May 16, 2023: EURUSD Elliott Wave and Technical Analysis – Charts

A slight bounce meets resistance along the short-term Elliott channel.

Summary: The bigger picture for Euro expects overall upwards movement for the long term, most likely to not make a new high above 1.60380.

For the short term, a pullback may continue lower to a target zone from 1.02862 to 1.01079. Thereafter, a strong third wave up may begin. Recent price action may be confirming this outlook.

An alternate, also predicting long-term upwards price movement, expects the short-term pullback is nearly over.

Quarterly and monthly charts were last updated here.

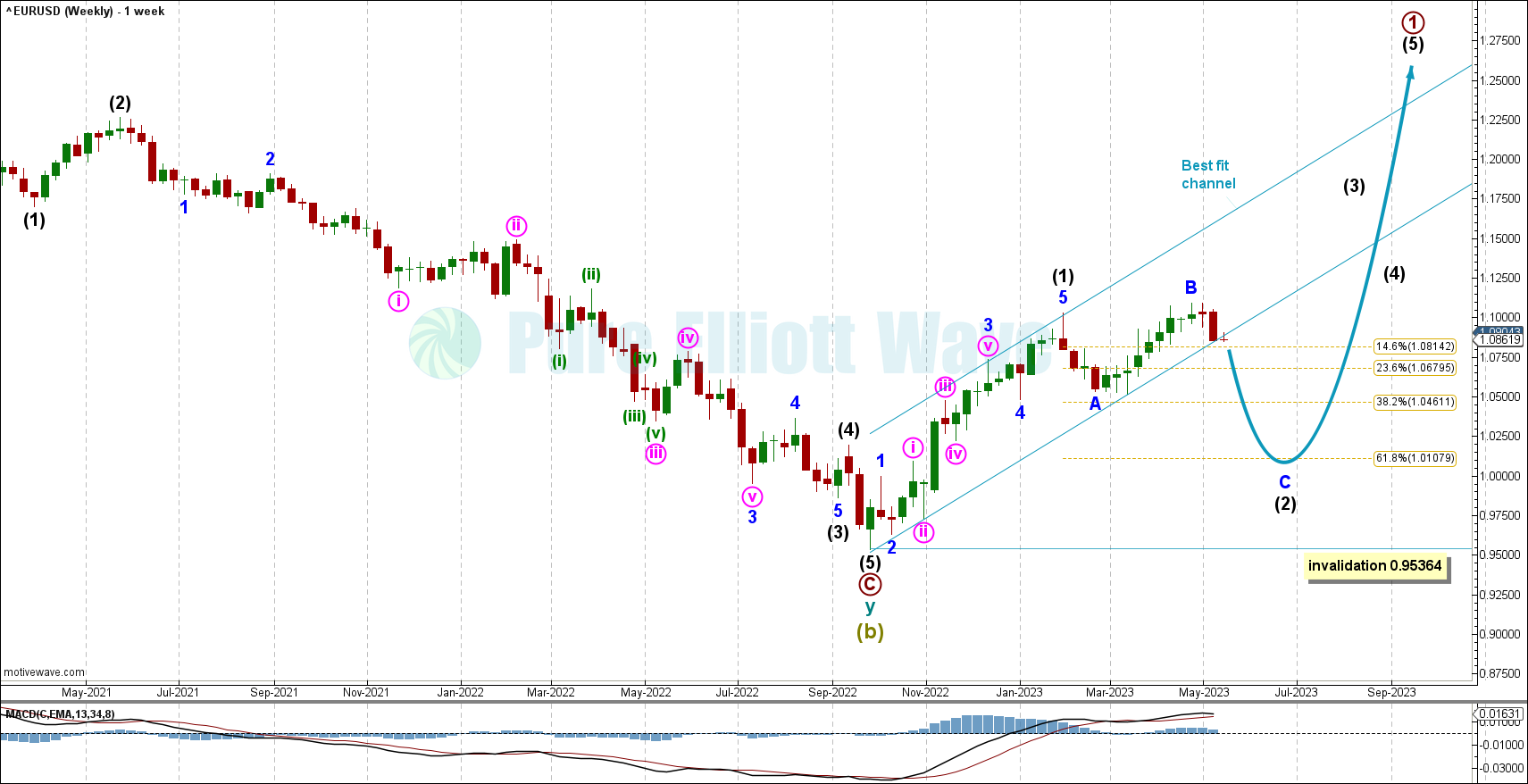

WEEKLY CHART

The weekly chart focusses on the end of Super Cycle wave (b) and the start of Super Cycle wave (c).

Within Super Cycle wave (c), cycle wave a must subdivide as a five wave motive structure. Primary wave 1 within cycle wave a would be most likely incomplete.

Within primary wave 1: Intermediate wave (1) may be over at the previous high and now intermediate wave (2) may continue to find support about the 0.618 Fibonacci ratio of intermediate wave (1) at 1.01079.

Intermediate 2 may be unfolding as an expanded flat with minor B reaching 113% the length of minor wave A. Expanded flats are common structures. Minor wave C appears to be underway and must subdivide as a motive structure downwards.

A best fit channel has been drawn to encompass all of the present upwards movement. The best fit channel has been broken, but a candle closing below this channel will confirm it is not a false breakout.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) below 0.95364.

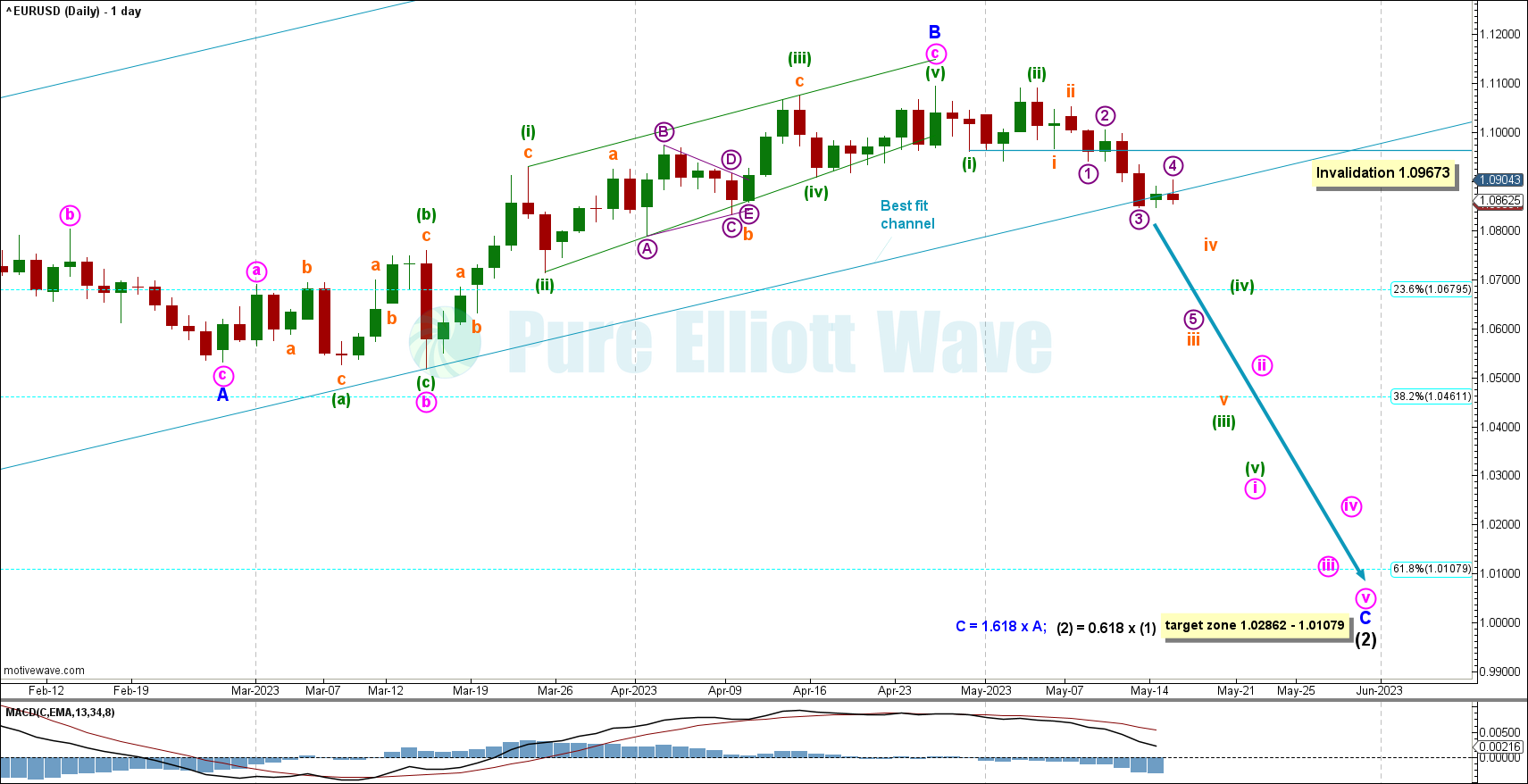

DAILY CHART

The daily chart focuses on minor waves B and C of intermediate (2).

Currently, price sits at the long-term best fit channel from September 2022 (Daily chart), encompassing all of the previous upwards movement. A full daily candlestick breaking below and not touching this channel will be another bearish signal for the medium-term trend.

Within the zigzag of minor wave B, minute wave c may have completed as an ending contracting diagonal. Within the diagonal: Minuette wave (v) is shorter than minuette wave (iii) and minuette wave (iii) is shorter than minuette wave (i).

The invalidation level at 1.09673 is utilizing the Elliott Wave rule that within an impulse wave 4 may not enter the price territory of wave 1. Price over this level would shift our focus to the alternate count detailed below.

With minor wave B complete, a target is calculated for minor wave C to reach 1.618 times the length of minor A at 1.02862, giving us a range from 1.02862 to 1.01079. This wave count is very bearish for the short term.

Today price attempted to rally and failed along the Elliott Wave channel (below).

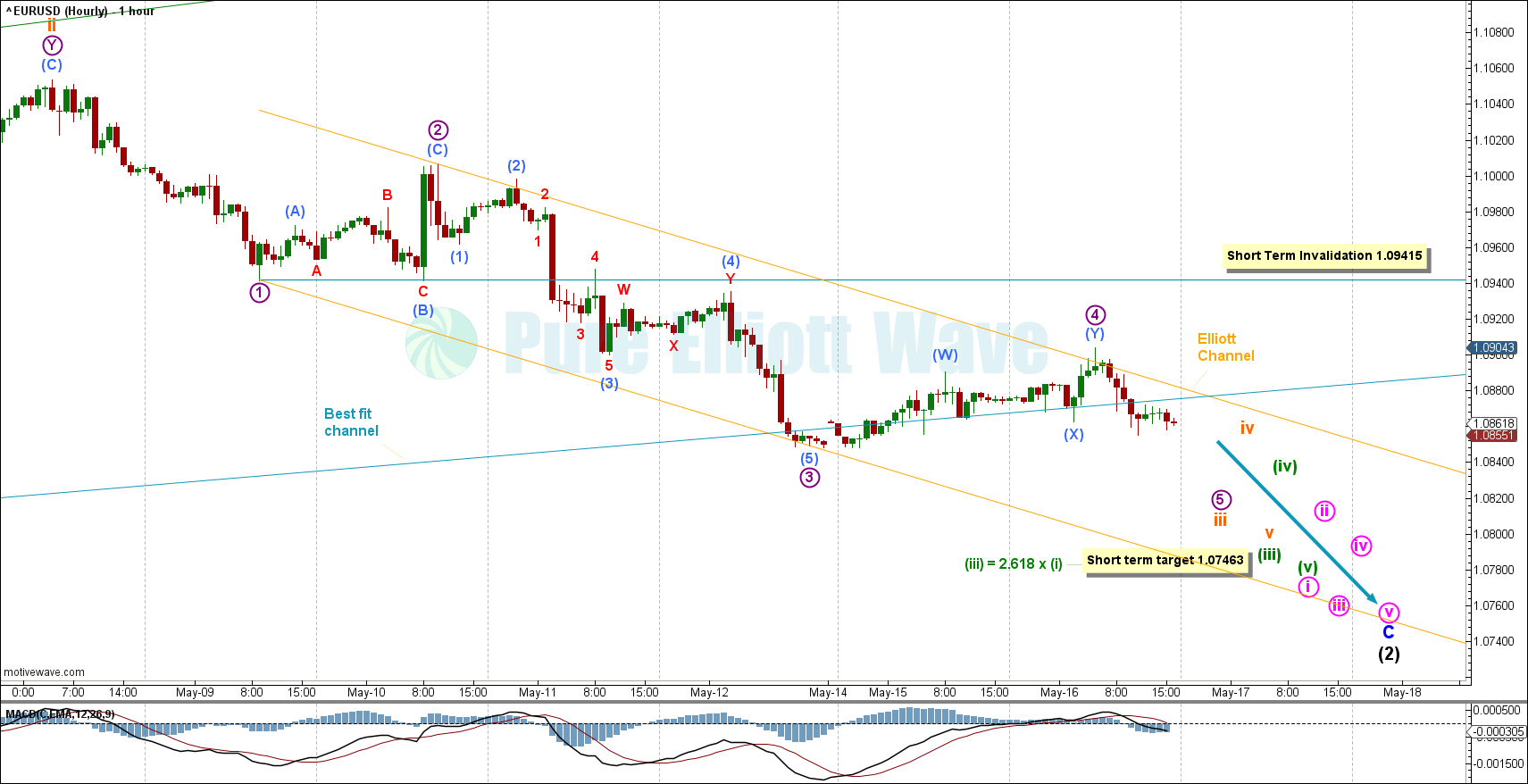

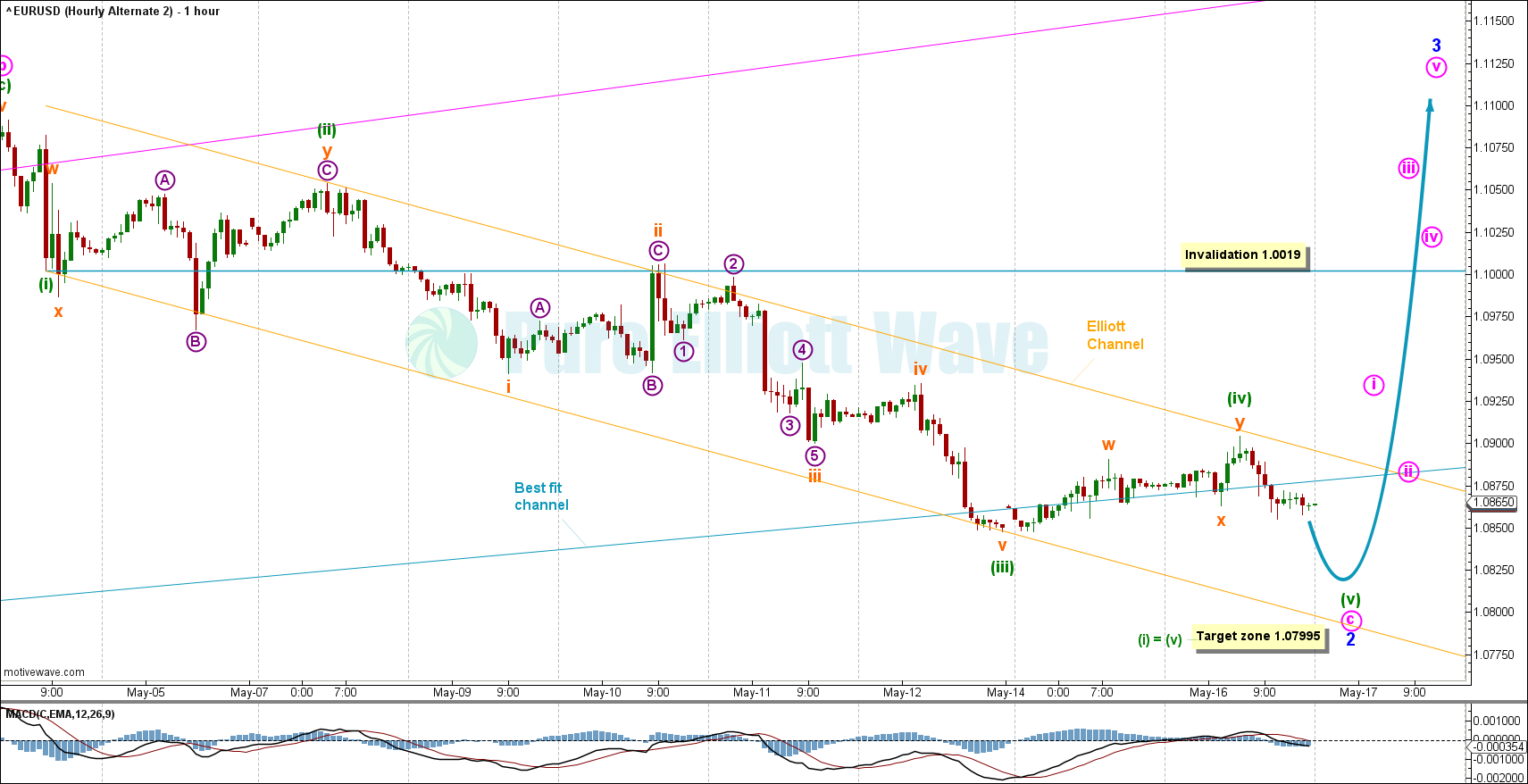

HOURLY CHART

The hourly chart focuses on minuette wave (iii) of minor wave C.

Recent overlapping price action after the end of minuette (ii) could be subdividing as an extending impulse. Invalidation for this idea is close at 1.09415. A breach of this level would be bullish for the short term.

A target has been calculated for minuette wave (iii) to reach the 2.618 fibonacci extension of minuette (i) at 1.07463.

The orange Elliott Channel was drawn and price for submicro wave 4 failed to break through. Next, submicro wave 5 may find support along the lower edge of this channel. The orange Elliott channel contains all recent price movement.

Price has been trading along the long-term bull trend best-fit channel.

For the short term, the downwards trend is expected to continue.

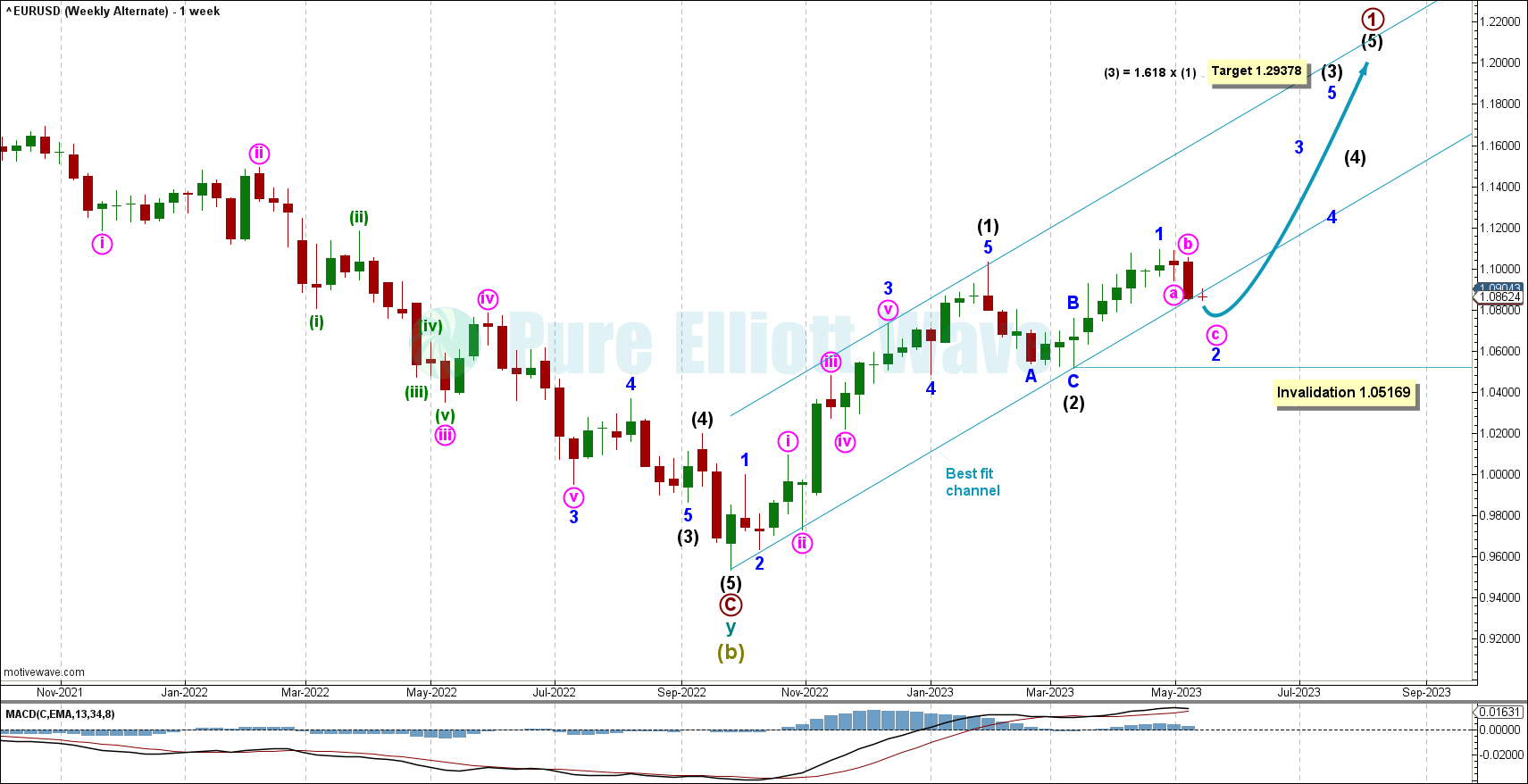

ALTERNATE WEEKLY CHART

This alternate reflects the possibility of intermediate (2) as complete.

This chart expects a shallower pullback in the short term followed by more upwards movement.

Minor wave 1 be complete. Minor wave 2 may be nearing completion as a zigzag.

A target is calculated for intermediate (3) to reach 1.618 the length of intermediate (1) at 1.29378.

Minor wave 2 may not move beyond the start of minor wave 1 below 1.05169.

ALTERNATE DAILY CHART

This daily alternate wave count expects a nearly complete shallow pullback for minor 2.

This alternate expects a less severe pullback unfolding now, but has a lower probability given the brief shallow intermediate (2).

Minuette wave (iv) may be complete. A target has been calculated for minuette (v) to reach equality in length with minuette wave (i) at 1.07589. There is no upwards invalidation for this alternate. Downwards invalidation sits below at the start of minor 1 at 1.05169.

ALTERNATE HOURLY CHART

This alternate reflects the short-term possibility that minor 2 may be nearing completion as a zigzag.

Within minor 2: Minute waves a and b are complete and minute wave C may be nearing completion.

Within minute wave c, minuette wave (iv) may not move into minuette wave (i) price territory above 1.10019.

Minuette wave (iv) may have met resistance along the upper edge of the orange Elliott channel. Minuette wave (v) may find support along the lower edge of this channel.

This count expects one more thrust downwards before bullish price action.

TECHNICAL ANALYSIS

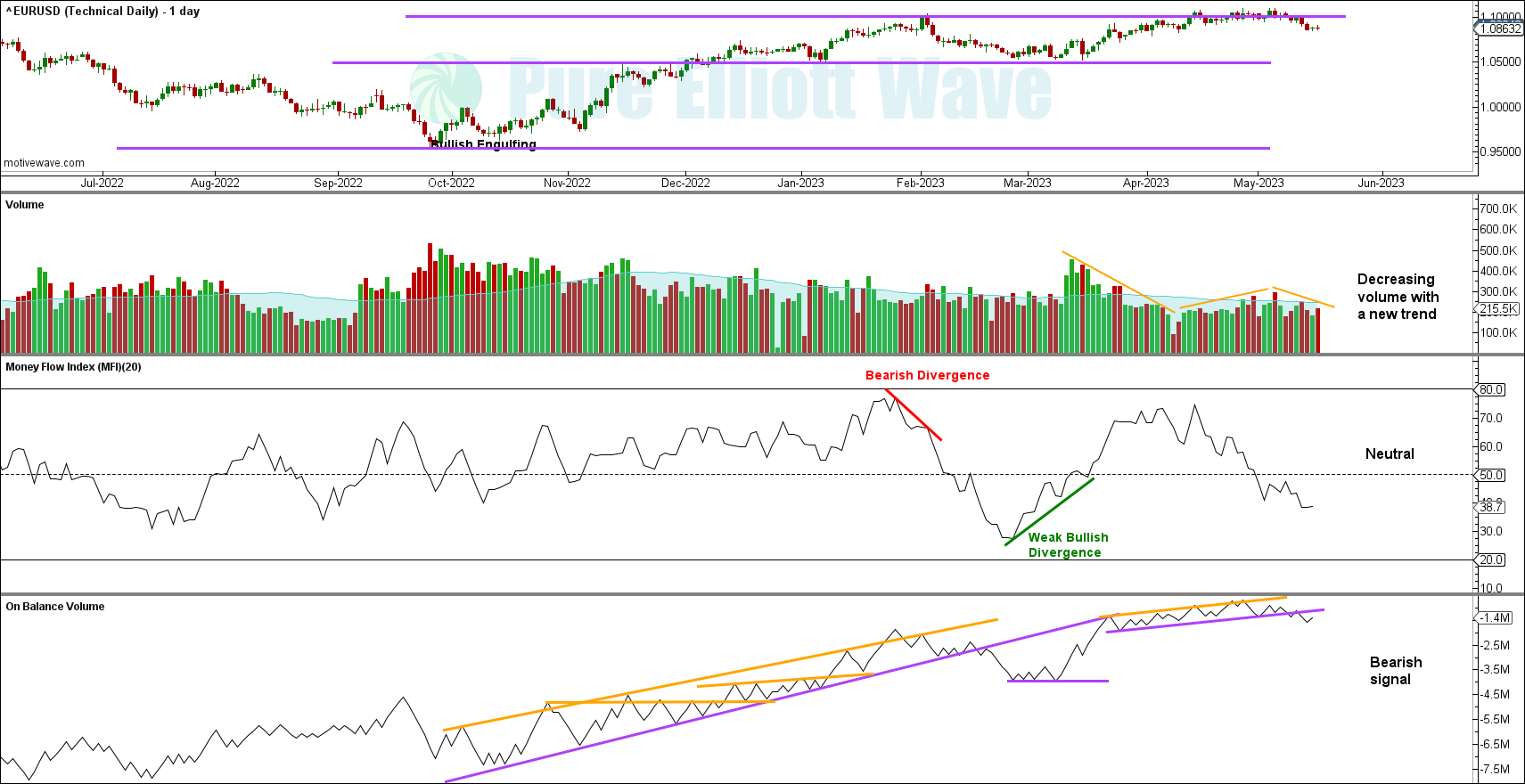

VOLUME

VOLUME WEEKLY CHART

Volume remains decreasing to flat with a new possible trend change. This is normal for the EURUSD coming off of tops.

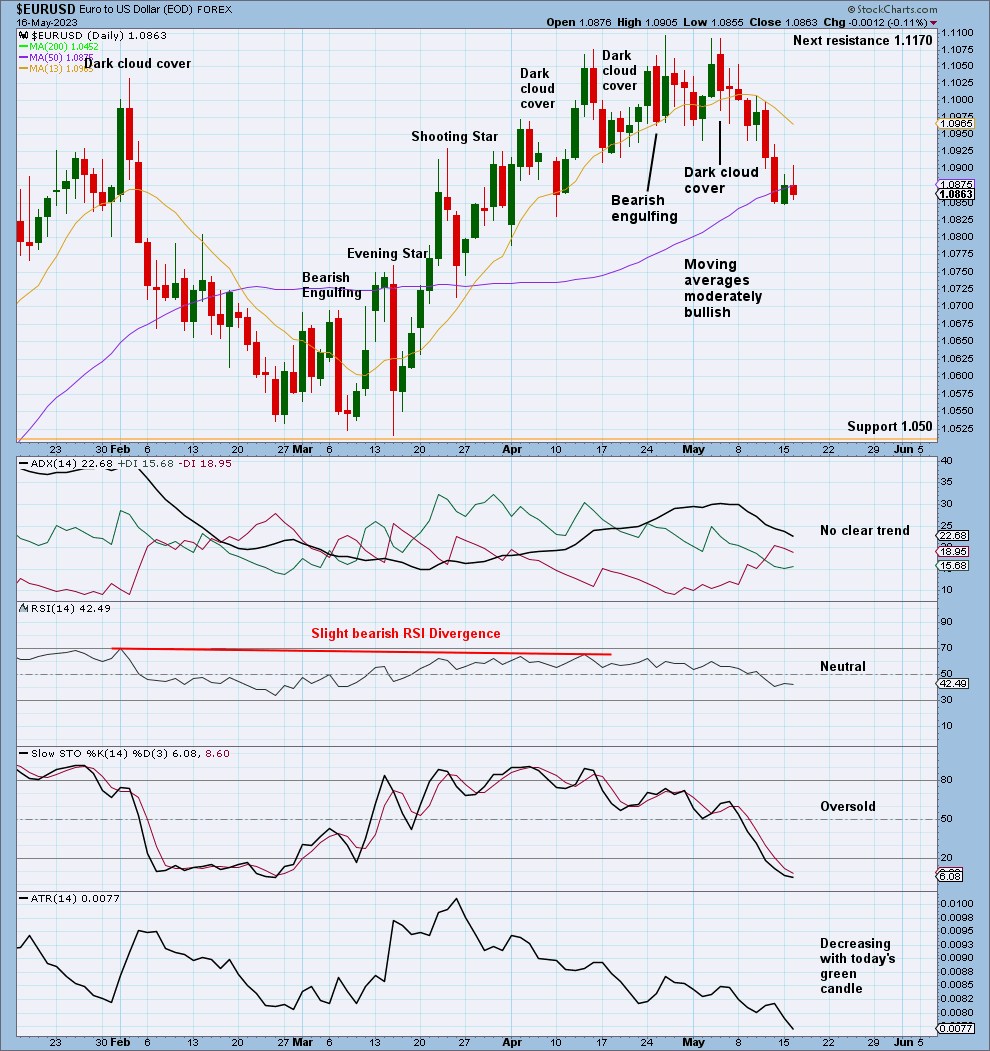

WEEKLY CHART

Last week’s candle was a strong bearish candle, supporting the top reversal patterns from the weeks before.

Next overhead resistance sits at 1.1170. Support below at 1.050.

ADX shows there is no longer a bullish trend.

This chart is bearish.

VOLUME DAILY CHART

The past week shows a decrease in volume with bearish price action. This is normal for tops on the EURUSD when studying past price/volume action. Price is falling of its own weight.

There is a strong bearish signal from On Balance Volume. The signal is strong due to the slope being reasonably flat and the line tested 4-6 times and held for a reasonably long amount of time.

DAILY CHART

Large bearish candlesticks were followed by a strong breakout from a consolidation zone with multiple bearish candlestick patterns.

ADX indicates the extreme trend has ceased.

Stochastics is oversold. Price may continue lower with stochastics being oversold until price finds support.

The moving averages are moderately bullish, all sloping up, with the 13 day now sloping down.

This chart is bearish, supporting the main Elliott Wave count.

Published @ 06:11 p.m. ET.

—

Careful risk management protects your trading account(s).

Follow our two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.

—