August 10, 2023: SILVER Elliott Wave and Technical Analysis – Video and Charts

Summary: Price declines after some consolidation.

Monthly charts are updated here.

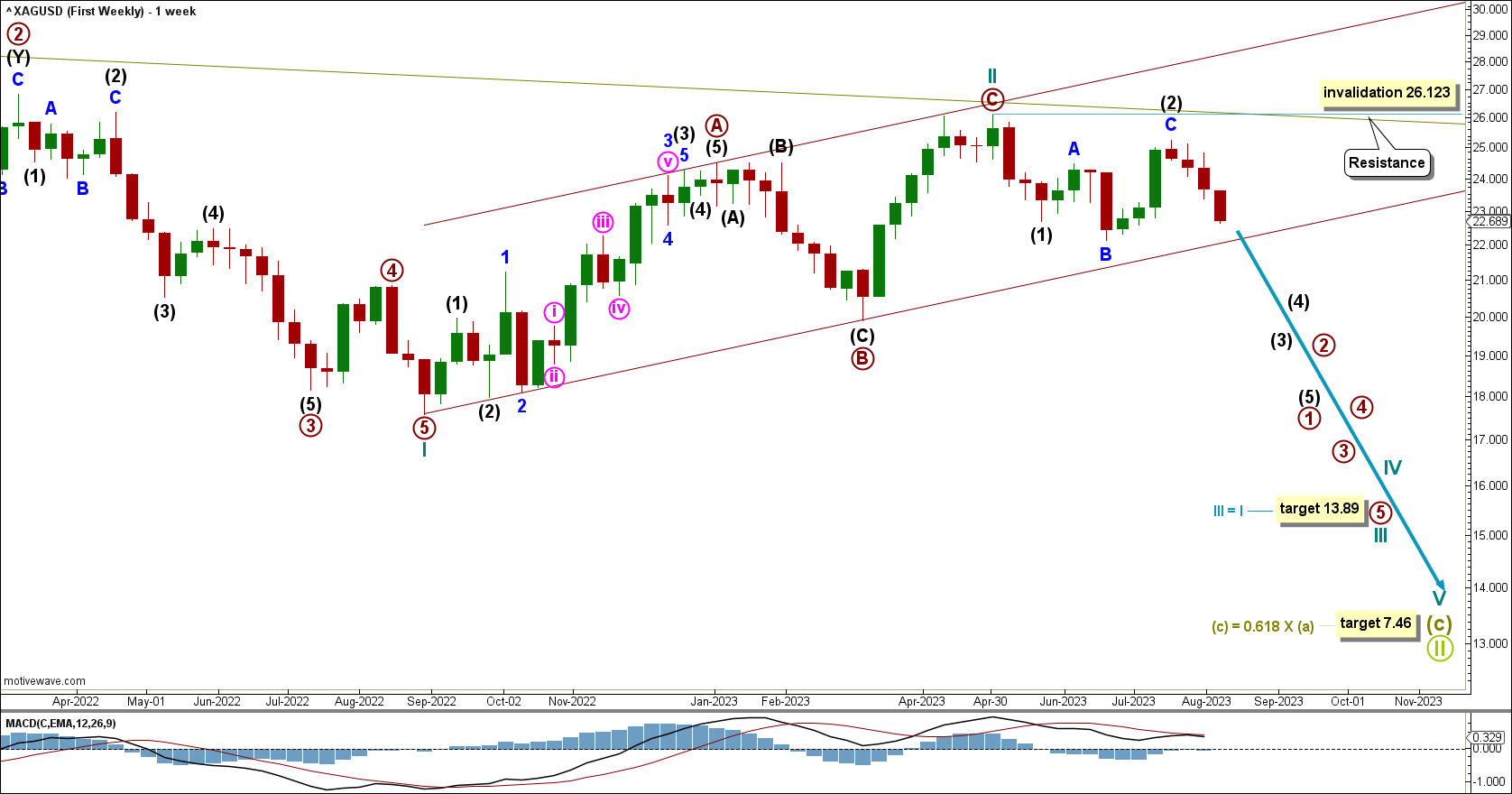

BEARISH ELLIOTT WAVE COUNT

WEEKLY CHART

There are two possible structures that Supercycle wave (c) may subdivide as, an impulse (more likely) or an ending diagonal (less likely). An impulse requires cycle wave I to subdivide as a five wave motive structure. Cycle wave I fits well as an impulse, which indicates Supercycle wave (c) would most likely be subdividing as an impulse.

Within the impulse, cycle waves I and II may be complete, with price now moving down for cycle wave III.

Cycle wave III is expected to be in its third intermediate wave of its first primary wave. Intermediate waves (1) and (2) may be complete. It is possible that intermediate wave (2) continues higher, though it cannot move above the start of intermediate wave (1) at 26.123.

With recent downwards movement there is added confidence in cycle wave II being complete at the last high, corresponding with resistance at the Supercycle degree trend channel. Price is now expected to continue downwards for cycle wave III.

Cycle wave III has a target calculated at 13.89, which is equality in length with cycle wave I.

Supercycle wave (c) has a target calculated at 7.46, the 0.618 Fibonacci ratio of Supercycle wave (a).

DAILY CHART

Cycle wave III has to unfold as an impulse.

Within primary wave 1: Intermediate waves (1) and (2) may be complete and intermediate wave (3) must move lower and can only subdivide as an impulse.

Within intermediate wave (3): Minor waves 1 and 2 may be complete and within minor wave 3 minute waves i and ii may be complete.

This wave count expects overlapping third waves at minute, minor, and intermediate degrees, which should unfold with increased downwards momentum. At these degrees, the third waves should be unmistakable.

Intermediate wave (3) has a target at 20.82, which is 1.618 times the length of intermediate wave (1).

Also, within intermediate wave (3), a second wave corrective movement cannot move above 25.264.

If price moves below the last low of primary wave B within cycle wave II at 19.909, then there will be added confidence to this wave count as at that point the alternate wave count below would be invalidated.

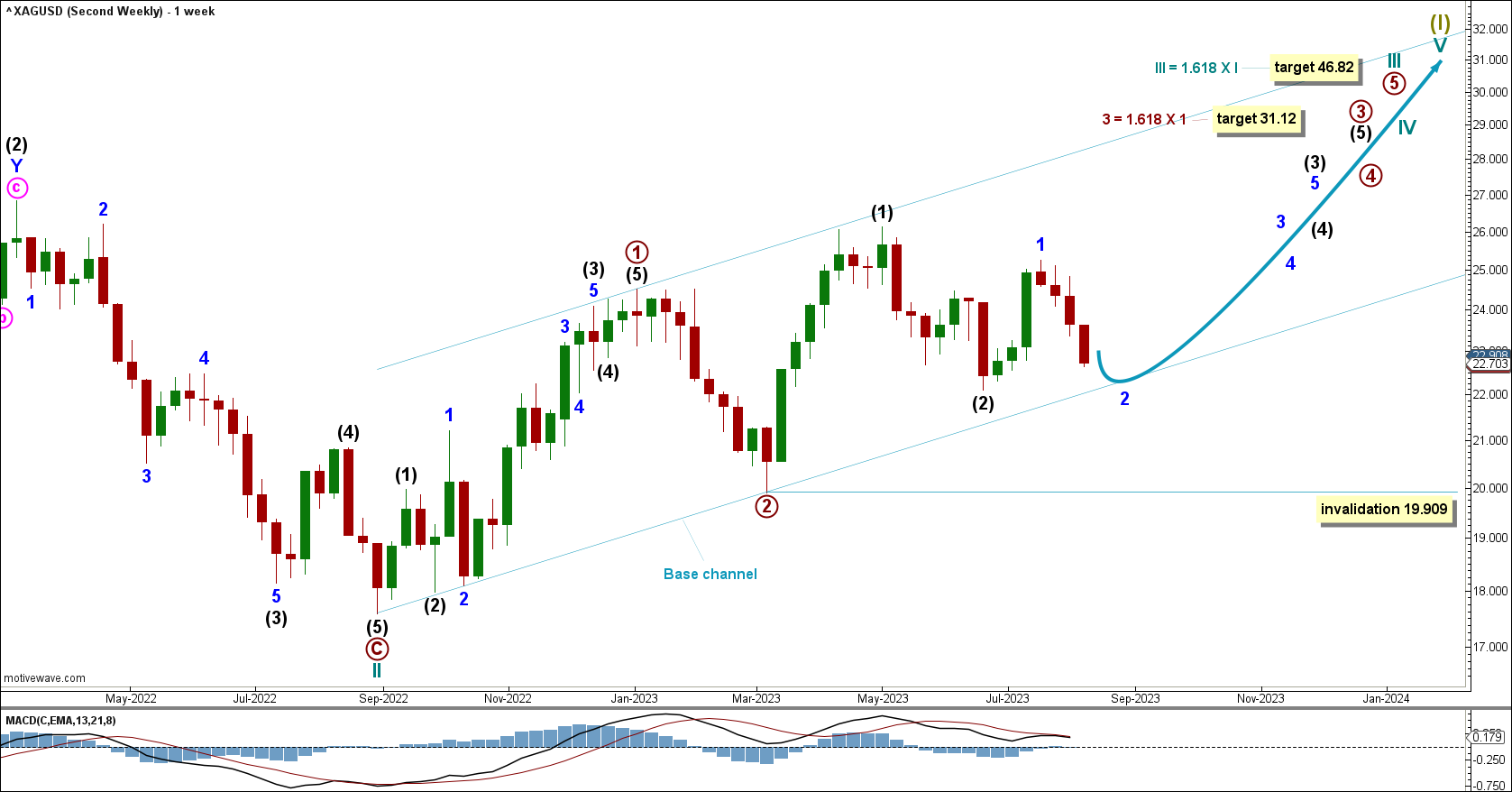

BULLISH ELLIOTT WAVE COUNT.

WEEKLY CHART

Within the trend of Supercycle wave (I), cycle wave III may have begun. Cycle wave III may only subdivide as an impulse. Within the impulse, primary waves 1 and 2 may be complete. Within primary wave 3, a second wave correction may not move below 19.909.

Primary wave 3 is expected to move price higher with a target calculated at 31.12, the 1.618 Fibonacci ratio of primary wave 1.

Within primary wave 3, minor wave 2 within intermediate wave (3) is expected to move slightly lower. It may find support at the lower edge of the base channel.

Draw a base channel about primary waves 1 and 2. Draw the first trend line from the start of primary wave 1 to the end of primary wave 2, then place a parallel copy on the end of primary wave 1. The lower edge of the base channel may show where deep corrections may find support. Primary wave 3 should have the power to break through resistance at the upper edge of the channel.

At 46.82 cycle wave III would reach 1.618 the length of cycle wave I. This target may be met in some years.

DAILY CHART

Intermediate wave (2) subdivides well as a complete zigzag; it reached the 0.618 fibonacci ratio perfectly. Within intermediate wave (2), minor wave C moved below the end of minor wave A, avoiding a truncation.

Minor wave 1 subdivides well as a complete impulse, with an extended third wave. Minor wave 2 subdivides as an incomplete zigzag, now expecting a slight bounce for minuette wave (iv) within minute wave c.

Minor wave 2 cannot move below the start of minor wave 1 at 22.118.

Minor wave 2 may be complete at this last low. If it is complete, then price is expected to increase upwards for overlapping third waves at minor, intermediate, and primary degrees. The power of primary wave 3 would be expected to break above resistance at the upper edge of the base channel.

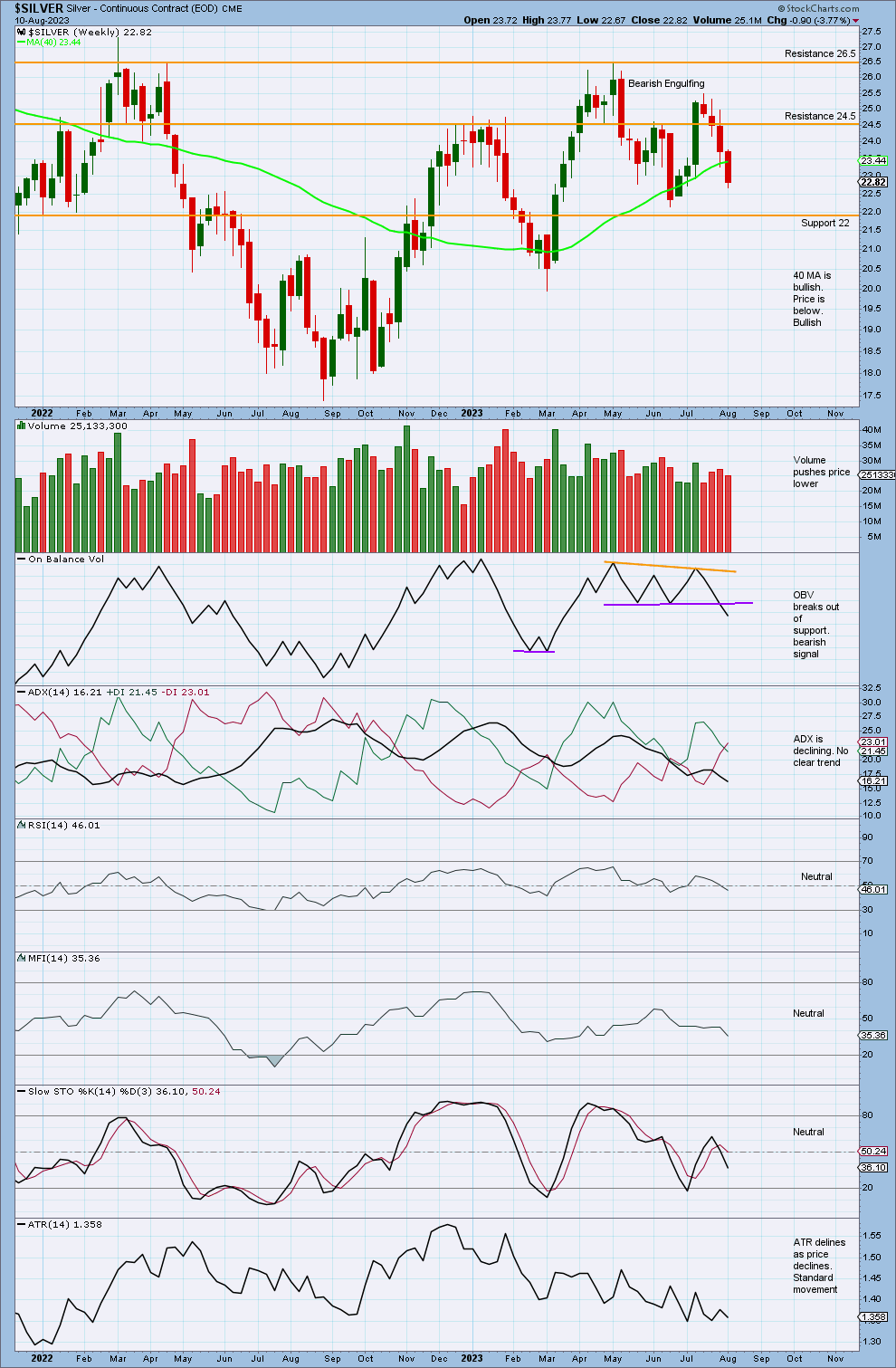

TECHNICAL ANALYSIS

WEEKLY CHART

There is currently no trend as price declines towards support at 22 with volume pushing it lower.

The volume profile is bearish; volume is strongest on bearish weeks.

On Balance Volume breaks out of support, giving a bearish signal, which adds additional weight to other bearish signals.

ADX indicates no clear trend, but the -DX line crosses above the +DX line which indicates a potential trend change to down.

As ADX indicates no clear trend we use a model of Stochastics and support and resistance. This model expects a downwards swing to continue until Stochastics reaches oversold and price reaches support around 22.

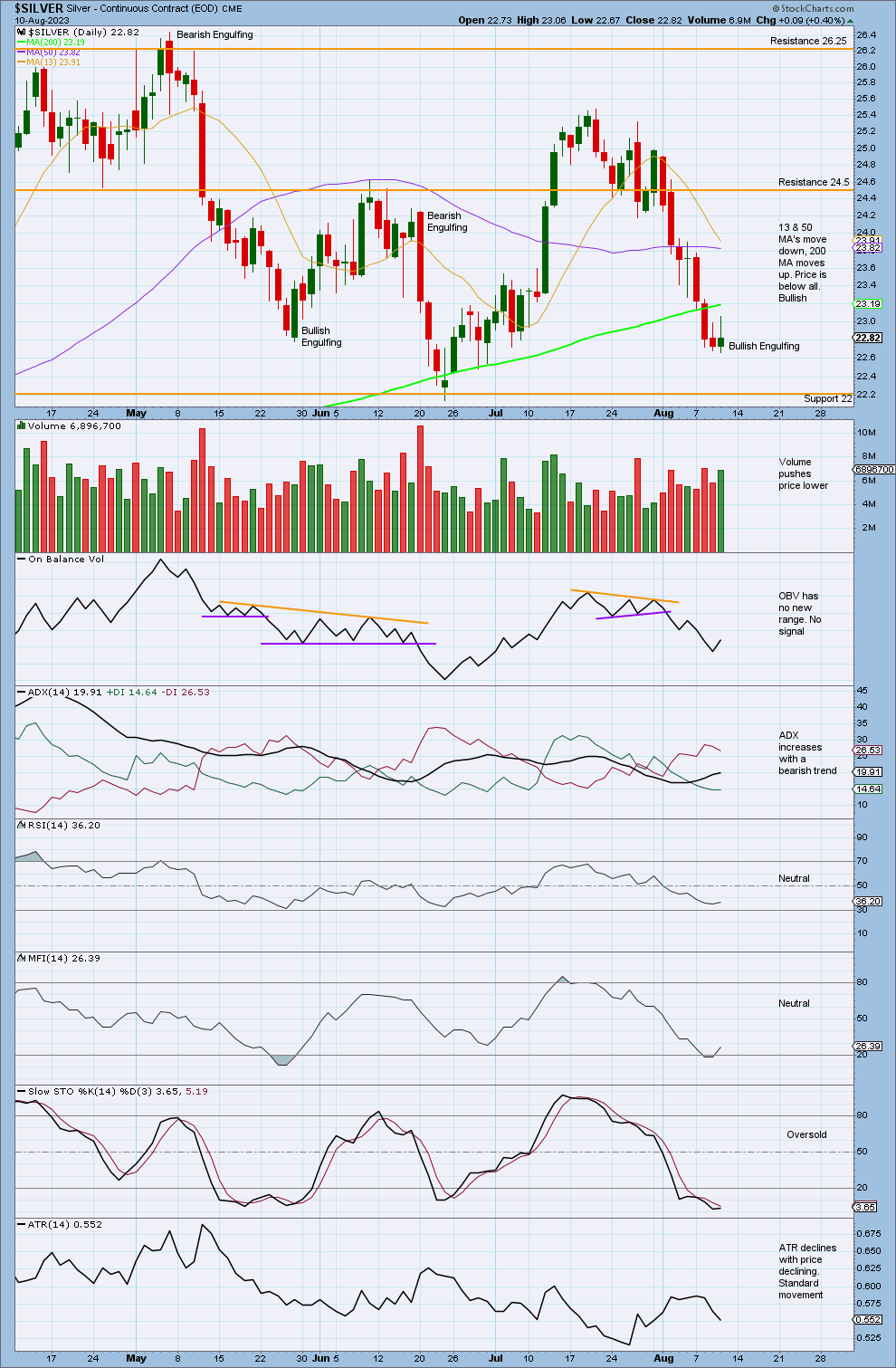

DAILY CHART

There is a clear bearish trend as ADX increases, with price nearing support at 22.

RSI and MFI are both neutral, with a considerable way to go before ADX reaches extreme. There is a long way for this downwards trend to go.

On Balance Volume previously gave a bearish signal as it broke out of support as price moved through resistance at 24.5.

There is a push from volume on some bearish candlesticks, indicating strength in bearish movement.

A small Bullish Engulfing pattern at the end of Friday may indicate a small bounce, as it has a push from volume. Though this is weak because the body is still quite small and has a long bearish upper wick.

Both volume and range declined as price moved higher to the last high in early May. This supports the first Elliott wave count and not the second. For the second Elliott wave count, a third wave up should not come with weak volume and declining range.

Published @ 11:58 a.m. ET on August 13, 2023.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Invest only funds you can afford to lose.

2. Have an exit strategy for both directions; when to take profit and when to exit a losing investment.

—

New updates to this analysis are in bold.

—