May 18, 2023: EURUSD Elliott Wave and Technical Analysis – Charts

Price is moving downwards strongly as the main Elliott Wave count expected.

Summary: The bigger picture for Euro expects overall upwards movement for the long term, most likely to not make a new high above 1.60380.

For the short term, a pullback may continue lower to a target zone from 1.02862 to 1.01079. Thereafter, a strong third wave up may begin. Recent price action may be confirming this outlook.

An alternate, also predicting long-term upwards price movement, expects the short-term pullback could be over today.

Quarterly and monthly charts were last updated here.

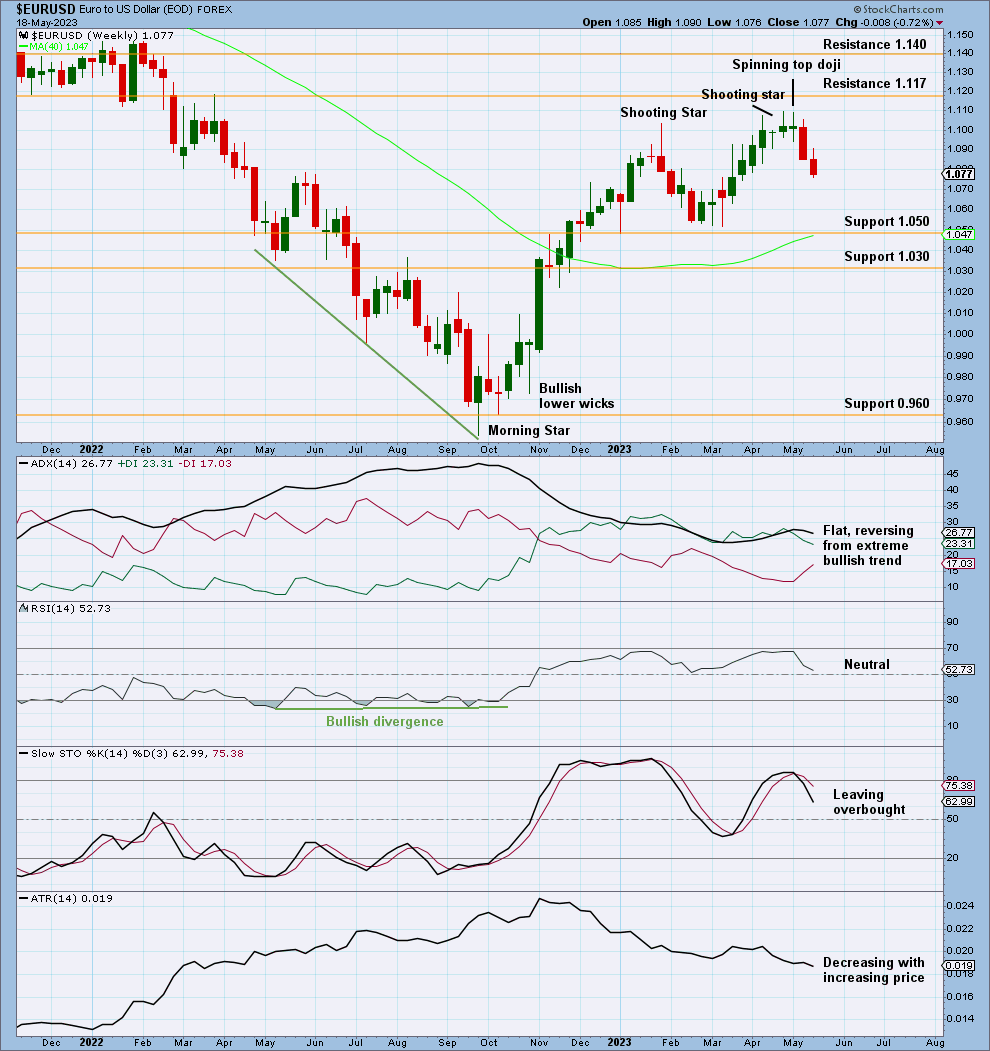

WEEKLY CHART

The weekly chart focusses on the end of Super Cycle wave (b) and the start of Super Cycle wave (c).

Within Super Cycle wave (c), cycle wave a must subdivide as a five wave motive structure. Primary wave 1 within cycle wave a is most likely incomplete.

Within primary wave 1: Intermediate wave (1) may be over at the previous high and now intermediate wave (2) may continue to find support about the 0.618 Fibonacci ratio of intermediate wave (1) at 1.01079.

Intermediate 2 may be unfolding as an expanded flat with minor B reaching 113% the length of minor wave A. Expanded flats are common structures. Minor wave C is most likely underway and must subdivide as a motive structure downwards.

A best fit channel has been drawn to encompass all of the present upwards movement. The best fit channel has been broken on the daily chart. A new short-term bear trend is likely.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) below 0.95364.

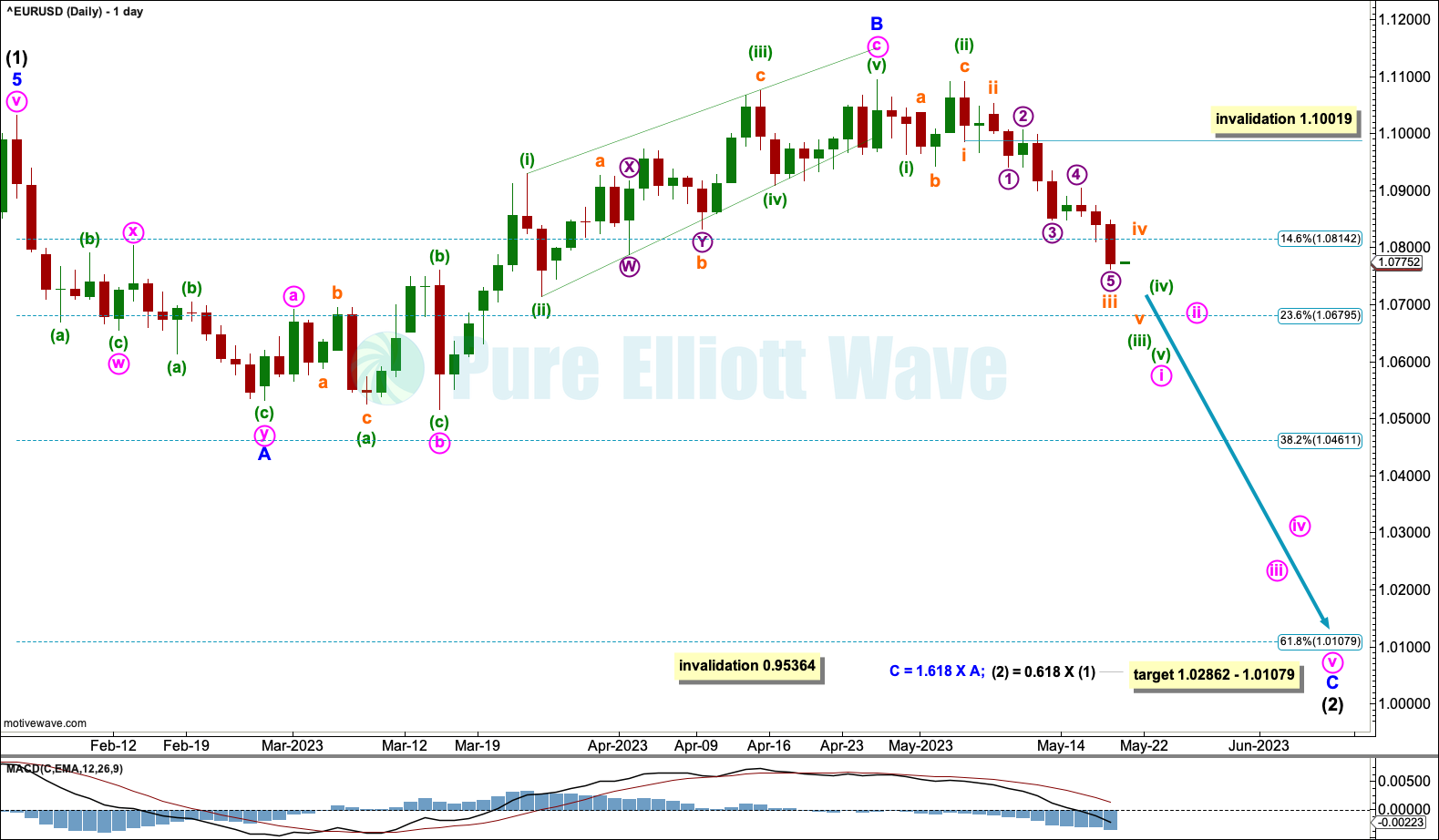

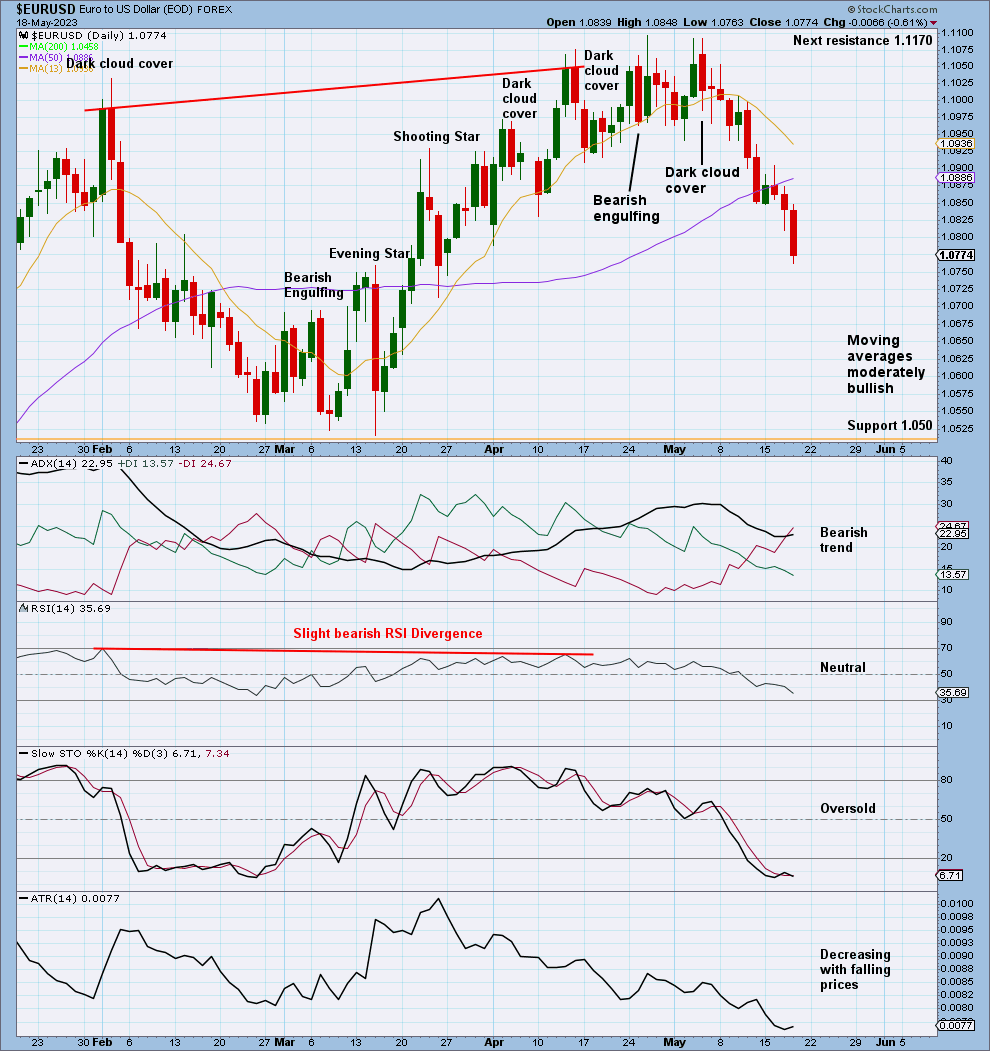

DAILY CHART

The daily chart focuses on minor waves B and C of intermediate (2).

Today yielded a strong bearish candlestick completing subminuette wave iii of minuette wave (iii). A bounce or consolidation for subminuette wave iv may find resistance along the orange Elliott Channel (see hourly chart), that contains all price action since May 4th.

The invalidation level at 1.10019 is utilizing the Elliott Wave rule that within an impulse wave 4 may not enter the price territory of wave 1. Price over this level would shift our focus to the alternate count detailed below.

With minor wave B complete, a target is calculated for minor wave C to reach 1.618 times the length of minor A at 1.02862, giving us a range from 1.02862 to 1.01079. This wave count is very bearish for the short term.

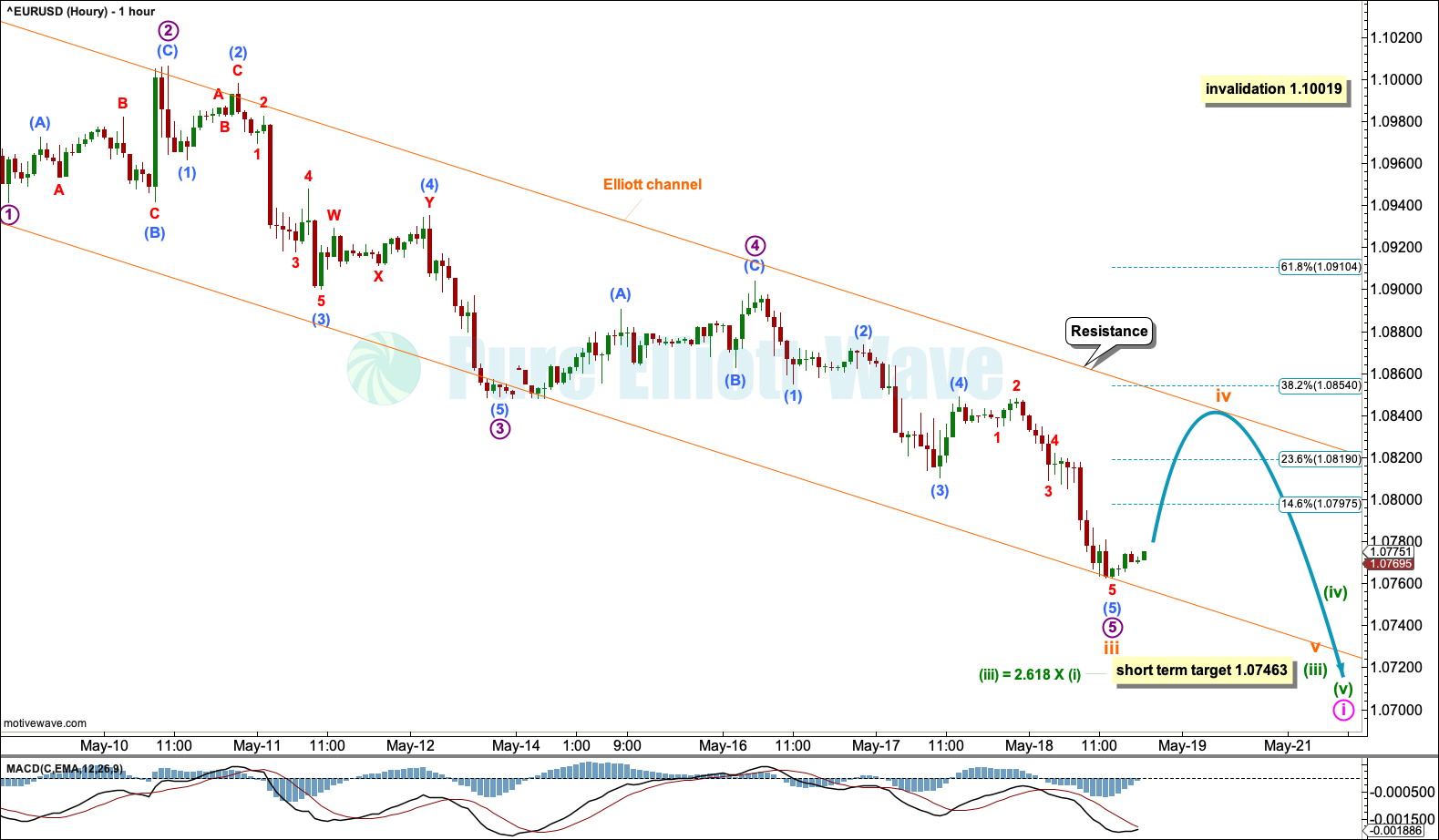

HOURLY CHART

The hourly chart focuses on minuette wave (iii) of minor wave C.

A target has been calculated for minuette wave (iii) to reach the 2.618 fibonacci extension of minuette (i) at 1.07463.

Recent price movement has remained inside the orange Elliott channel. Micro wave 5 of subminuette wave iii may have found support along the lower edge of this channel. Subminuette wave iii may be complete.

Subminuette wave iv is expected to bring breif bullish price action and may meet resistance along the upper edge of the channel. Subminuette wave iv may not move into subminuette wave i price territory above 1.10019.

Price has been moving downwards strongly for the short term.

ALTERNATE WEEKLY CHART

This alternate reflects the possibility of intermediate wave (2) as complete.

This chart expects a shallower pullback in the short term followed by more upwards movement.

Minor wave 1 be complete. Minor wave 2 may be nearing completion as a zigzag.

A target is calculated for intermediate wave (3) to reach 1.618 the length of intermediate wave (1) at 1.29378.

Minor wave 2 may not move beyond the start of minor wave 1 below 1.05169.

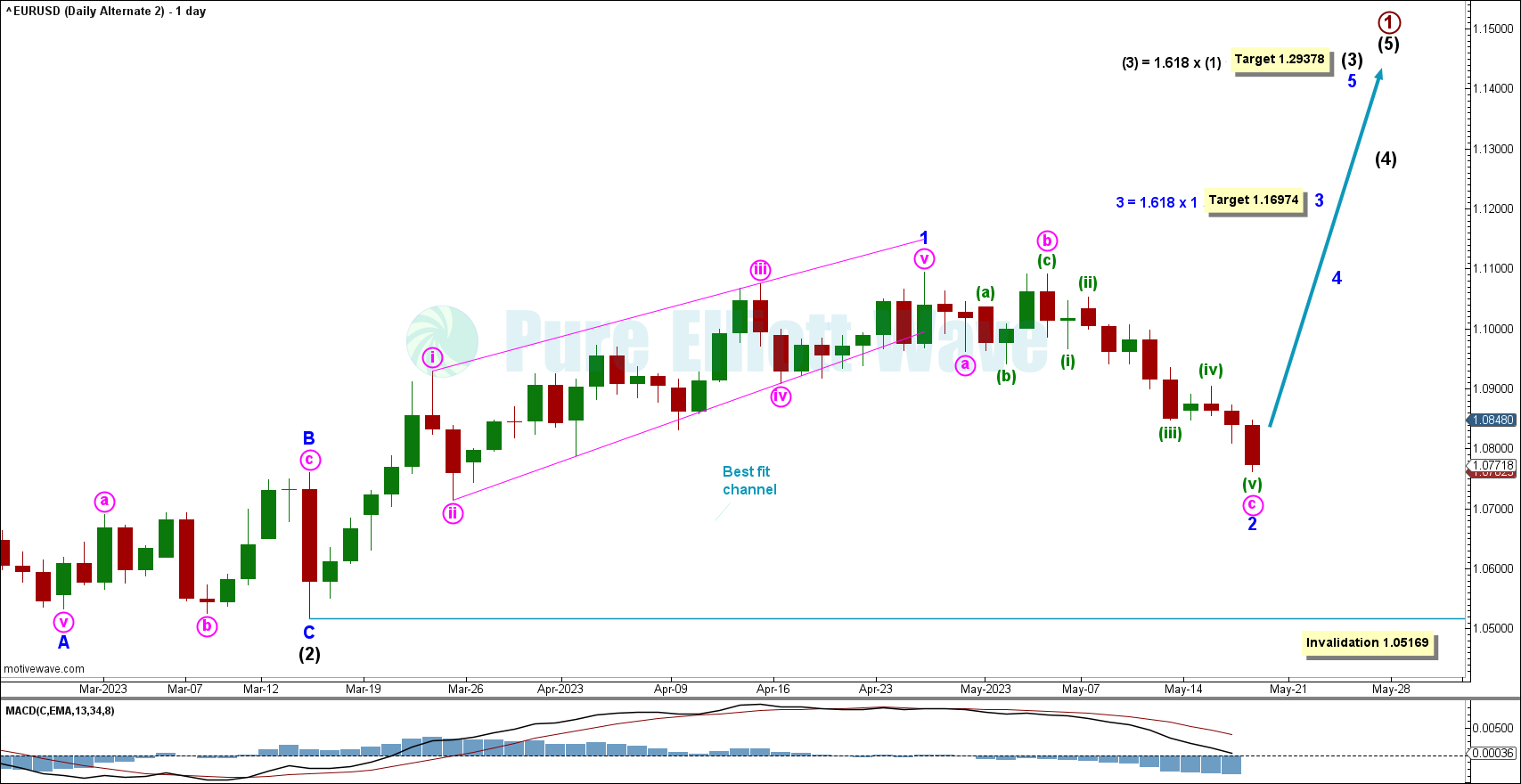

ALTERNATE DAILY CHART

This daily alternate wave count shows the possibility of upwards movement.

This alternate expects a less severe pullback unfolding now, but has a lower probability given the brief shallow intermediate (2).

With minor wave 2 possibly complete, a target has been calculated for minor wave 3 to reach the 1.618 extension of minor wave 1 at 1.16974. There is no upwards invalidation for this alternate. Downwards invalidation sits below at the start of minor wave 1 at 1.05169.

Confidence in this alternate wave count would come if the main wave count invalidation point was breached above 1.10019.

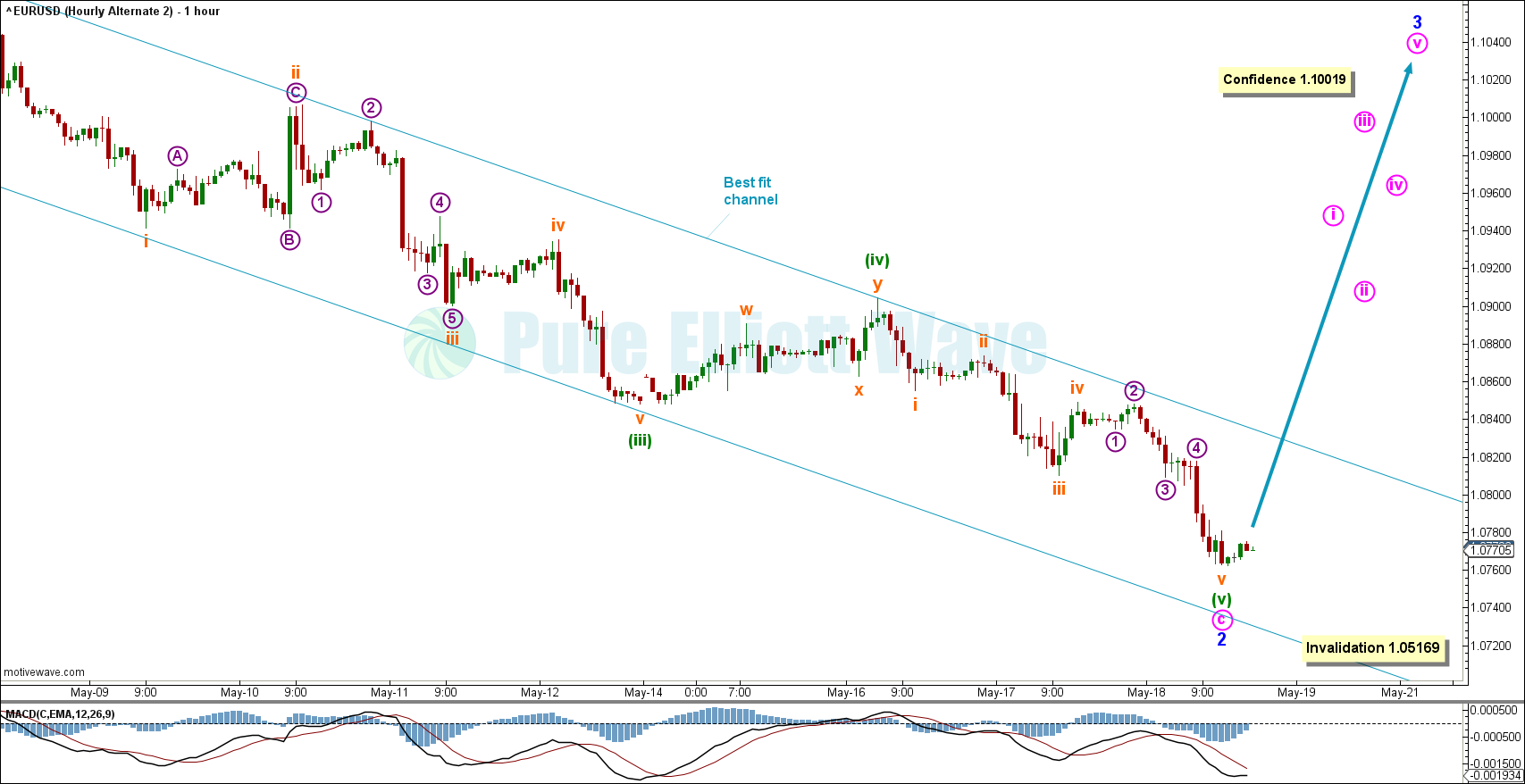

ALTERNATE HOURLY CHART

This alternate reflects the short-term possibility that minor wave 2 may be complete as a zigzag.

If the blue best fit channel is broken by upwards movement, then this could be a sign the short-term bear trend is over.

The confidence level at 1.10019 is the level at which the main wave count is invalidated.

This count is very bullish, as 3rd waves often contain the most bullish price action. Especially since minor wave 1 was a diagonal (note that often times third waves extend after wave one diagonals).

TECHNICAL ANALYSIS

WEEKLY VOLUME

Volume still decreases with a new possible trend change. This is normal for the EURUSD coming off of tops.

WEEKLY TECHNICALS

Last week’s candle was a strong bearish candle, supporting the top reversal patterns from the weeks before.

Next overhead resistance sits at 1.1170. Support below at 1.050.

ADX shows there is no longer a bullish trend.

This chart is bearish.

DAILY VOLUME

The past week shows a decrease in volume with bearish price action. This is normal for tops on the EURUSD when studying past price/volume action. However, it should be noted downwards movement could be limited based on volume and ATR decreasing.

There was a strong bearish signal from On Balance Volume. The signal is strong due to the slope being reasonably flat and the line tested 4-6 times and held for a reasonably long amount of time.

DAILY TECHNICALS

Today’s candle was a strong red candle.

ADX indicates a bearish trend, not yet extreme.

The moving averages are moderately bullish, all sloping up, with the 13 day now sloping down.

This chart is bearish for the medium term. Overall decreasing ATR suggests volatility could be limited downwards.

Published @ 07:24 p.m. ET.

—

Careful risk management protects your trading account(s).

Follow our two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.

—