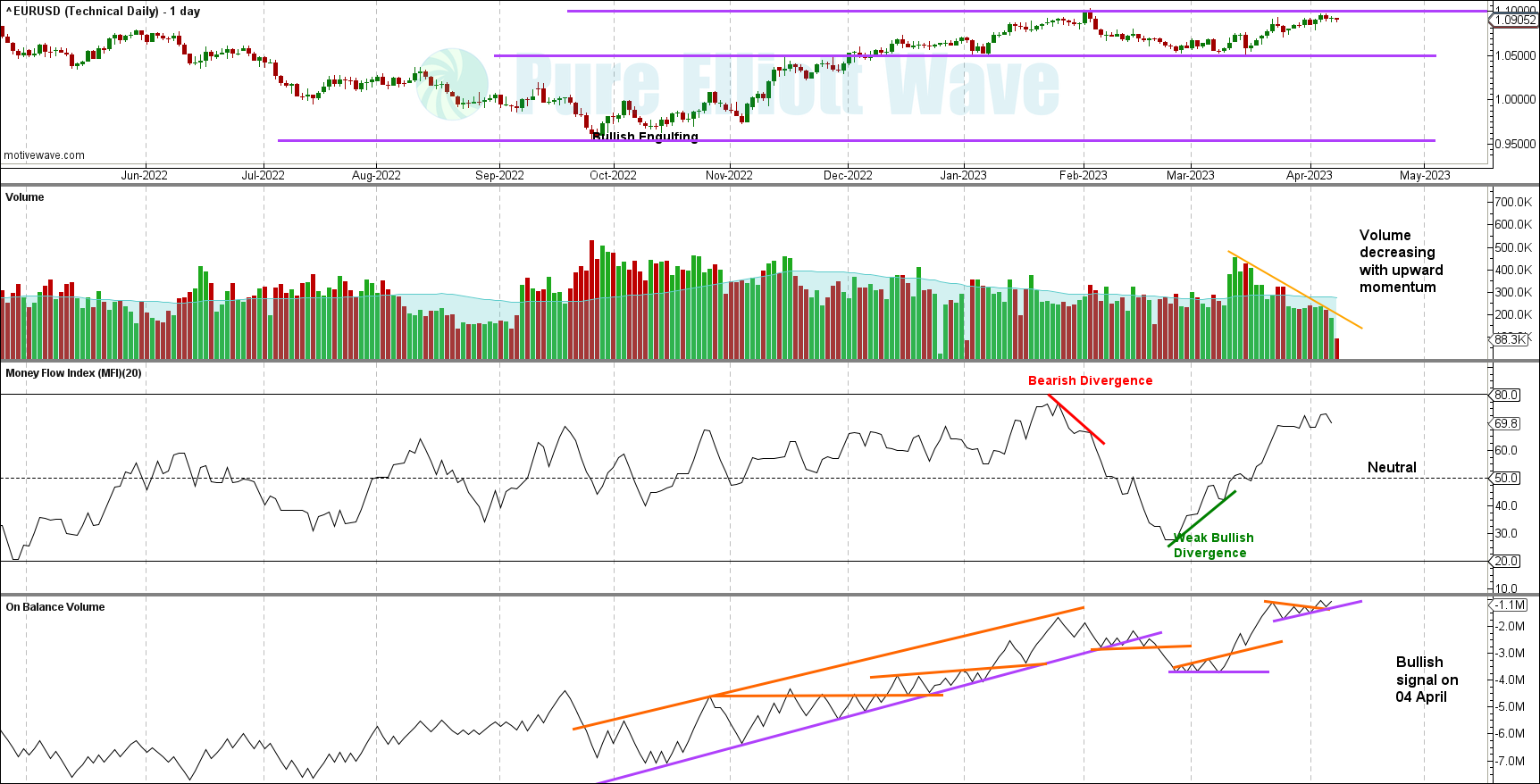

VOLUME

VOLUME WEEKLY CHART

The volume profile is bearish with severely decreasing volume with bullish momentum, which overshadows a weak on balance volume signal. This signal is weak due to the slope of the upwards sloping orange line, and only 2-3 tests of this line before the recent breach.

WEEKLY CHART

This week’s candlestick is approaching overhead resistance.

ADX shows the early stages of a bullish trend with more to go.

This chart looks neutral to slightly bullish. Daily technicals provides more clarity.

VOLUME DAILY CHART

Over the past month, volume has dramatically fallen with bullish movement. This is a bearish signal, a pullback is likely to occur.

The last few days show nearly no bullish conviction to bring price higher.

Although money flow exhibited bullish divergence, this divergence is weak due to the low of the second pivot only being a few pips below the first. The bearish signals from other technicals outweigh this signal.

On balance volume signalled a bullish breakout on April 4, 2023, but has not yet shown follow through; price instead has remained flat.

DAILY CHART

A head and shoulders candlestick pattern has been noted on the chart, highlighted by the left shoulder (LHS), head (H), and right shoulder (RHS). A neckline was drawn from the bases of the heads where the shoulders connect. A candlestick closing below this neckline would be a breakout from the pattern. If price rises above the head, this would invalidate it.

A recent dark cloud cover on April 5, 2023, signals a possible reversal. This is supported by overbought stochastics and overhead resistance.

The moving averages are very bullish, all sloping up, with the 13 day above the 50 and the 50 day above the 200.

This chart is bearish. The moving averages and ADX starting a bullish trend are overshadowed by overhead resistance, the head and shoulders pattern, the dark cloud cover, and overbought stochastics. A pullback may be likely soon.

Published @ 09:33 a.m. ET on April 9, 2023.

—

Careful risk management protects your trading account(s).

Follow Lara’s two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.

—